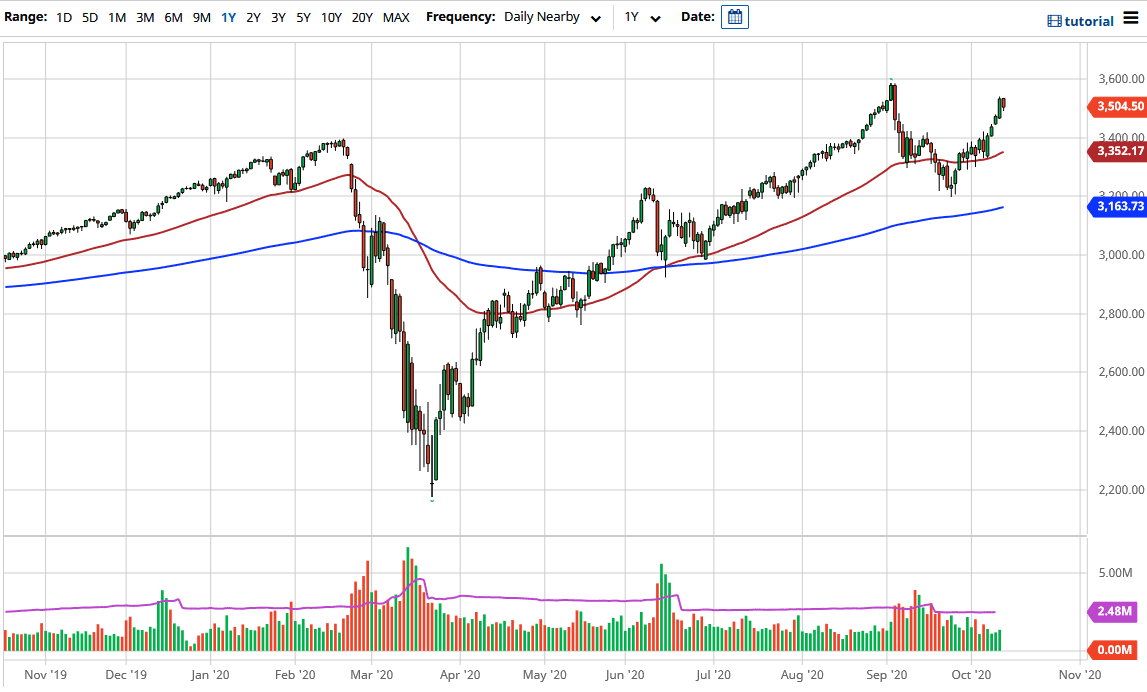

This is a market that some people will be screaming “double top” and I do not think that is the case. I think we simply have gotten ahead of ourselves because no matter what happens we are more than likely going to see a significant amount of stimulus. Stimulus typically means that we have buyers stepping into the marketplace to take advantage of a depreciating US dollar.

To the downside, I believe that the 3400 level will be supportive and that a lot of traders will be paying attention to it. We also have the 3500 level between here and there, but I think it is very likely to be pierced given enough time. The trend is still higher and with the 50 day EMA curling higher, it should continue to offer support as well. That being the case, I have no interest in shorting this market and you know that if you have been following me here at Daily Forex, shorting indices is not something I do very often. This is mainly due to the fact that they are not designed to go lower, and once you understand that you realize it is simply a matter of finding the opportunities to take advantage of value as it occurs. I believe that you are about to get another one of those opportunities, so I will be paying attention to daily candlesticks in order to get long.

If we do break straight up in the air, that becomes even more unstable and more dangerous, so therefore I am not interested in trying to buy that breakout and I think it would only cause even more trouble. The strengthening US dollar is part of what is working against the value of the index, so I like the idea of paying attention to the US Dollar, and perhaps trading in the opposite direction if I get the opportunity. Clearly, this is all about stimulus or perked haps even the possibility of the lack of stimulus, so headlines will continue to throw this market all over the place but I think at the very least we need to pull back in order to get a grip on reality.