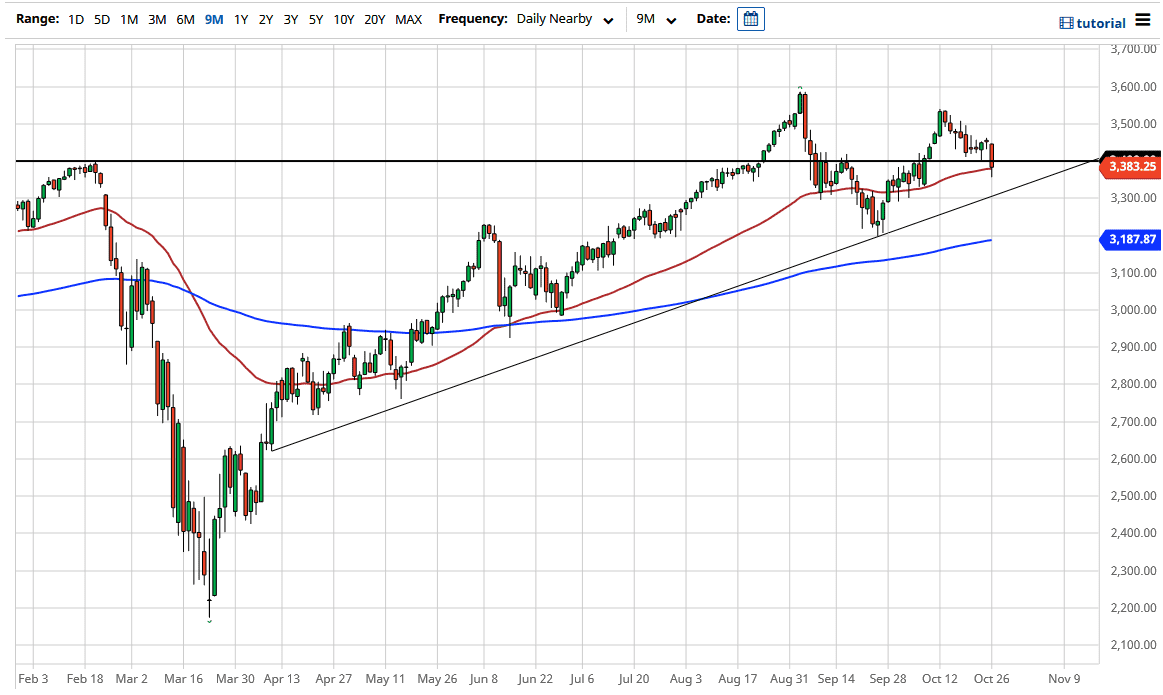

The S&P 500 has broken down significantly during the trading session on Monday, slicing through the 3400 level. At this point time, the market is likely to see a lot of volatility, as we head into the presidential election. Ultimately, the market is likely to see several areas underneath that could be supported, not just the 50 day EMA where we have set on during the trading session. However, the length of the candlestick is of course very negative, but at this point in time I think the only thing you can count on is going to be a lot of noise.

By slicing through the 3400 level, it has brought a lot of attention into this marketplace as we have broken the back of a couple of hammers. This is typically a very negative sign, and therefore I believe that we are probably in the midst of a breakdown in the market. The 3300 level will be an area that will attract a lot of attention, not only due to the large, round, psychologically significant figure, and of course the uptrend line. Looking at this chart, we have recently made a “lower high”, but we have not confirmed that as we have not made a “lower low.” In other words, the trend change has not been confirmed yet, and would not be until we have broken down below the 200 day EMA at the 3200 level.

Pay attention to the fact that there is almost no hope of stimulus out there, so with that being the case the S&P 500 will almost certainly throw some type of tantrum. Looking at this chart, I do believe that we have a couple of days’ worth of negativity coming soon, and therefore I am probably more likely to be buying the US dollar instead of shorting this market, because the S&P 500 is driven by a handful of stocks, so can rally even when there is negativity. With this being the case, I do like the idea of buying the S&P 500 eventually, just that we need to get a lot of headlines risk out of the way first, and at this point it is likely that we probably will get that until the middle of next week at the very least. People will need to know the makeup of the US government to decide whether or not there is going to be a lot of that cheap money.