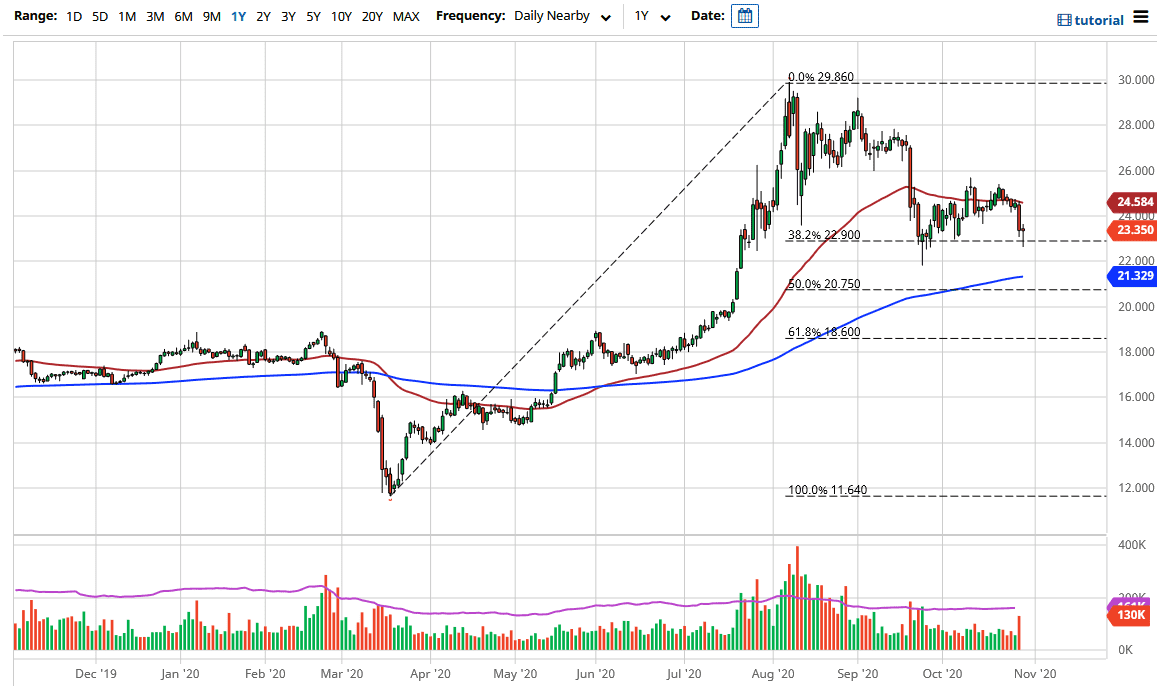

Silver markets have broken down a bit during the trading session on Thursday, slicing through the $23 level only to find buyers again. Ultimately, the market ended up turning around and forming a bit of a hammer, which of course is a bullish sign. If we can break above the top of the candlestick for the day, it is very likely that the market will go looking towards the 50 day EMA again. However, I do believe that we are likely to see a lot of noise in the markets, due to the fact that the silver markets are volatile under the best of conditions.

That being said, you have to pay attention to the US dollar. The US dollar of course is crucial to the directionality of precious metals, as it does tend to have a short-term negative correlation. The market is likely to see a lot of noisy trading due to the fact that we are heading towards the US elections, so the US dollar could be very noisy to say the least.

Central banks around the world will continue to see the need to flood the markets with liquidity, and that will drive down the value of fiat currency in general. People will be looking towards hard assets such as precious metals to protect their wealth. However, I would say that you should pay attention to the fact that silver is an industrial metal as well, meaning that it will lag the gold market as traders typically flock to their first. However, they do tend to move in the same direction.

To the downside, I see the 200 day EMA offering plenty of support and of course the $20 level. I think there are plenty of supportive areas between here and there though, so I think we are waiting for some type of supportive candlestick to start buying. The Thursday candlestick may just be that one, but I also recognize that there are probably multiple attempts to form a bit of a base here. We are in the longer-term uptrend and I do not see that changing anytime soon, so obviously I have no interest in shorting this market. I expect to see a lot of choppy behavior, but unless the US dollar takes off, I think silver will probably continue to be very stagnant in the short term.