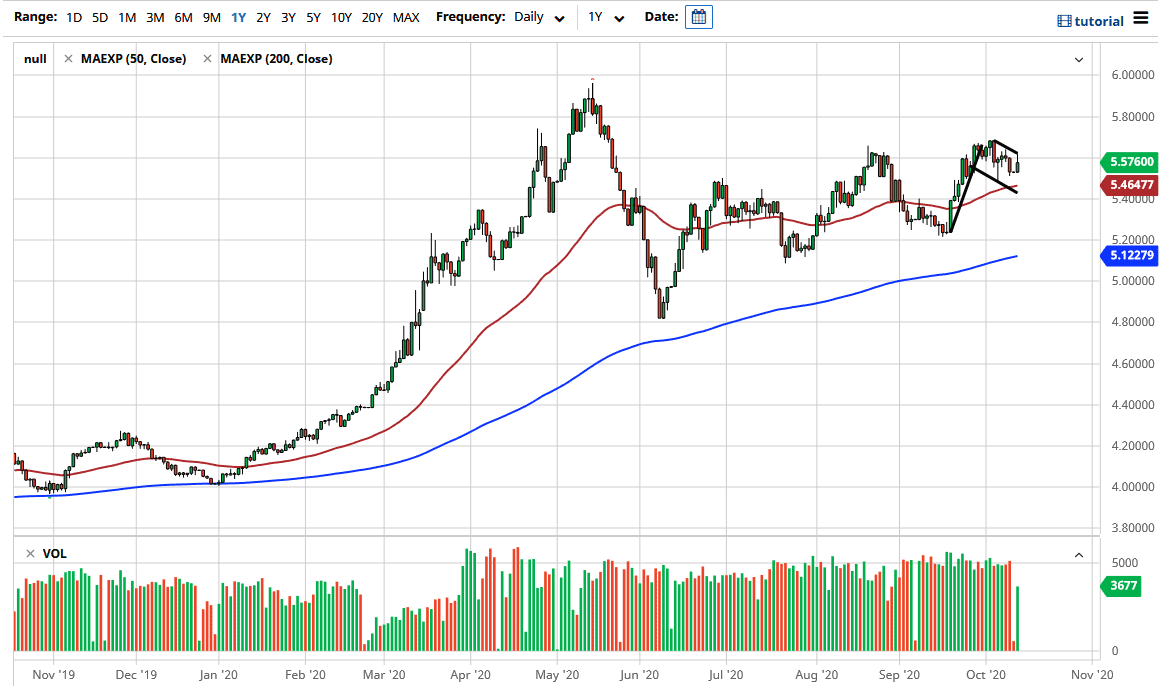

US dollar has rallied a bit during the trading session on Tuesday to test the top of the bullish flag that the market has been forming as of late. Ultimately, this is a market that shows quite a bit of choppiness, and it looks to me like we are trying to break the top of this flag. If we do, then the market is likely to continue to reach towards the upside.

For what it is worth, the bullish flag measures for a 0.50 move, which extends to the 6.00 level. Ultimately, this is a market that I think continues to see a lot of volatility and that makes quite a bit of sense considering that the emerging markets out there are going to continue to struggle due to the fact that there are a lot of concerns about the global growth situation. The Brazilian real is a currency that represents Latin America, which also extends to the entirety of South America and Central America. Brazil is by far the largest economy in this region, so it is a bit of a proxy for the entire area, right along with the Mexican peso. In other words, people will gauge what is going on in that region of the world in use these two currencies to express that view.

What is even more important about this currency pair is the fact that it features the US dollar, which is safety. It looks as if the emerging markets are going to get hammered again, and if we break above the top of this bullish flag it is yet another continuation. The 50 day EMA sits just below the recent trading and telling to the upside. It should offer dynamic support. Ultimately, another thing that has weighed upon this market is that the IMF has suggested that emerging markets were going to have a tough year ahead, while the developed markets should fare much better. This suggests that global growth is starting to stall a bit, and that works against places like Brazil. Ultimately, shorting this market is all but impossible right now, because we have been in a series of “higher highs” and “higher lows.” Essentially this looks like an up-trending channel that we are still in, and the market should continue to follow that overall path.