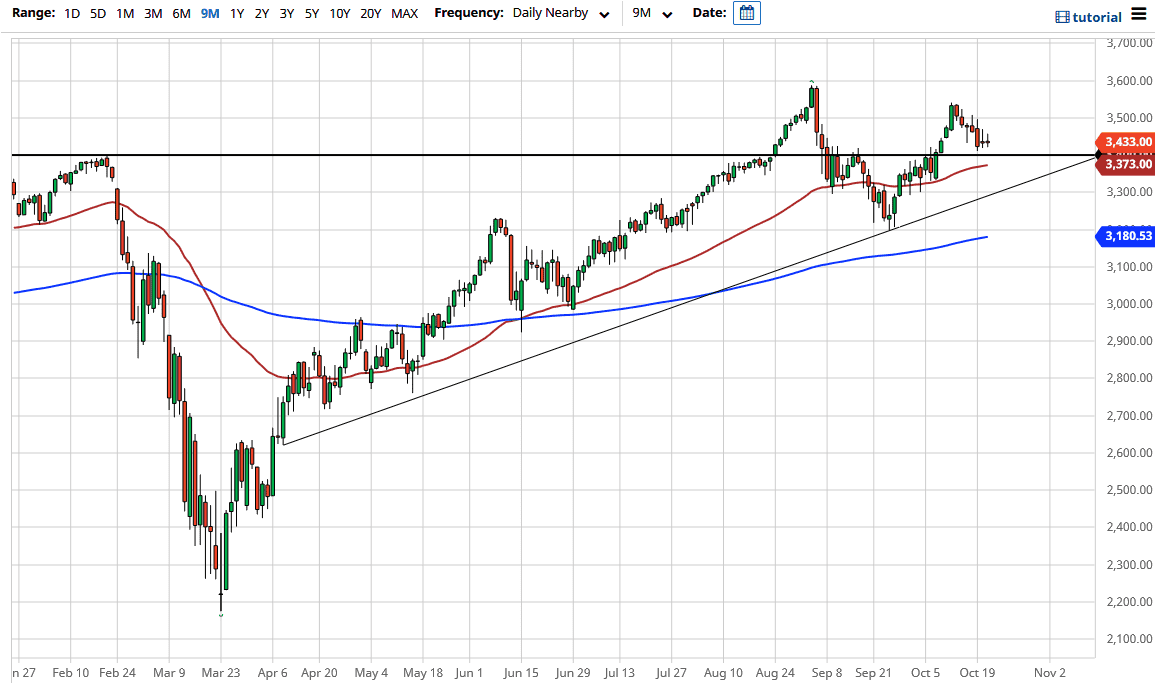

The S&P 500 went back and forth during the trading session on Wednesday, as we continue to wait to see what is going to happen when it comes to stimulus, so having said that it is likely that we will continue to see indecision. The 3400 level underneath is an area that had previously been resistant, and now it looks as if it is going to offer support. That makes quite a bit of sense due to market memory, and the 50 day EMA sits just below there. Ultimately though, this is a market that I think will continue to go higher given enough time because that is what these prepackaged indices do.

The S&P 500 is driven higher by a handful of stocks, so keep that in mind. The candlestick shows confusion, just as it did during the previous session, showing that we are simply sitting here trying to kill time. At this point in time, if we can break above the top of the candlestick for the past couple of days, then it is likely that we will go looking towards the 3500 level. If we can break above there, then the market is likely to continue going even higher. At this point in time, the market would more than likely go looking towards the highs.

Unfortunately, we are waiting on politicians to decide whether or not they can do stimulus before the election, as they typically think of themselves instead of other people. That being the case, I would not have a lot of faith in the politicians, but the longer-term trend is to the upside and when we break down from here it is very likely that we will continue to find value hunters underneath. The 50 day EMA is a place that I think is important, but even beyond that, we have a nice uptrend line below there that should offer a lot of support. All things being equal, if and when the market gets it stimulus it will be interesting to see how we behave because there have been so many traders out there simply hanging on the latest words of Nancy Pelosi, Steve Mnuchin, or even Donald Trump. Most of Wall Street assumes that stimulus is coming, so if it does not this could cause massive disruption.