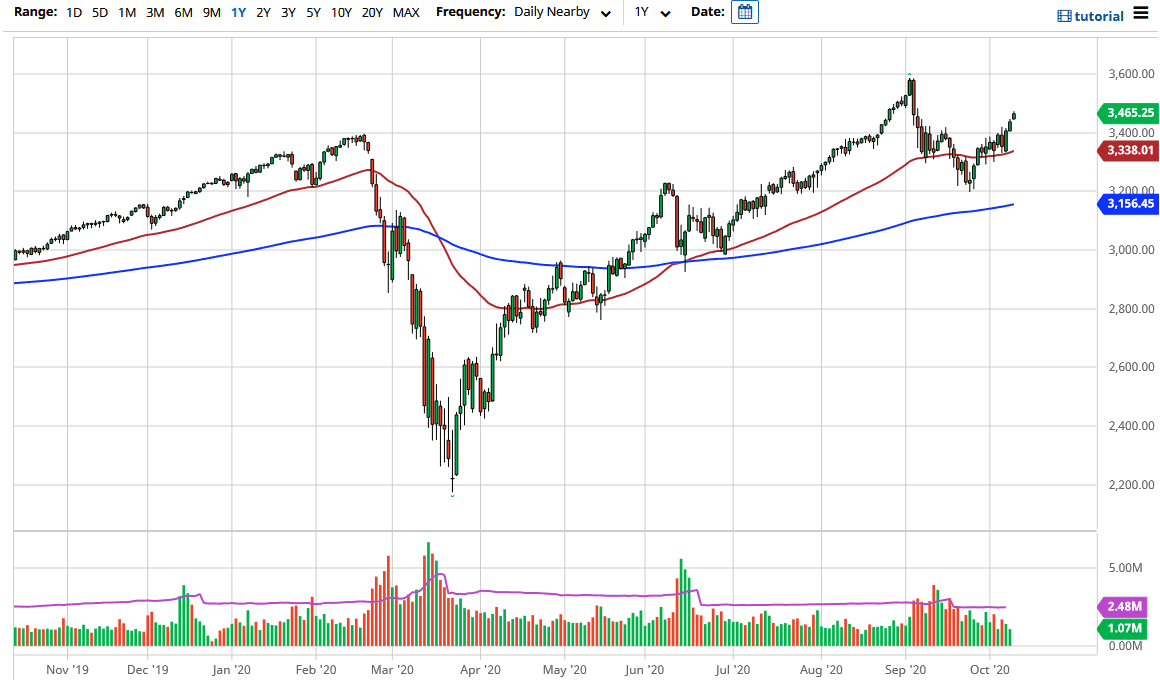

The S&P 500 has broken out during the trading session on Friday, as the stimulus has taken over the thought process of Wall Street. With that being the case, we continue to move to the upside, and it looks like we are going to try to go towards the highs again which are just underneath the 3600 level.

Recently, I have been looking at the market in a 200 point range, with the 3200 level offered support and the 3400 level offering resistance. However, the market has broken out of that range, so it is obvious that we are going higher. This is a market that, I think, continues to see a lot of bullish pressure based upon the idea that Congress may actually do something involving fiscal stimulus, and the Federal Reserve may jump into the fray as well. The reality is that the S&P 500 is designed to go higher, as it is not an equally weighted index. With that being the case, it makes quite a bit of sense that we will continue to go higher as a certain handful of stocks continue to drive.

To the downside, the 3400 level should offer a certain amount of support, and should we reach down towards the 50 day EMA, there has been a significant amount of support over the last couple of weeks as well. Ultimately, I think that we will probably have to pull back just a little bit in order to build up a little bit of momentum, but you should be cautious about headlines coming out over the weekend, as the lack of stimulus or a sign that we will be getting any stimulus anytime soon could send the markets reeling. However, the recent comments coming out of Donald Trump suggest that he may be willing to deal a bit more than he suggested earlier in the week. Ultimately, this is a market that is a “buy on the dips” market yet again. If we can break above the all-time high, then we will continue to go higher, perhaps reaching towards the 3650 level. To the downside, I see a massive “floor” near the 3200 level, and if we were to break down below there it could change a lot of things, but I find that to be very unlikely.