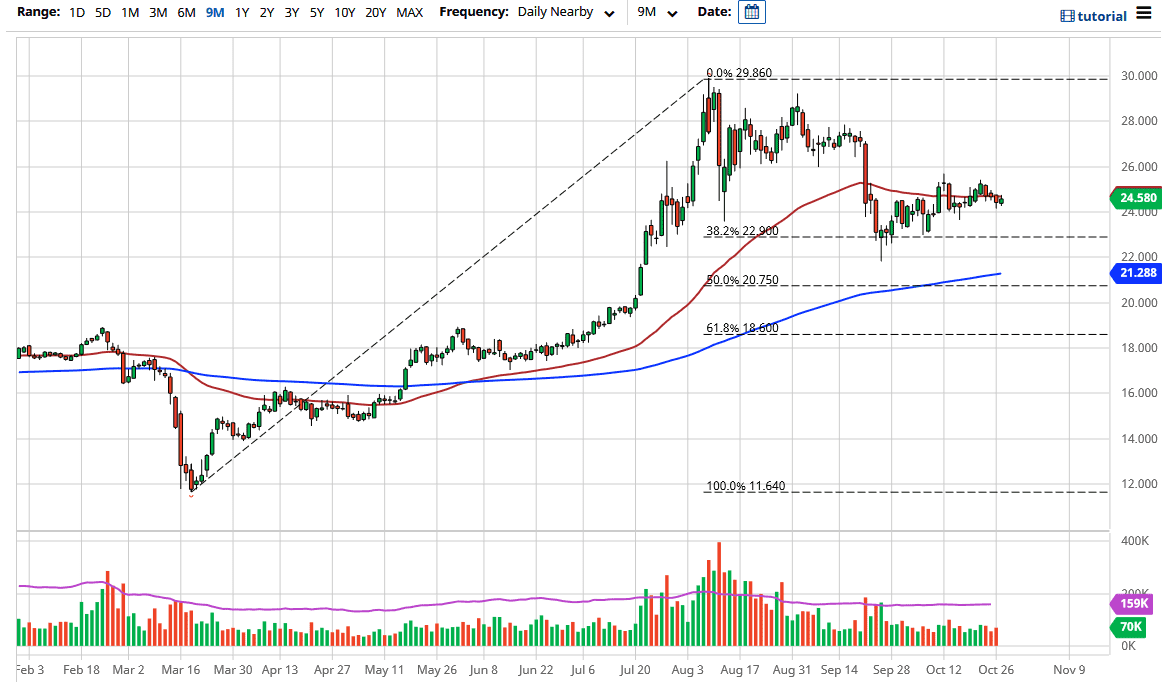

Silver markets initially drifted a bit lower during the trading session on Tuesday only to turn around and reach towards the 50 day EMA again. However, we have pulled back from there, so it looks like we are ready to struggle bit, so I think what we are seeing here is a market that has no idea what it wants to do quite yet. With that being said, it is likely that we will continue to see a lot of back and forth noise, perhaps with a little bit of a downward proclivity as we have to worry about so many different moving pieces at the same time.

We have to worry about the election which of course is a major issue, and has a lot of risk built into it, so having said that it is likely that silver will move back and forth with the value of the US dollar. Keep in mind that the US dollar will probably be very noisy as we head closer to the election, and therefore it is possible that we get both bullish and bearish pressure at multiple instances. After all, if the US dollar strengthens, quite often it is negative for the silver market, as well as precious metals in general. On the other hand, if the US dollar sells off it could send the precious metals markets higher. There are a whole host of reasons to think that we could move in that direction as well.

Furthermore, we have to worry about the stimulus and the back and forth noise that continues to be a major issue. While stimulus more than likely is not coming between now and the election, it is likely that there is still going to be a lot of hope out there. Expect volatility to pick up the closer we get to the election, and then of course we have to worry about all kinds of other things like coronavirus numbers. If the US dollar strengthens due to the European slowdown, that could cause some issues as well. It is very possible that the Euro sells off which by its very definition could have the US dollar strengthening, at least in the short term. I do believe that there are plenty of buyers underneath that would probably jump on the silver markets at various levels, especially near the $24 level, the $22 level, and of course the 200 day EMA. That is essentially what I am looking for.