Brazil maintains a high number of Covid-19 cases, but the overall trend shows a gradual slowdown when more countries report an uptick in confirmed infections. Partial credit for the positive news goes to a lack of tests, which assists in the recovery of business sector confidence. The Getulio Vargas Foundation (FGV), a think tank, announced that it's September Business Confidence Index (ICE) rose 1.5 points to 97.5. Adding to bullishness for was the Current Business Situation Index (ISA), up 4.4 points to 93.0, and above the 92.5 reported in February. The USD/BRL completed a breakdown below its resistance zone from where an accelerated sell-off is expected.

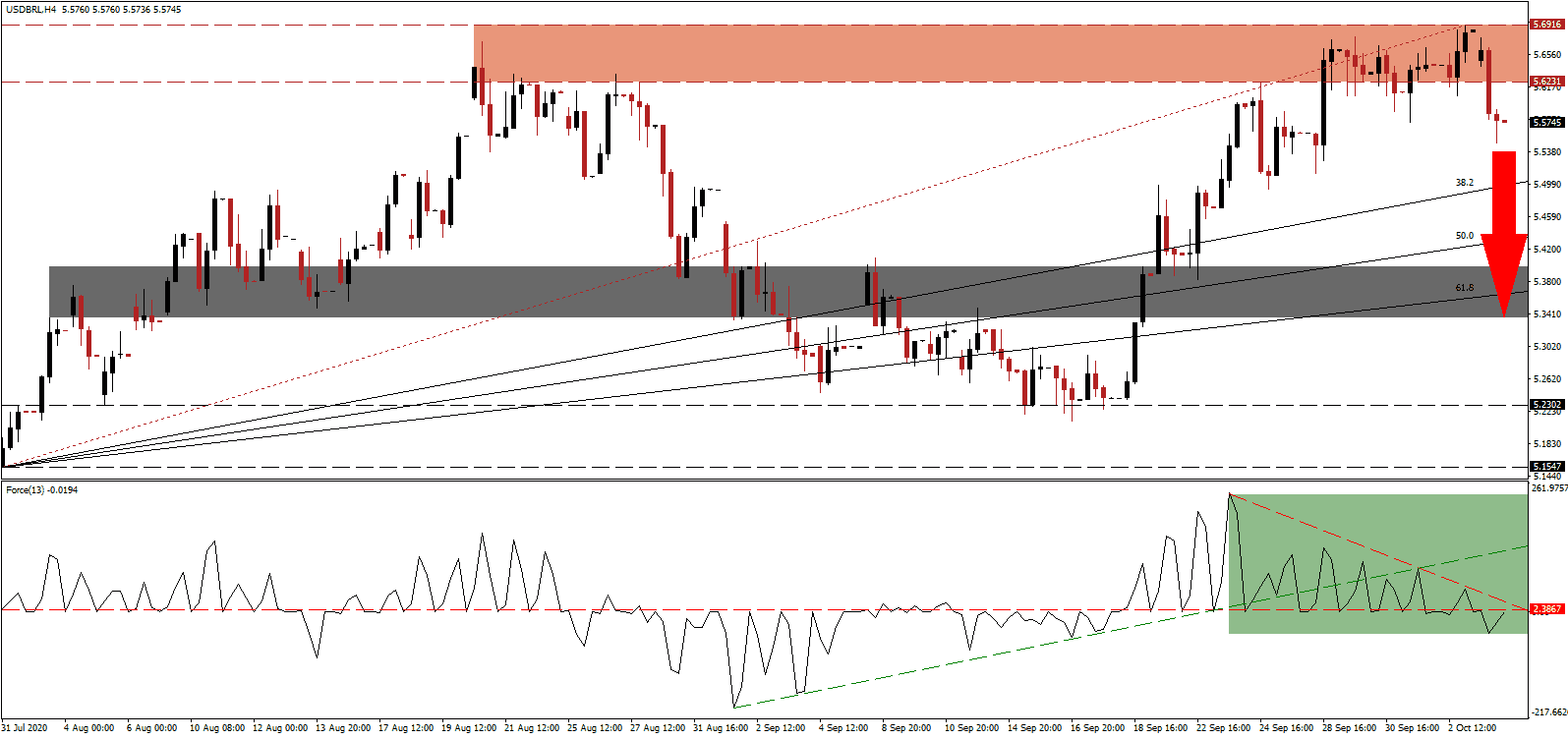

The Force Index, a next-generation technical indicator, confirms bearish dominance after sliding below its ascending support level and remains below its horizontal resistance level. Adding to downside pressure is the descending resistance level, as marked by the green rectangle, positioned to drive this technical indicator farther into negative territory. The USD/BRL remains under bearish control, with more downside ahead.

While business confidence approaches pre-pandemic levels, consumer confidence remains depressed. National Industry Confederation (CNI) reported the September National Consumer Expectation Index (INEC) at 42.8. Pessimism was highest among high-income earners and urban residents. Following the breakdown in the USD/BRL below its resistance zone located between 5.6231 and 5.6916, as identified by the red rectangle, price action is well-positioned to resume its long-term downtrend.

Due to the lack of domestic demand, Brazil recorded a record trade surplus of $6.163 in September for a year-to-date reading of $42.455. Exports were down 9.1% to $18.459 and imports by 25.5% to 12.296. Providing another catalyst was the 2020 upward revision for the Brazilian GDP by the International Monetary Fund (IMF), which now predicts a decrease of 5.8% versus the previous estimate for a 9.1% collapse. The IMF credits President Jair Bolsonaro and his Covid-19 response for the improvement. The USD/BRL is on course to correct into its short-term support zone located between 5.3357 and 5.3981, as marked by the grey rectangle and enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. More downside is likely to materialize.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.5750

Take Profit @ 5.3350

Stop Loss @ 5.6350

Downside Potential: 2,400 pips

Upside Risk: 600 pips

Risk/Reward Ratio: 4.00

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/BRL could attempt a short-term reversal. Forex traders should take advantage of any advance in price action with new net short positions. The outlook for the US Dollar remains long-term bearish amid excessive debt and a slowing post-lockdown recovery with a surge in localized restrictions. The upside potential is reduced to its intra-day high of 5.8753.

USD/BRL Technical Trading Set-Up - Reduced Reversal Scenario

Long Entry @ 5.7200

Take Profit @ 5.8700

Stop Loss @ 5.6350

Upside Potential: 1,500 pips

Downside Risk: 850 pips

Risk/Reward Ratio: 1.77