The national recovery rate rose to 90.6%, with a fatality rate of 1.50%. Over the next 48 hours, the world’s second-most populous nation will join the US as the second country exceeding over 8,000,000 confirmed infections. Despite the improvement, India, together with the rest of the world, prepares for a challenging winter. The USD/INR completed a breakdown below its resistance zone from where a complete reversal can follow.

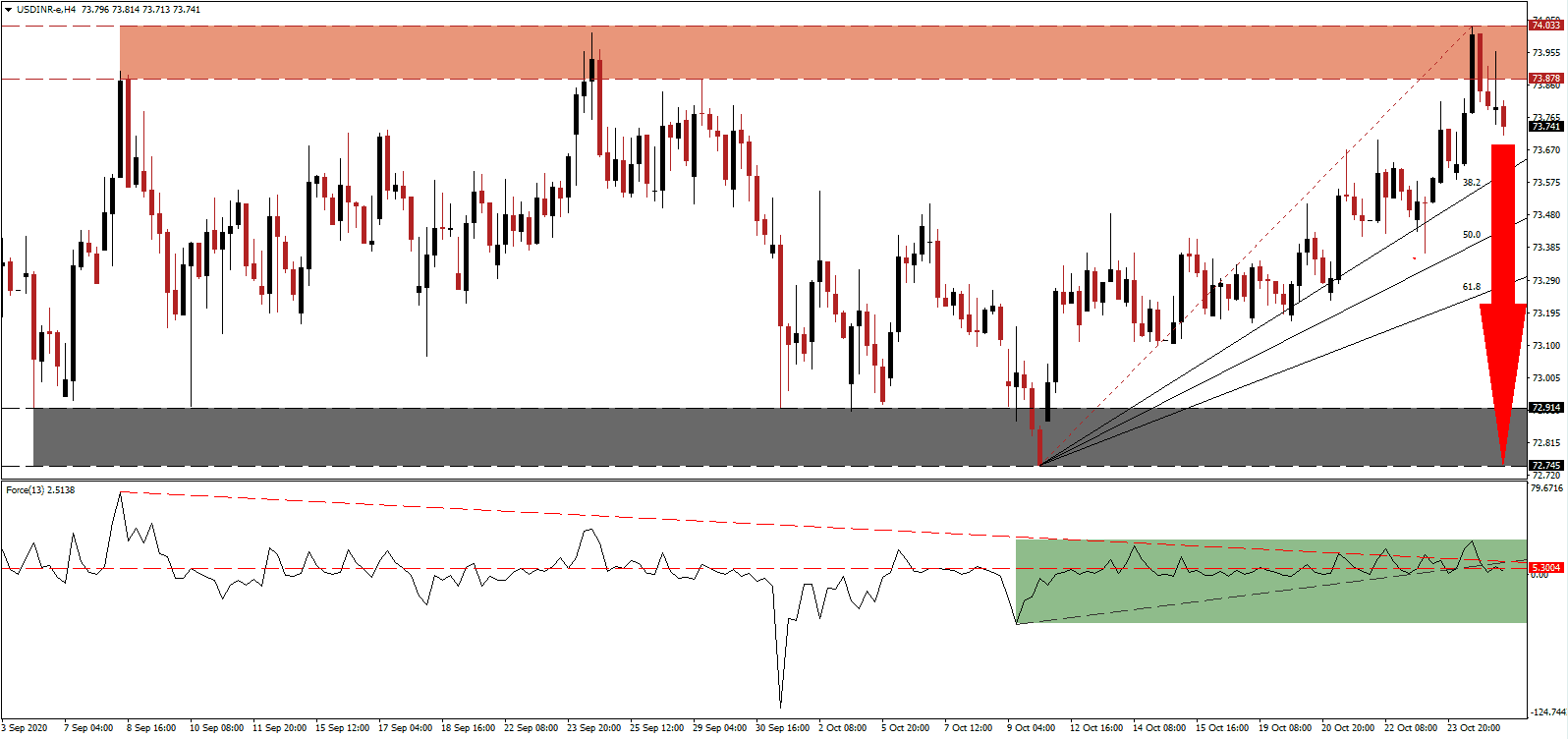

The Force Index, a next-generation technical indicator, shows the build-up in bearish momentum after recording a marginally higher high. It swiftly reversed below its descending resistance level, followed by a move below its ascending support level, as marked by the green rectangle. Bears regained full control over the USD/INR after this technical indicator crossed below its horizontal resistance level, setting it on course to a collapse into negative territory.

While top officials from the Indian Ministry of Finance confirmed that another stimulus could be announced, they failed to provide further details. The government of Prime Minister Narendra Modi announced plans to boost public finances by selling stakes in public sector enterprises (PSEs) back to the companies. Bearish pressures on the USD/INR accumulated following the breakdown below its resistance zone located between 73.878 and 74.033, as identified by the red rectangle.

Plans by Prime Minister Modi to grow the Indian economy to $5 trillion per year appear out-of-reach this decade. An estimated by Indian CARE Ratings outlined a GDP growth rate of 11.6% per year could reach the $5 trillion-goal by 2027, which appears unlikely given the disruptions caused by the Covid-19 pandemic. The relationship with China continues to sour, adding uncertainty to the ambitious GDP target. A breakdown in the USD/INR below its ascending 50.0 Fibonacci Retracement Fan Support Level is favored to take price action into its support zone located between 72.745 and 72.914, as marked by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 73.750

- Take Profit @ 72.750

- Stop Loss @ 74.000

- Downside Potential: 10,000 pips

- Upside Risk: 2,500 pips

- Risk/Reward Ratio: 4.00

A sustained move in the Force Index above its ascending support level, serving as resistance, may lead the USD/INR into a secondary breakout attempt. It will grant Forex traders a secondary short-selling opportunity amid the intensifying bearish pressures on the US Dollar. The post-Covid-19 lockdown recovery is losing steam, and the US reports record new daily infections, while restrictions to slow the spread are absent. Any push higher remains confined to its intra-day high of 74.370.

USD/INR Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 74.150

- Take Profit @ 74.350

- Stop Loss @ 74.000

- Upside Potential: 2,000 pips

- Downside Risk: 1,500 pips

- Risk/Reward Ratio: 1.33