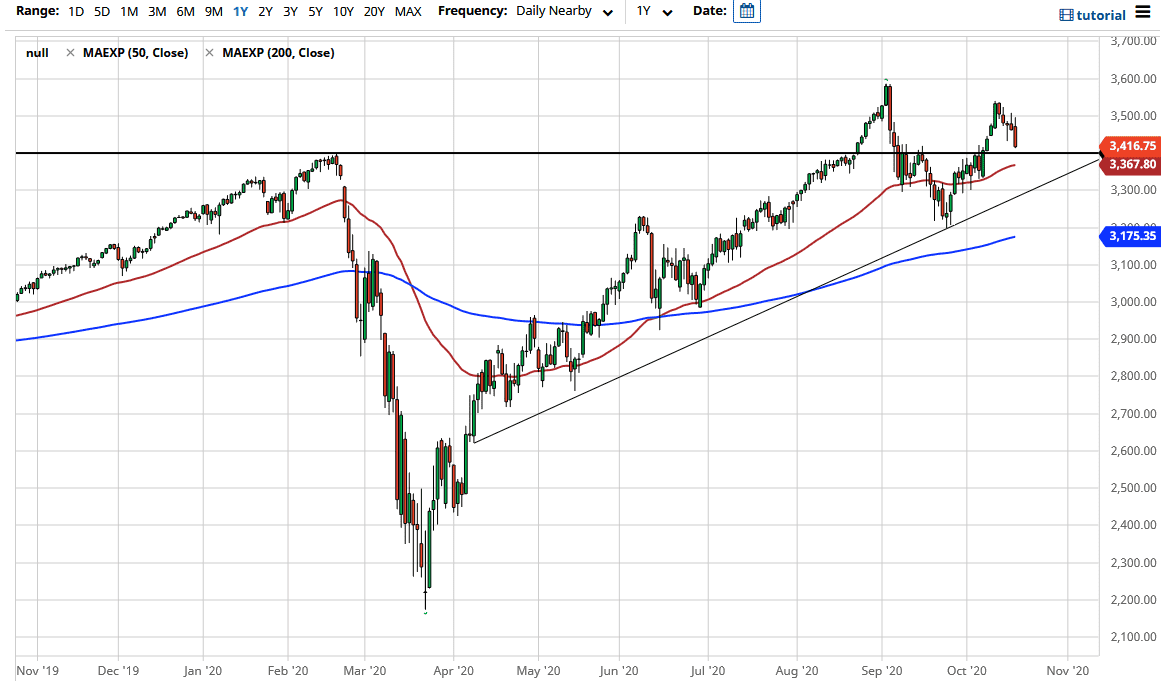

The S&P 500 initially tried to rally during the trading session on Monday but gave back the gains as the 3500 level has caused a bit of resistance. At this point, the market looks as if it is trying to go down to the 3400 level, which was the scene of a significant breakdown. This has a lot to do with what could be coming as far as the stimulus is concerned, as there is the thought that if we do not get something done by Tuesday, there may not be a stimulus between now and the election. At this point, I cannot believe that anybody actually believed that was a likely outcome.

The 50 day EMA sits just below the 3400 level, so it should be something that is worth paying attention to. The 50 day EMA has previously offered quite a bit of support for the longer-term trend, and therefore you should not dismiss the EMA has been important. Furthermore, we have an uptrend line underneath that looks like it could coincide with 3300. Because of this, I think that there are buyers out there and as we all know, it is an index that is built on a handful of stocks, so it would not take much to get things turned back around. Yes, I recognize that there could be a bit of a “double top” at the moment, but the stock exchange is littered with the bodies of those who thought they would be cute and start shorting.

One of the best ways to play the index being sold off rather drastically is to simply buy the US dollar. This is because it typically gives you more time to get out of what would essentially be the “short trade”, because the initial surge higher in the stock market will drive the US dollar higher as well, not only due to the buying of treasury bonds and safety. In other words, you have a lot more leeway as to how you deal with it. Shorting the S&P 500 is a great way to lose money unfortunately due to the algorithms out there that will jump on the latest headline or Tweet, and sin futures traders into the market to start buying the E-mini S&P 500 contract. With that being the case, it is very difficult to short this market, so why bother?