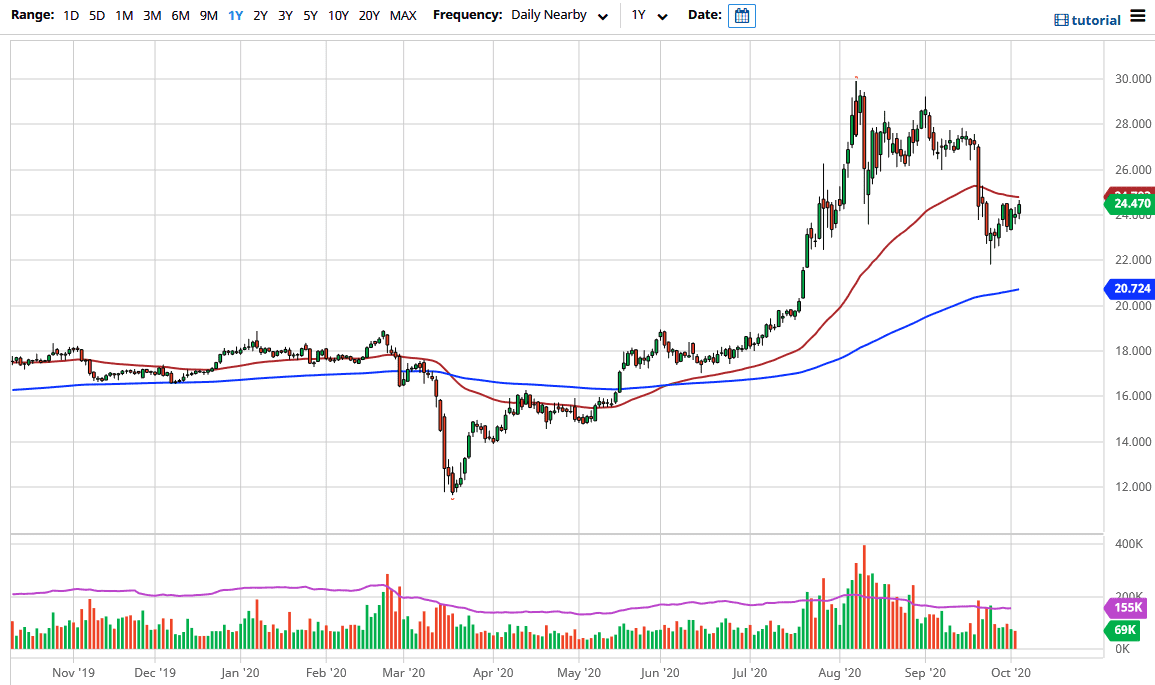

Silver markets rallied a bit during the trading session on Monday, reaching towards the 50 day EMA. By doing so, it looks as if the market is going to continue to press the 50 day EMA, and perhaps try to make an attempt to break out. However, it is not until we break above the 50 day EMA on a daily close that I would be a buyer, as it would show a technical break out again. The $25 level obviously will cause a little bit of psychological importance and pressure, but once we get past all that it should send this market looking towards the $27 level rather quickly as it was the scene of the most recent supply.

Ultimately, we could pull back towards the $24 level, which was minor support during the trading session, and then possibly even as low as the $22 level rather quickly. Underneath there, I am paying attention to the 200 day EMA and then the $20 level which for me is a large, round, psychologically significant figure not only due to the structure of the “whole number theory”, but the fact that it was the scene of a major breakout.

Looking at this chart, I think that it probably has a bit of work to do before we go higher, and it will obviously have a lot to do with what happens in the US dollar itself. After all, the US dollar has been rather erratic as of late, and if it rallies it tends to work against the value of silver. However, if it falls apart it quite often will help silver gain as it is such a thin contract. With all that in mind, even though we had a bullish session during the day here on Monday, the reality is that we did not break fresh ground. In other words, we are still simply trying to build some type of bottoming pattern, and the question is whether or not we are done trying to find buyers, and have we gotten this market low enough to have all of the value hunters come back? I suspect that the answer that will be found in the US dollar index as the negative correlation continues to be crucial when it comes to evaluating the directionality of precious metals overall, especially silver.