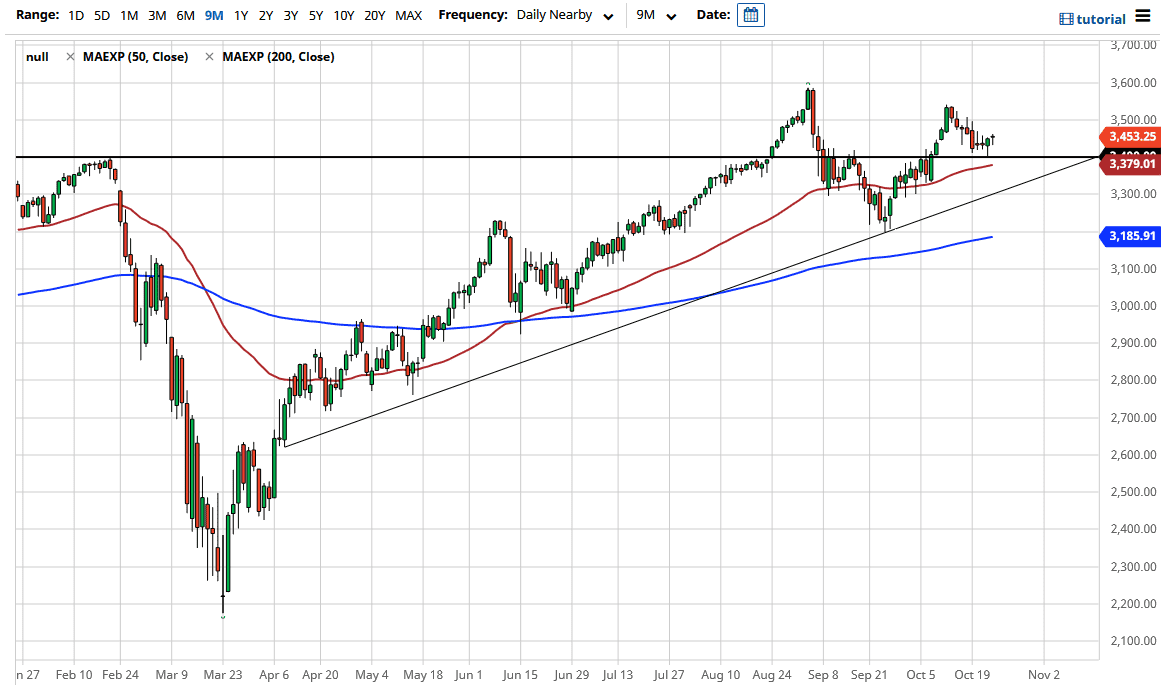

The S&P 500 initially pulled back during the trading session on Friday but looks as if it is trying to show signs of life again and rally. The market is going to eventually find a reason to go higher one way or another. After all, that is what the S&P 500 does, and with that in mind I like buying short-term dips. That being said, the 3400 level is a massive support level that people will be paying close attention to, right along with the 50 day EMA underneath. The fact that we formed a hammer on both Thursday and Friday suggests that we are more than likely going to find buyers on dips and continue the overall bullish attitude.

Wall Street is banking on the idea of stimulus coming sooner or later, and therefore people are starting to buy stocks here because they believe that the S&P 500 will shoot straight up in the air given enough time. After all, that is with the S&P 500 has done for the last 12 years, waited for signs of cheap or free money, and then went to the upside.

Even if we do break through both the 50 day EMA and the 3400 level, there is a massive uptrend line underneath that will also come into play, so I have got no interest in trying to get short of this market anytime soon. To the upside, I believe that the market could go looking towards the 3550 handle again, but it may be more of a grind until we get a stimulus package. If we get above there, then the market is likely to go looking towards the 3600 level. However, even with stimulus hopes still out there, we also have to keep in mind that we are paying attention to the US election, which of course is going to continue to be something that people try to trade around. All things been equal though, this is a market that sin an uptrend and there is no reason to doubt that as the S&P 500 is heavily skewed towards that direction most times. In fact, I do not sell indices anymore because if there is one thing that the last 12 years has taught us, if they fall too quickly the Federal Reserve will come out and save everyone.