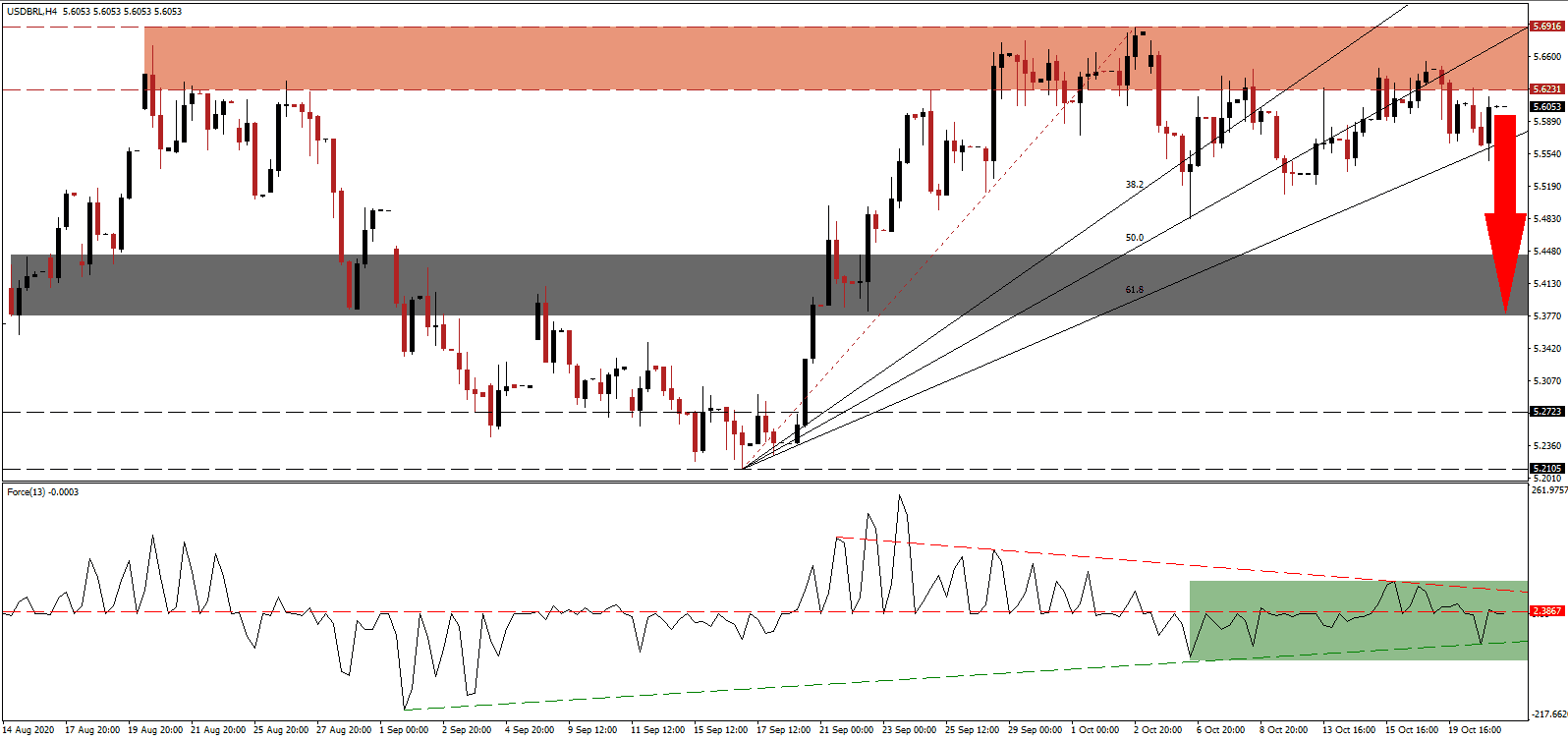

With the global Covid-19 pandemic forcing permanent changes to existing business models and supply chains, some countries embrace it more than others. Brazil continues to take advantage of issues and positions itself to emerge as a more connected, digital, and dominant player on the global stage. The US continues to favor its debt-driven consumerism, gambling away the financial future of coming generations, and failing to realize opportunities. After the USD/BRL trended sideways below its resistance zone, dominant bearish pressures are on track to ignite a new sell-off.

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level, as marked by the green rectangle. Adding to breakdown pressures is the descending resistance level, favored to guide this technical indicator below its ascending support level and into negative territory. Bears remain in control of the USD/BRL with the Force Index below the 0 center-line.

Paulo Guedes, the Minister of Economy, during a live online event hosted by the Milken Institute, confirmed that Brazil could join the Organisation for Economic Co-operation and Development (OECD) in 2021. He added that Brazil took necessary steps in areas like privatizations, asset sales, fiscal discipline, and deregulation. Following the breakdown in the USD/BRL below its resistance zone located between 5.6231 and 5.6916, as marked by the red rectangle, bearish pressures remain dominant and suggest more downside.

Brazil also works on a closer relationship with the Arab world, while China continues to support Latin America’s largest economy with a growing demand for soft commodities. Ernesto Araújo, the Minister of Foreign Affairs, outlined the importance of a strategic relationship with Arab countries in a post-Covid-19 world. Brazil also announced plans for an initial public offering (IPO) for the digital arm of Caixa Economica Federal, which registered 64,000,000 customers in less than six months. A breakdown in the USD/BRL below its ascending 61.8 Fibonacci Retracement Fan Support Level can take it into its short-term support zone between 5.3772 and 5.4435, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 5.6050

Take Profit @ 5.3775

Stop Loss @ 5.6775

Downside Potential: 2,275 pips

Upside Risk: 725 pips

Risk/Reward Ratio: 3.14

In case the Force Index pushes above its descending resistance level, the USD/BRL may attempt a breakout. Forex traders should consider any advance as a secondary selling opportunity. With $2 trillion in additional debt pending, a crumbling labor market recovery, and a grim economic outlook over the next few quarters, the US Dollar is bound to extend its weakness. The upside potential remains confined to its resistance zone located between 5.8753 and 5.9900.

USD/BRL Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 5.7675

Take Profit @ 5.9225

Stop Loss @ 5.6775

Upside Potential: 1,550 pips

Downside Risk: 900 pips

Risk/Reward Ratio: 1.72