The USD/BRL remains within the higher plateaus of its mid-term range, but significantly the forex pair has shown the ability to incrementally lower resistance levels above via technical charts. Yesterday’s trading saw an early wave of downside price action, but as President Trump sparked intrigue regarding the merits of another stimulus package cautious trading ensued and the USD/BRL reversed higher.

Momentary news blasts however should not be enough to rattle the markets long term, as long as investors practice the art of taking a deep breath and allowing themselves to test their own notions instead of reacting to every dose of presumed breaking news. Technical traders perceived and believed in the ability of the USD/BRL to provide adequate resistance in recent sessions may be inclined to suspect the reversal higher seen yesterday may prove superficial.

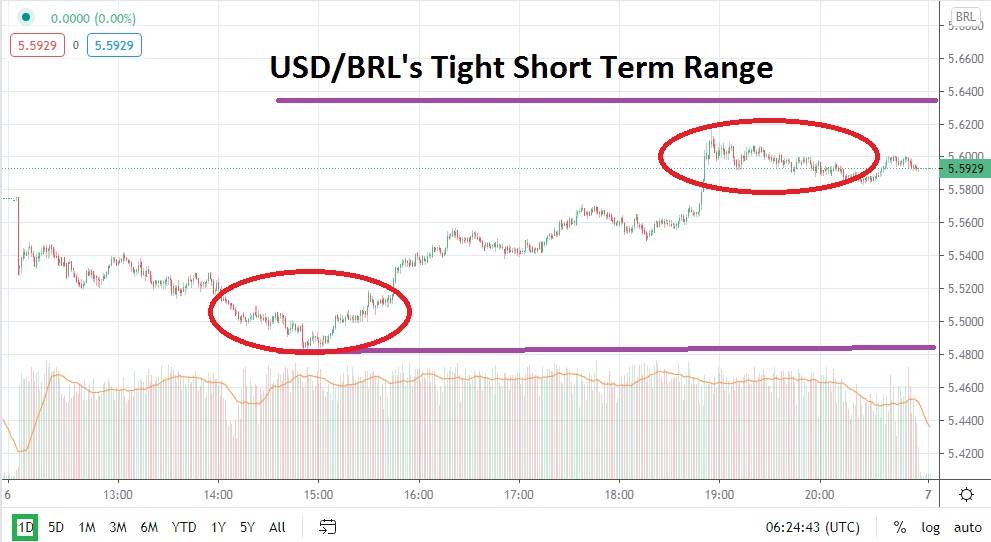

Resistance at the 5.6400 level does look enticing as a stop loss. If a stronger dose of risk appetite is delivered into global equity markets today the USD/BRL may have the ability to resume another leg down. The Brazilian Real touched support near the 5.4800 juncture yesterday and traders may use this value as a targeted goal. Although the value may feel like it is far away from the current price action, the recent consolidated range of the USD/BRL suggest that a limited breakout is about to occur.

Speculators may suspect via risk-reward scenarios contemplated there is more downside potential than upside likelihood regarding the USD/BRL. Certainly, the Brazilian Real has tested higher values against the US Dollar, but the loftier heights of 5.7000 and above were prices the USD/BRL suffered from during the height of the coronavirus chaos as global markets roiled with fear.

The USD/BRL has been beleaguered in some ways, the Brazilian Real has not recovered its lost value like many other emerging market currencies have been able to accomplish. Yes, Brazil remains troubled with economic and health concerns regarding coronavirus, but it also has a dynamic place within international trade and this is not going to suddenly disappear. Selling the USD/BRL and looking for downside momentum may be the best speculative position near term.

Brazilian Real Short Term Outlook:

Current Resistance: 5.6400

Current Support: 5.5550

High Target: 5.6925

Low Target: 5.4820