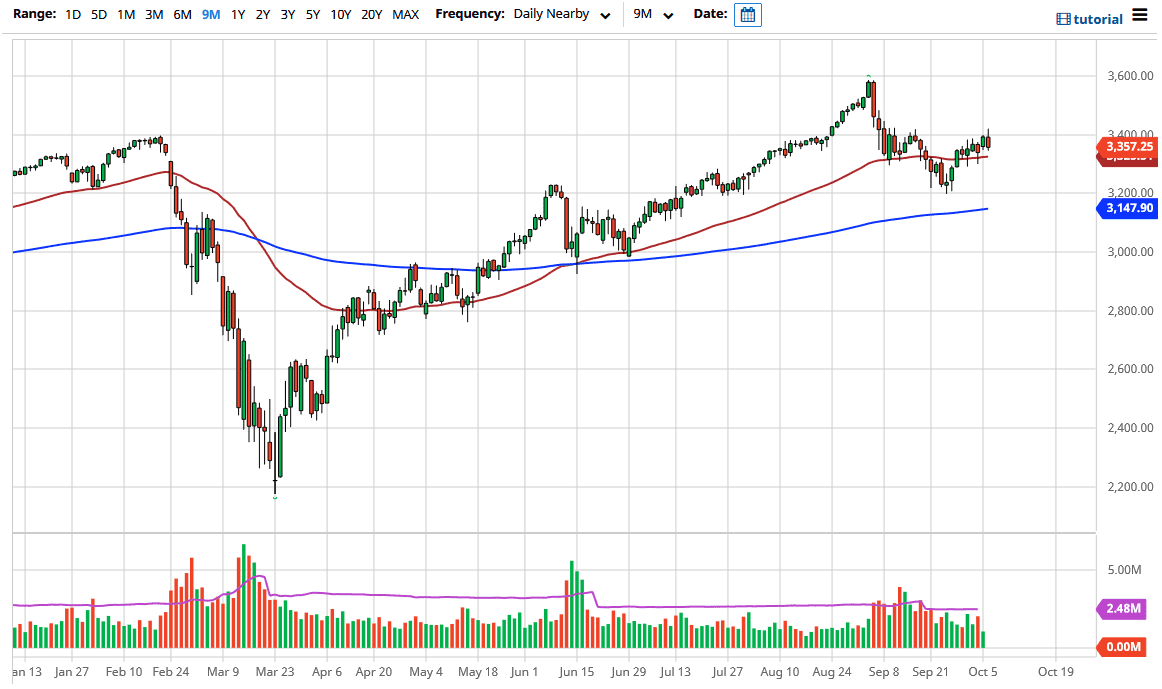

The S&P 500 initially tried to rally during the trading session on Tuesday, pulling back from the 3400 region. Ultimately, this is a market that continues to see a lot of noise and I think the area above 3400 will be the gateway to higher levels. At this point, we need to see a close above the 3420 level in order to start going long again. At that point, the market is probably free to go to the 3500 level, possibly even the 3600 level which with the all-time high.

It is very possible that we could reach down towards the 50 day EMA, which is at the 3327 handle. Breaking down below there then as the market looking towards the 3200 level. The 3200 level is the bottom of the overall consolidation area that I thought we are trying to form, and what is worth paying attention to is the fact that we fell off significantly when Donald Trump suggested that he was calling off negotiations when it came to stimulus, and the fact that the market fell so hard tells you that it is a major influence as the where we go next. A lot of traders on Wall Street assume that stimulus is coming, so, therefore, it has caused a lot of concerns in the markets. Whether or not it will last for any significant amount of time, it remains to be seen.

All things being equal, the market has a lot to worry about right now, and then we have the election. The election will cause quite a bit of concern as to what happens next, and this uncertainty continues to cause people a lot of concern. The fact that we have close at the very bottom of the candlestick shows just how concerned the market could be given a little bit of a nudge, so it is worth paying attention to. In general, I believe that we will eventually go higher but we may have a lot to chew through over the next couple of weeks, so this market remains range-bound from what I see. The 50 day EMA will attract a certain amount of attention in and of itself, but you can see that we have sliced through at a couple of times so I would only put so much credence into it.