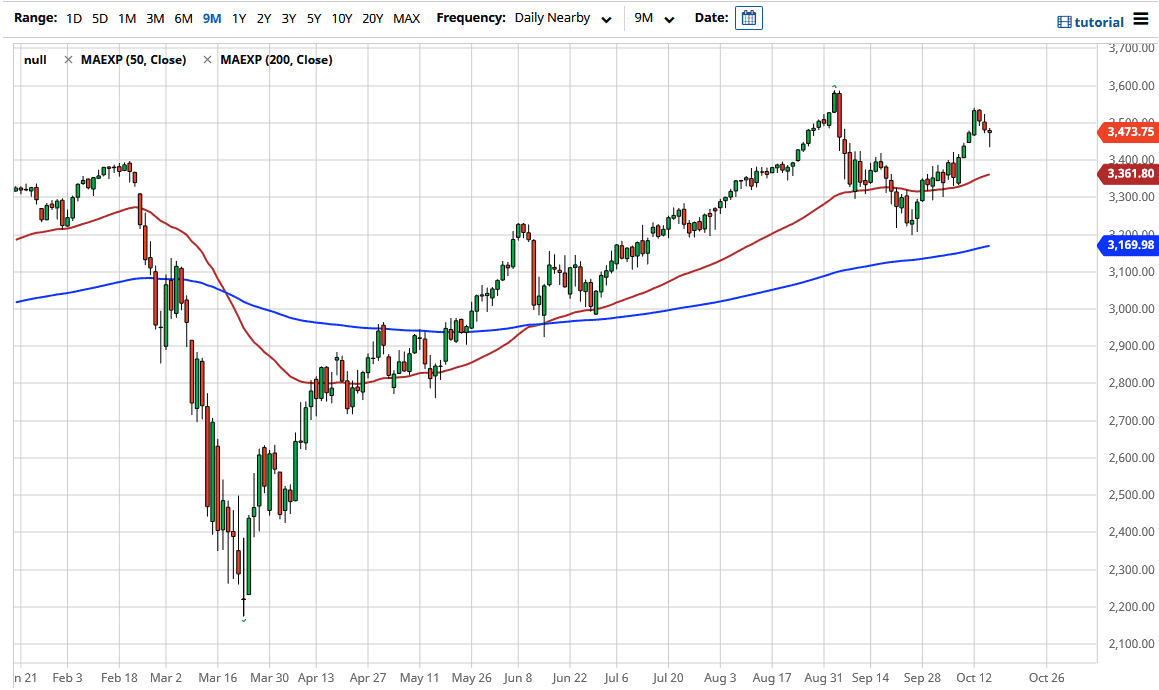

While the candlestick does suggest that we are going to go higher, the reality is that we did not form this candlestick based upon support, so we could see a little bit more of a grind lower. We can clearly go to the upside here, but I would feel much better about going long from a more substantial support level.

The 50 day EMA is sitting right around the 3360 handle, and I think it will be significant for the longer-term trend. Furthermore, the 3400 level is a significant barrier that people need to pay attention to. The 3400 level was the scene of a significant break out, so it should have a certain amount of “market memory” to be found here. Alternately, if we were to turn around a break above the top of the candlestick for the session on Thursday, we could go looking towards the 3540 handle. If we break above there, then we go to the all-time highs. Again though, I prefer to buy value in the S&P 500 if we get an opportunity.

I have no scenario in which I am willing to short this index, because the overall direction is most certainly to the upside and of course it is clearly built to go higher considering that the large portion of weighting in the index is based upon all of the usual household names that Wall Street buys. Given enough time, I think that the markets will find a reason to go higher, even if it comes down to the Federal Reserve stepping in and saving everybody yet again. Ultimately, it is just so much easier to go “long only” of the index, because that is where the big money plays. Market participants are better off simply looking at the long side or at least been on the sidelines when the market is ready to offer value. Value of course is something that people look towards, as it has paid off repeatedly over the last 12 years or so. The noise going into the weekend will probably be based around potential stimulus and of course the direction of the US dollar.