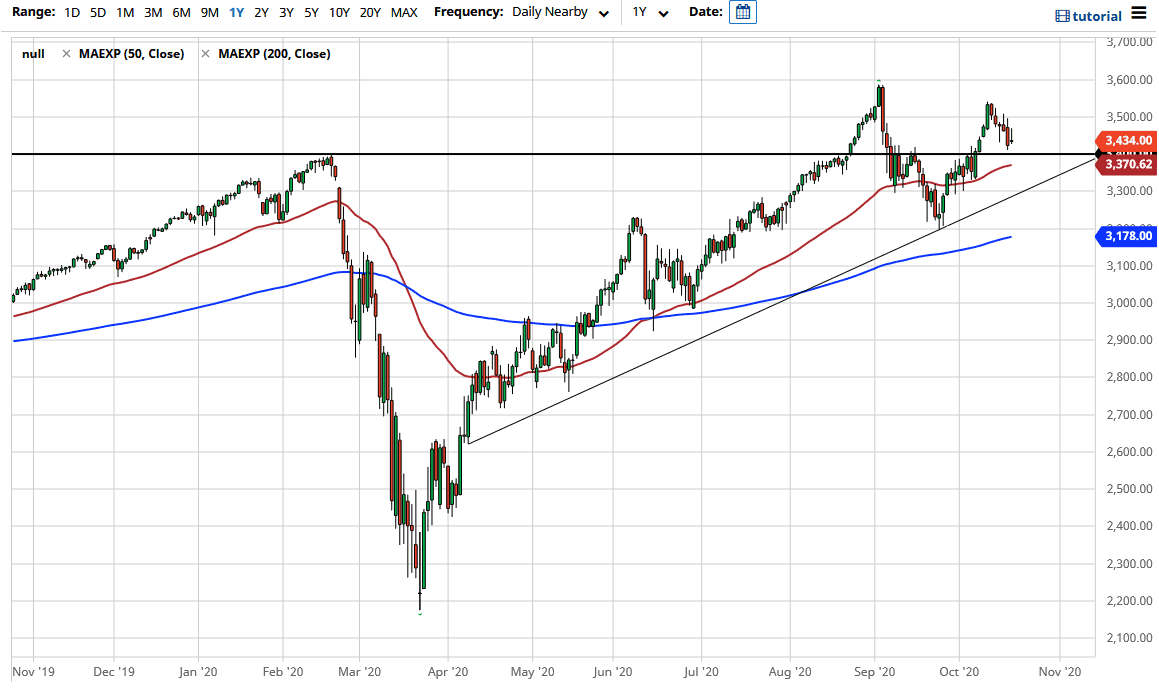

This is a market that I think continues to see a lot of confusion due to the fact that stimulus continues to be at the forefront of everybody’s mind. Ultimately, if we do pull back from here there should be plenty of buyers out there. The 3400 level is an area that we have seen a breakout from, and it should now offer plenty of support. Beyond that, we also have the 50 day EMA underneath there that could attract a certain amount of attention.

The candlestick is a bit of a shooting star shaped candlestick, so this suggests that we probably have a little bit more downward pressure as politicians in the United States continue to drag their feet when it comes to stimulus. Eventually we get the stimulus passed, and stocks could eventually go higher. Having said that, I do not necessarily think that we will go to the all-time highs, because there are plenty of other risks out there. At the very least, the election coming in two weeks will keep the market somewhat confused as well.

Even below the 50 day EMA, I see plenty of support, especially near the uptrend line. This is a market that cannot be shorted even though we have potentially form what some people will look at as a “double top.” That being said, I do not necessarily look at it as a major trend change, just an opportunity to pick up value underneath. A major breakdown probably offers value more than anything else and this is essentially what I think a lot of longer-term traders are waiting for.

To the upside, the 3580 handle is going to be tested eventually, perhaps even broken through. All things been equal though, I think the only thing that we can count on here is going to be a significant amount of volatility. The idea of this market going back and forth makes quite a bit of sense, because we are hanging on the every word of politicians that are trying to jump in and out of favor with the media and score political points it comes to the election in two weeks.