Indonesia lacks adequate Covid-19 testing capabilities or refuses to deploy them amid protests, and the police response to them, against President Joko Widodo and his Omnibus law. It aims to attract foreign direct investment, privatize public goods and services, and create jobs. The House of Representatives passed it on October 5th, and infrastructure remains central to the post-Covid-19 recovery plan by the Indonesian government. Dominant bearish momentum in the USD/IDR suggests more downside following the breakdown below its resistance zone.

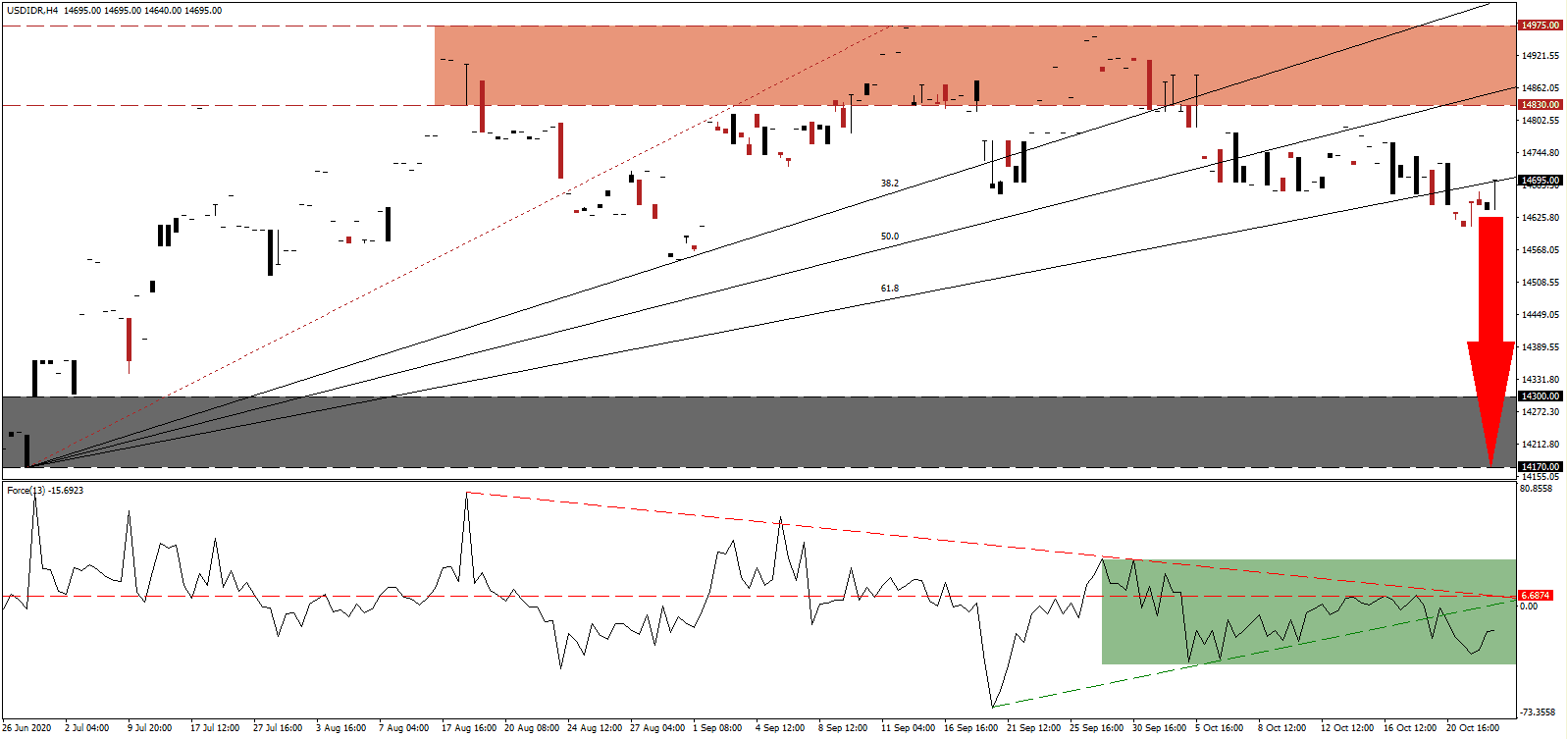

The Force Index, a next-generation technical indicator, confirms downside pressures after the rejection by its horizontal resistance level and the collapse below its ascending support level. Adding to bearish momentum is the descending resistance level, as marked by the green rectangle. Bears remain in complete control over the USD/IDR with this technical indicator below the 0 center-line.

With the Covid-19 pandemic pressuring banks with the risk of a surge in bad loans, the Financial Services Authority of Indonesia, Otoritas Jasa Keuangan (OJK), announced the extension of loan restructuring incentives until March 2022. The latest data revealed 7,500,000 debtors restructured Rp904.3 trillion, with a non-performing loan ratio (NPL) of just 3.15%. The breakdown in the USD/IDR below its resistance zone located between 14,830 and 14,975, as identified by the red rectangle, cleared the path for more selling.

Another positive development for Indonesia is the $262 million in financing for healthcare projects by the Islamic Development Bank (IsDB). It will upgrade five regional hospitals to enhance healthcare delivery. Indonesia and China have also signed a deal to use the Indonesian Rupiah and the Chinese Yuan to settle trade and investment transactions. It will create more financial stability and independence from the US Dollar. Bearish pressures in the USD/IDR spiked after the move below its ascending 61.8 Fibonacci Retracement Fan Support Level. Price action is favored to accelerate into its support zone located between 14,170 and 14,300, as marked by the grey rectangle.

USD/IDR Technical Trading Set-Up - Breakdown Acceleration Scenario

- Short Entry @ 14,700

- Take Profit @ 14,170

- Stop Loss @ 14,870

- Downside Potential: 530 pips

- Upside Risk: 170 pips

- Risk/Reward Ratio: 3.12

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/IDR could attempt to push higher. Forex traders should take advantage of any price spike amid a bleak outlook for the US Dollar, faced with more debt and a slowing economy. Indonesia takes the necessary step to boost its economy in the long-term, adding to strength for its currency. The upside potential remains confined to its intra-day high of 15,220.

USD/IDR Technical Trading Set-Up - Confined Reversal Scenario

- Long Entry @ 15,000

- Take Profit @ 15,200

- Stop Loss @ 14,870

- Upside Potential: 200 pips

- Downside Risk:130 pips

- Risk/Reward Ratio: 1.54