The S&P 500 has gone back and forth during the trading session on Wednesday as we continue to dicker around with the idea of whether we are going to get stimulus or not in the United States. At this point, it looks like the market is probably going to pull back a bit, but at the same time I think there is more than enough support underneath that should continue to lift the S&P 500 given enough time.

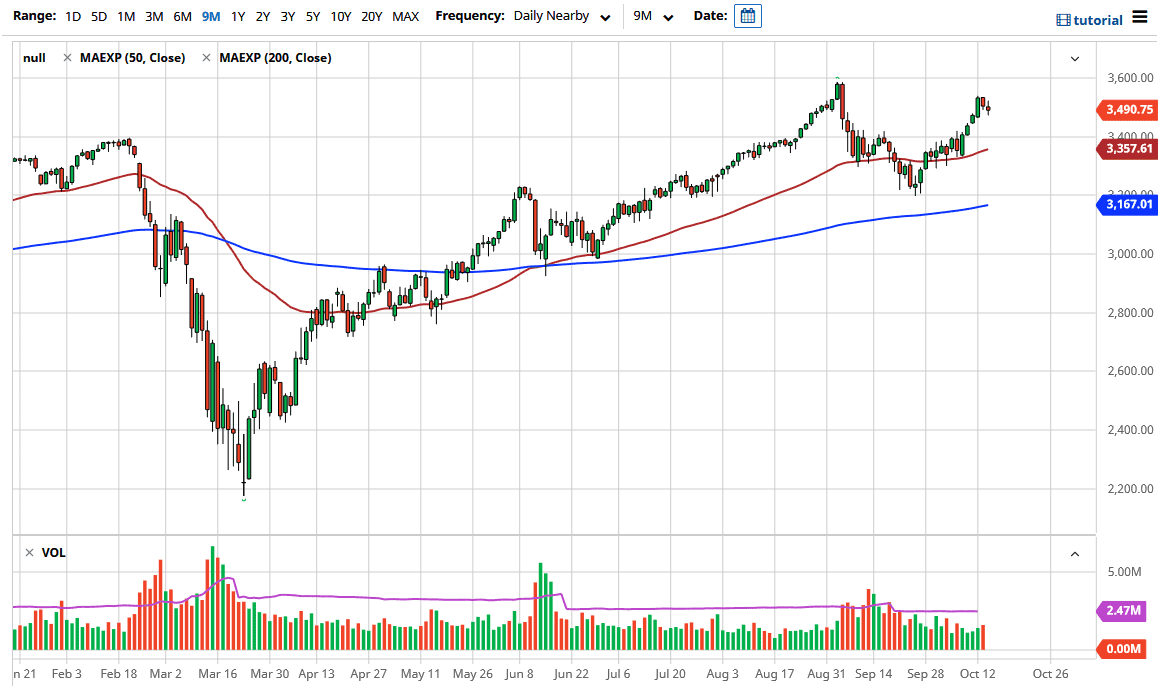

The market broke down below the 3500 level, so I think it is likely that we will probably pull back a bit more instead of going sideways like I thought was possible yesterday. The 3400 level underneath was the scene of a major breakout, so it is likely to be a bit of a floor in the market, and the fact that the 50 day EMA is racing towards that area does not exactly kill that idea either. I think at this point it is likely that the market will continue to see value hunting come back into the market as there is so much noise out there. Furthermore, we have the election that will probably have people holding their breath in the short term. Overall, I think this is a market that has been in an uptrend, and even though some people will be talking about a potential “double top”, I would be very surprised to see that play out. After all, it is quite astonishing just how much Wall Street can overlook. After all, they can almost always find some reason to get bullish.

Beyond that, you have to keep in mind that the market is well supported by the 50 day EMA, and the 200 day EMA is getting close to the 3200 level. All things being equal, I think that pullbacks will probably be a bit of a buying opportunity. Ultimately, I think that we will eventually get stimulus given enough time, and between now and then we will probably continue to see a lot of back and forth. The 3600 level above is obvious resistance, so if we can build up enough momentum to finally break above there, then the measured move at that point suggests that the S&P 500 goes to the 4000 level. I know that sounds a bit strong at this point, but there are multiple times in the past where I have said something like that in the past and yet here we are.