While India remains at the top of new daily Covid-19 infections, slowly closing the gap to the US, which is the most-infected country globally, the economy continues to show signs of recovery. India appears to lag many other countries, where the post-lockdown spike in economic activity shows signs of exhaustion. New surrounding US President Donald Trump Covid-19 infection added to short-term volatility. He received supplemental oxygen and received treatment reserved for severe cases, but was discharged from the hospital. Until more clarity is available, the USD/INR is likely to engage in a short-covering rally.

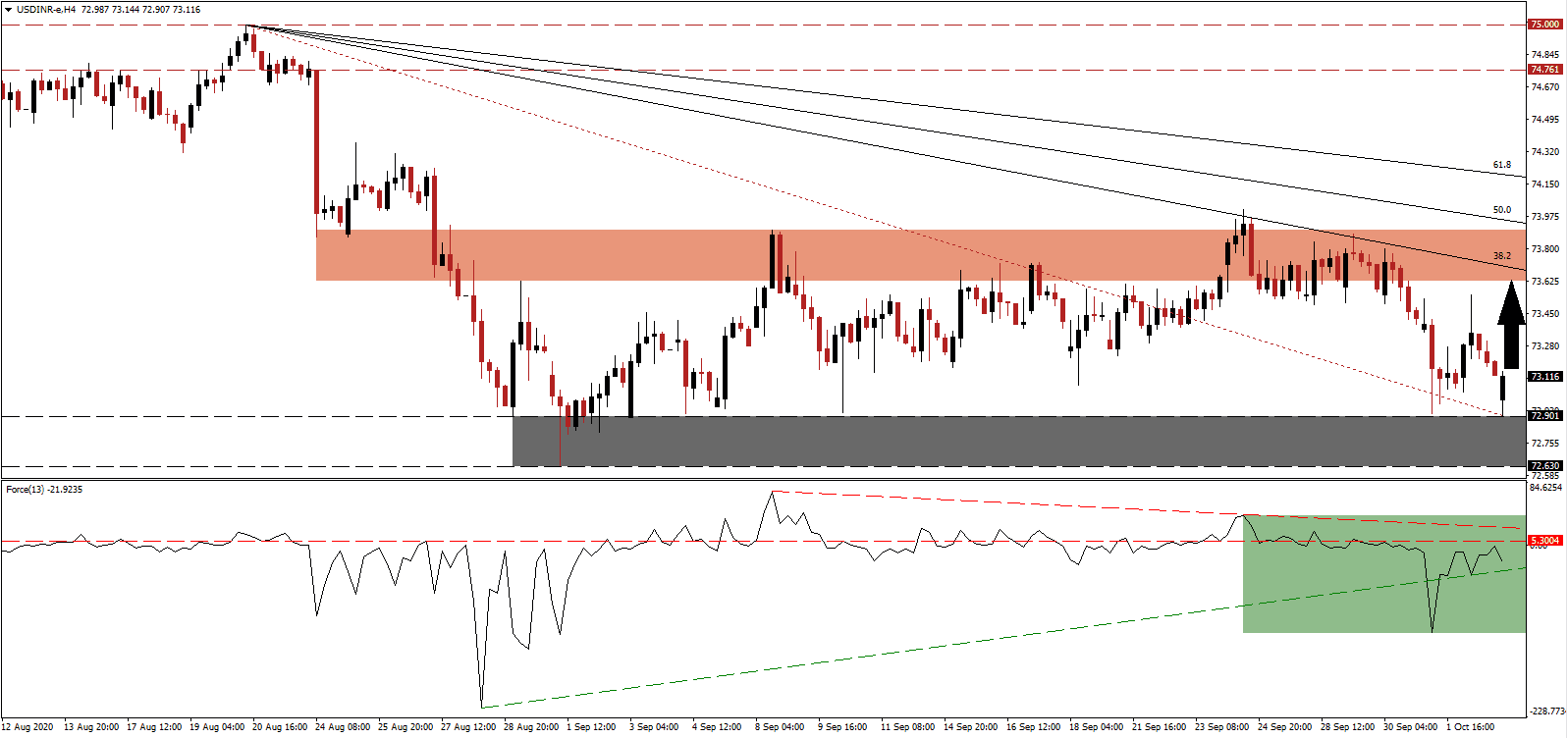

The Force Index, a next-generation technical indicator, initially plunged through its redrawn ascending support level, as marked by the green rectangle, but swiftly reversed above it. Despite the advance, it remains below its horizontal resistance level and the 0 center-line. The descending resistance level is favored to pressure this technical indicator farther into negative territory while bears remain in charge of price action in the USD/INR.

Krishnamurthy Subramanian, the Chief Economic Adviser to the Government of India, follows the same pattern of his global counterparts and claims a V-shaped recovery. He notes a gradual recovery in sectors like coal, oil, gas, steel, and cement, partially driven by Prime Minister Narendra Modi and his ₹1.46 trillion in infrastructure projects, part of the ₹1.70 trillion in economic stimulus. Following the breakdown in the USD/INR below its resistance zone located between 73.625 and 73.899, as identified by the red rectangle, price action accelerated into the top range of its support zone.

After six consecutive months of export contractions, September posted a rise of 5.27%, with cereals, iron ore, and rice leading the recovery. Imports plunged by 19.6%, an indicator of weak domestic demand, which is bearish for an emerging economy and confirms more long-term issues ahead. With the vision to grow GDP to $5 trillion by 2025 derailed, how the government of Prime Minister Modi will promote an economic recalibration will be essential for the future of India. The USD/INR may bounce off of its support zone located between 72.630 and 72.901, as marked by the grey rectangle, but the descending 38.2 Fibonacci Retracement Fan Resistance Level is likely to keep the long-term downtrend intact.

USD/INR Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 73.100

Take Profit @ 73.600

Stop Loss @ 72.900

Upside Potential: 5,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.50

Should the Force Index collapse through its ascending support level, the USD/INR is favored to resume its long-term correction. The US labor market deteriorates rapidly, and more localized lockdowns become a distinct possibility. Uncertainty over the health of US President Trump adds to the bearish outlook. Forex traders should view any advance as a selling opportunity, with a collapse into its next support zone between 71.429 and 71.710 probable.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 72.600

Take Profit @ 71.450

Stop Loss @ 72.900

Downside Potential: 11,500 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 3.83