Indonesia became the new Covid-19 hotspot in Southeast Asia, surpassing the Philippines. It is now the eighteenth most-infected country globally and has the seventeenth highest death toll. The world’s fourth-most populous country outlined a plan to distribute an unspecified Covid-19 vaccine from 2021, but many Indonesians may not get access to it. Presently, there is no vaccine available, several tests halted, and developed countries pre-purchased over 50% of supply from leading candidates. The USD/IDR completed a breakdown below its resistance zone, from where a more massive sell-off appears probable.

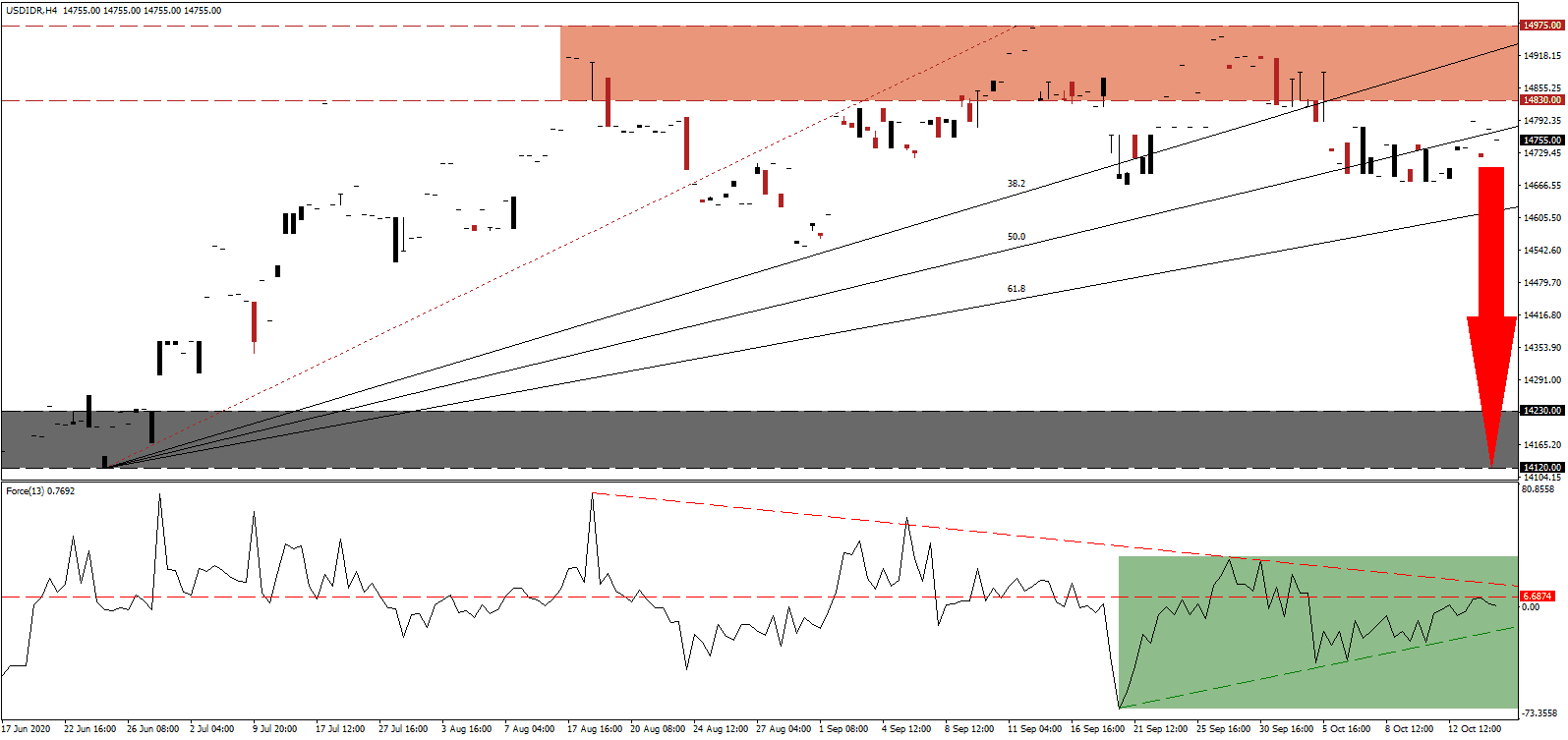

The Force Index, a next-generation technical indicator, was able to record three higher lows but was rejected by its horizontal resistance level. Adding to downside pressures is the descending resistance level, as marked by the green rectangle, which is favored to result in a collapse below its ascending support level. Bears wait for this technical indicator to slide below the 0 center-line to resume complete control over the USD/IDR.

President Joko Widodo continues to face harsh criticism for his Omnibus law, a 1,000 page plus legislation intended to attract foreign investment, limit red tape, and create jobs. Critics claim it will hurt domestic labor, indigenous people, religious minorities, and the environment. Three days of intense protest saw clashes with the police, but President Widodo will sign the final version into law next week. After the USD/IDR exited its resistance zone located between 14,830 and 14,975, as marked by the red rectangle, to the downside, bearish pressures continue to accumulate.

Sri Mulyani, the Minister of Finance, remained upbeat on the outlook for Indonesia and confirmed the assessment that the country began to recover economically. Third-quarter GDP is forecast to contract between 1.0% and 2.8%, but well above the 5.3% drop registered in the second quarter. More downside is favored in the USD/IDR after it moved below its ascending 50.0 Fibonacci Retracement Fan Support Level. A sell-off into its support zone between 14,120 and 14,230 is anticipated to materialize, driven by US Dollar weakness.

USD/IDR Technical Trading Set-Up - Breakdown Acceleration Scenario

- Short Entry @ 14,750

- Take Profit @ 14,120

- Stop Loss @ 14,930

- Downside Potential: 630 pips

- Upside Risk: 180 pips

- Risk/Reward Ratio: 3.50

A breakout in the Force Index above its descending resistance level could result in a retracement of the breakdown in the USD/IDR. With the likelihood of $2 trillion more in debt in the US, together with a weak US Dollar policy by the US Federal Reserve and a weakening labor market, Forex traders should sell any advance. The upside potential is reduced to its intra-day high of 15,220.

USD/IDR Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 15,030

- Take Profit @ 15,200

- Stop Loss @ 14,930

- Upside Potential: 170 pips

- Downside Risk: 100 pips

- Risk/Reward Ratio: 1.70