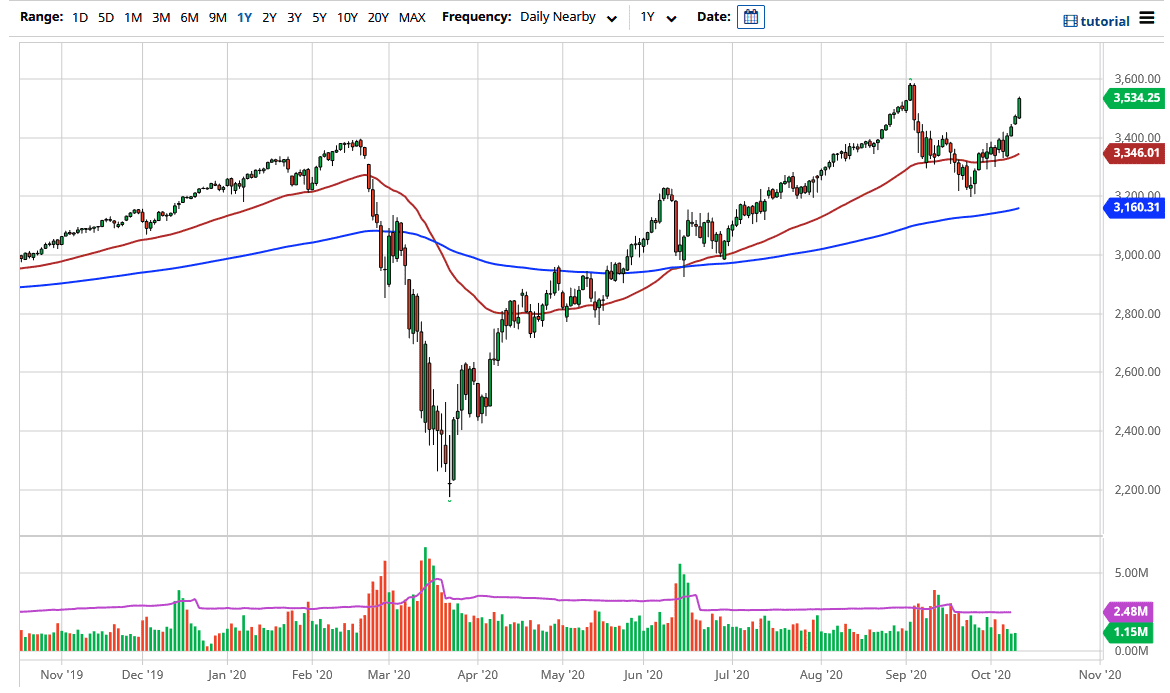

The S&P 500 has gone straight up in the air during the trading session on Monday, as we continue to see the market look at the stimulus with wild eyed abandon. Having said that, I see a massive amount of resistance just above and it is worth noting that we had gotten a bit ahead of ourselves. I suspect that we could get a little bit of a pullback, and it is probably only a matter of time before somebody says something to get people concerned.

This does not mean that we are going to suddenly break down and that we should be shorting this market, just that we probably get an opportunity to buy it on some type of debt. That has been the way to work this market for some time, and therefore I am looking for pullbacks towards the 3500 level, where I would anticipate a lot of people would be interested in. If you have not bought this market yet, you need to step to the side and wait for some type of opportunity. This is a market that has a lot of resistance built in at the 3580 handle, and of course the large, round, psychologically significant figure at 3600.

If we do break above there, then we simply continue the overall long-term bullish run, which is something that I anticipate is actually going to happen. However, to go straight up in the air it is very difficult considering that we are already stretched, and the farther we stretch to the upside the less stable that the underlying index becomes. Embrace the volatility, and look at pullbacks as a buying opportunity, not something to be afraid of. Even if we break down below the 3500 level, the market will more than likely find plenty of support underneath at the 3400 level. Make sure that you pay attention to the US dollar, because the US dollar falling has been a major push to the upside, giving this market more momentum as people rushed to buy assets and get away from cash. I think that continues to be the main theme here, and therefore we have to track the US Dollar Index right along with the S&P 500 as the negative correlation has been extremely high for the last 90 days.