The S&P 500 has gone back and forth during the trading session on Wednesday, as we have no idea what to do next. It was the end of both the month and the end of the quarter that had a lot of money flowing in and out of the S&P 500, so at the end of the day it was simply a lot of noise just waiting to happen. After all, big money managers had to square out their positions and perhaps add to some that they are not involved with, and therefore it always causes a strange day or two right around this time.

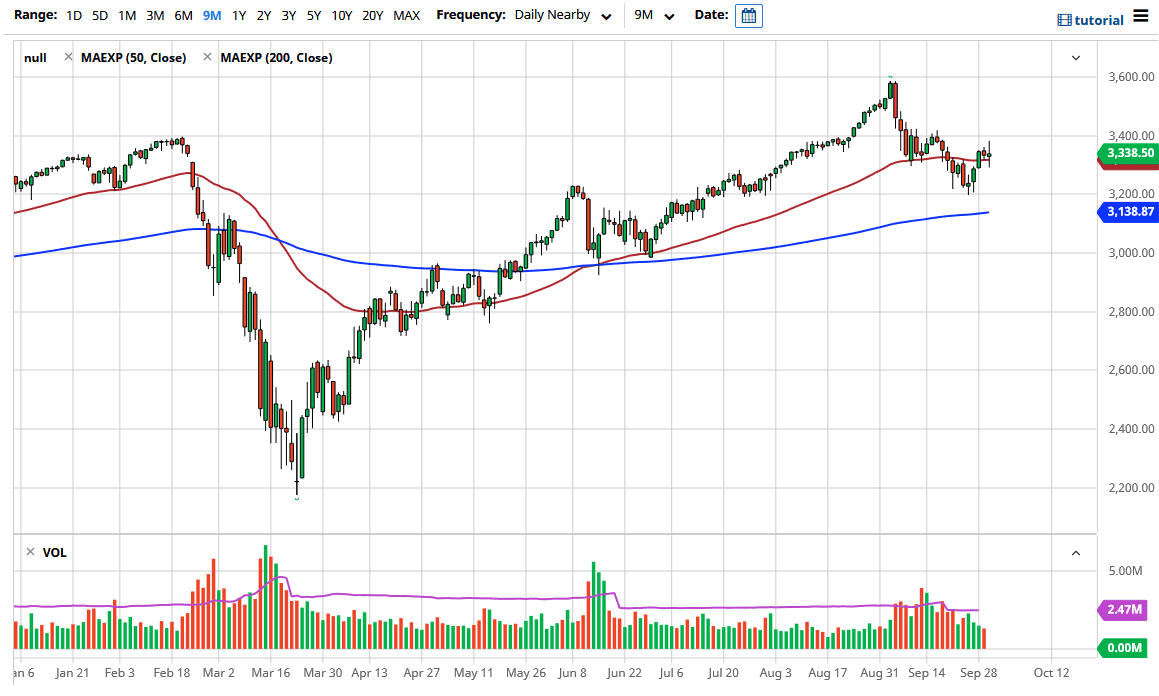

Looking at this chart, I think that we do have plenty of support down at the 3200 level, so I do not necessarily think that we are going to break down below there in the meantime. If we did, then we would go looking at the 200 day EMA underneath which is currently sitting at the 3138 level. That is a longer-term technical indicator that a lot of people pay attention to, so therefore it is worth recognizing it as a potential trade area.

On the other hand, we could break above the 3400 level and that could send this market much higher. I would need to see a daily close above 3425 in order to get overly bullish, but at that point, I think that we are ready to go looking towards the 3600 level above. That was the all-time high, so I think the market does try to get there eventually but we may have a little bit more of a base building to go. One thing is for sure, the market looked extraordinarily bullish at one point during the day, only to turn right back around and sell-off. Because of this, I think we are going to continue to see a lot of noise, and therefore I think it is going to be very difficult to jump into the market with a huge position, and therefore we need to be very cautious. With that being the case, it might be easier to simply wait until we break out of this 200 point range, something that we may or may not do in the short term. Pay attention to the US dollar, it has been highly negatively correlated to the S&P 500.