Brazil seeks ways to extend financial support to the poor are the country reports over 30,000 new Covid-19 infections daily. A new program labeled Renda Cidada, Portuguese for citizen income, faces similar funding issues as other proposals. Financial markets in Brazil faced a rise in volatility after reports surfaced that President Jair Bolsonaro wanted to fund Renda Cidada with court-ordered future financial payments on existing debt worth R$55 billion. The USD/BRL advanced into its resistance zone from where bullish momentum collapsed.

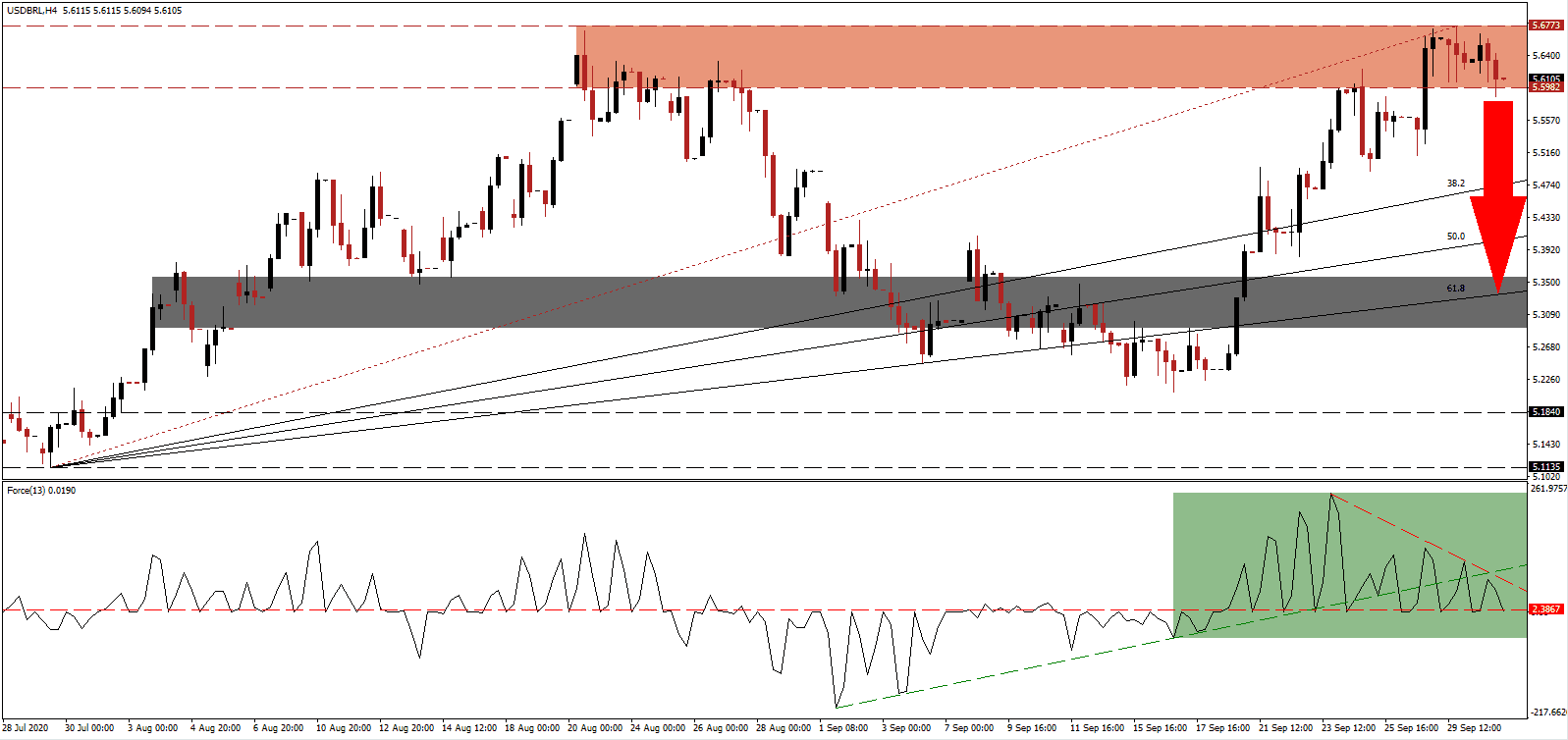

The Force Index, a next-generation technical indicator, initially spiked to a new multi-week peak before drifting lower, while price action advanced, forming a negative divergence. It has since corrected below its ascending support level and pierced through its horizontal resistance level, as marked by the green rectangle. The descending resistance level is set to drive this technical indicator farther into negative territory and bears controlling the USD/BRL.

Paulo Guedes, the Brazilian Minister of the Economy, assured financial markets that the government would not use accounting tricks to pay for any programs. Instead, his team seeks to combine 27 existing social welfare programs into Renda Cidada. He did acknowledge that expense to the future court-ordered payments are being examined, but that using potential savings to pay for welfare is not suitable. The USD/BRL currently challenges its resistance zone located between 5.5982 and 5.6773, as marked by the red rectangle, from where a breakdown is favored.

One bright spot despite the Covid-19 pandemic is the IPO (initial public offering) market in Brazil, which experiences the best year since 2007. With 17 completed IPOs worth $3.6 billion and another 40 in the pipeline, the equity market remains busy, adding long-term support to the Brazilian Real and the economy. One change due to the global pandemic is that local banks are leading the deal flow, another positive for Brazil. The USD/BRL is well-positioned for a profit-taking sell-off into its short-term support zone located between 5.2913 and 5.3565, as identified by the grey rectangle, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/BRL Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 5.6100

Take Profit @ 5.3400

Stop Loss @ 5.6900

Downside Potential: 2,700 pips

Upside Risk: 800 pips

Risk/Reward Ratio: 3.38

A breakout in the Force Index above its descending resistance level may result in a temporary price spike in the USD/BRL. Given the weakening labor market, together with prospects of more debt and a resurgence of Covid-19 infections, the outlook for the US Dollar remains bearish. Forex traders should sell any rallies with the upside potential limited to its intra-day high of 5.9700.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.7800

Take Profit @ 5.9300

Stop Loss @ 5.5600

Upside Potential: 1,500 pips

Downside Risk: 900 pips

Risk/Reward Ratio: 1.67