The market has closed towards the top of the candlestick which does typically suggest that there is more follow-through coming. However, this is all about stimulus so therefore it will be all about the latest headline. It is a bit difficult to make a confident trade without getting that out of the way, because all it would take us one tweet or rumor to knock the whole thing back down. It is because of this we need to see some type of resolution to the stimulus situation to be a bit more confident. However, in the meantime it is all about risk management, and therefore your position size should be kept relatively small.

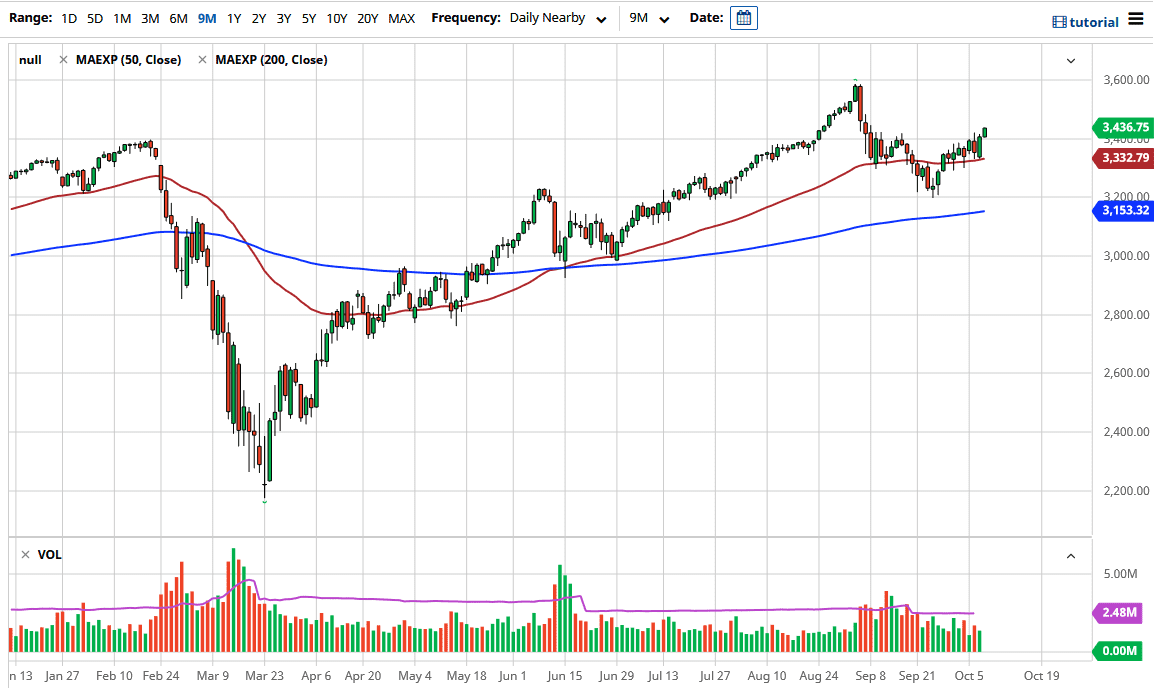

The 3400 level underneath should be supported at the moment, so if we were to break back down below there we will probably have to “reset” the entirety of the move higher. On the other hand, if we break above the highs from the session on Thursday, it is likely that we go looking towards the 3480 level initially, perhaps even as high as 3580.

The 50 day EMA underneath is curling higher and offering support, so I think it is only a matter of time before we get some type of buying pressure on a pullback. In other words, I am not necessarily looking to short the stock market, but I recognize that the timing is going to be very crucial. This is part of what putting a smaller position on initially will help with, because you can ride out the volatility. We have just finished a “V bottom” and broken to the upside to typically that is a bullish sign. However, when the market is moving on the latest headline, technical analysis can only take you so far as absolute panic and hit the market at any given moment. Because of this, it does make quite a bit of sense that we will continue to see a lot of volatility, but ultimately it still favors the upside as long as people are looking towards stimulus coming down the road, perhaps even after the election. All things being equal, this is a market that shows quite a bit of resiliency.