While the second Covid-19 infection gathers pace and on course to place a significantly larger strain on healthcare systems, Tarun Bajaj, the Economic Affairs Secretary of India, confirmed that the government is open to another stimulus program. India remains the second-most infected country globally, trailing only the US, but lacks testing capacities. Nirmala Sitharaman, the Minister of Finance, announced a series of measures to support the vital festival season, which may also accelerate the spread of the pandemic. The USD/INR faced a price spike, vulnerable to a new breakdown amid the lack of bullish momentum.

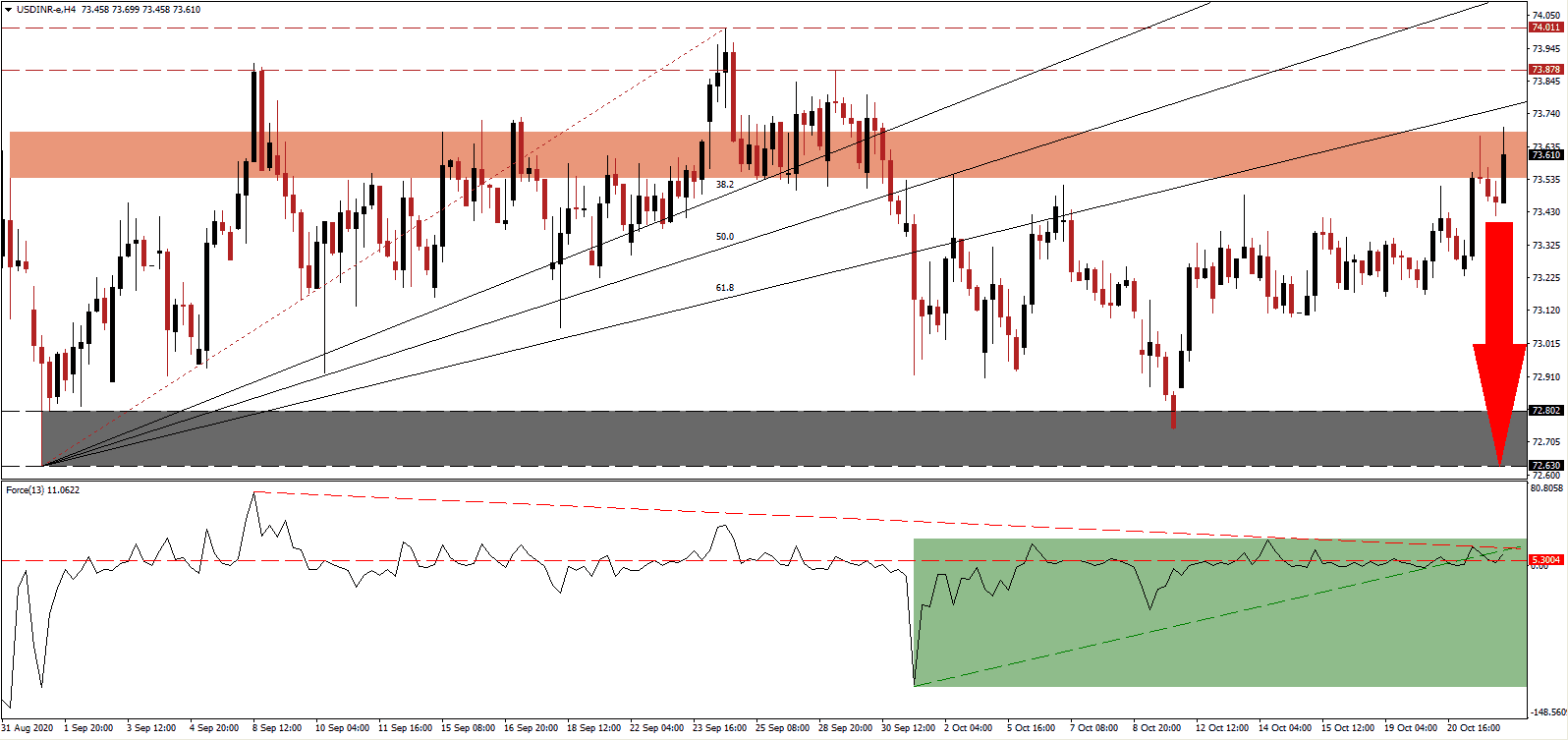

The Force Index, a next-generation technical indicator, remains confined to a narrow range just above and below its horizontal resistance level, as marked by the green rectangle. Adding to downside pressures is the descending resistance level, and this technical indicator maintains its positions below its ascending support level. A move below the 0 center-line will allow bears to regain complete control over the USD/INR.

With India attempting to safeguard its domestic economy and maintaining an attractive destination for foreign direct investment, India makes headlines on the international stage. It has opposed the US, Brazil, and Colombia in the World Trade Organisation (WTO) to pressure countries into an acceleration of commitments, and the implementation of them, under the Trade Facilitation Agreement (TFA). The recent price spike took the USD/INR into a new short-term resistance zone, located between 73.536 and 73.682, as marked by the red rectangle, with bearish momentum dominant.

India additionally appears on course to worsen relations with China, following a multi-month and unresolved border dispute. The government of Prime Minister Narendra Modi signaled its willingness to start trade talks with Taiwan, which China considers one of its provinces. While there is no schedule and official talks remain unlikely, it will harm India, which seeks to reduce its dependence on China. The redrawn ascending 61.8 Fibonacci Retracement Fan Resistance Level is well-positioned to reject the USD/INR and force it to retreat into its support zone located between 72.630 and 72.802, as identified by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 73.600

Take Profit @ 72.650

Stop Loss @ 73.800

Downside Potential: 9,500 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 4.75

Should the Force Index maintain a breakout above its descending resistance level, the USD/INR could seek an extension of its advance. Political uncertainty, more debt, and localized restrictions due to the Covid-19 pandemic, apply downside pressure on the US Dollar. With the US outlook deteriorating, more upside will allow Forex traders to add to short positions. The intra-day high of 74.370 marks the limit of the current upside potential.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 74.000

Take Profit @ 74.350

Stop Loss @ 73.800

Upside Potential: 3,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.75