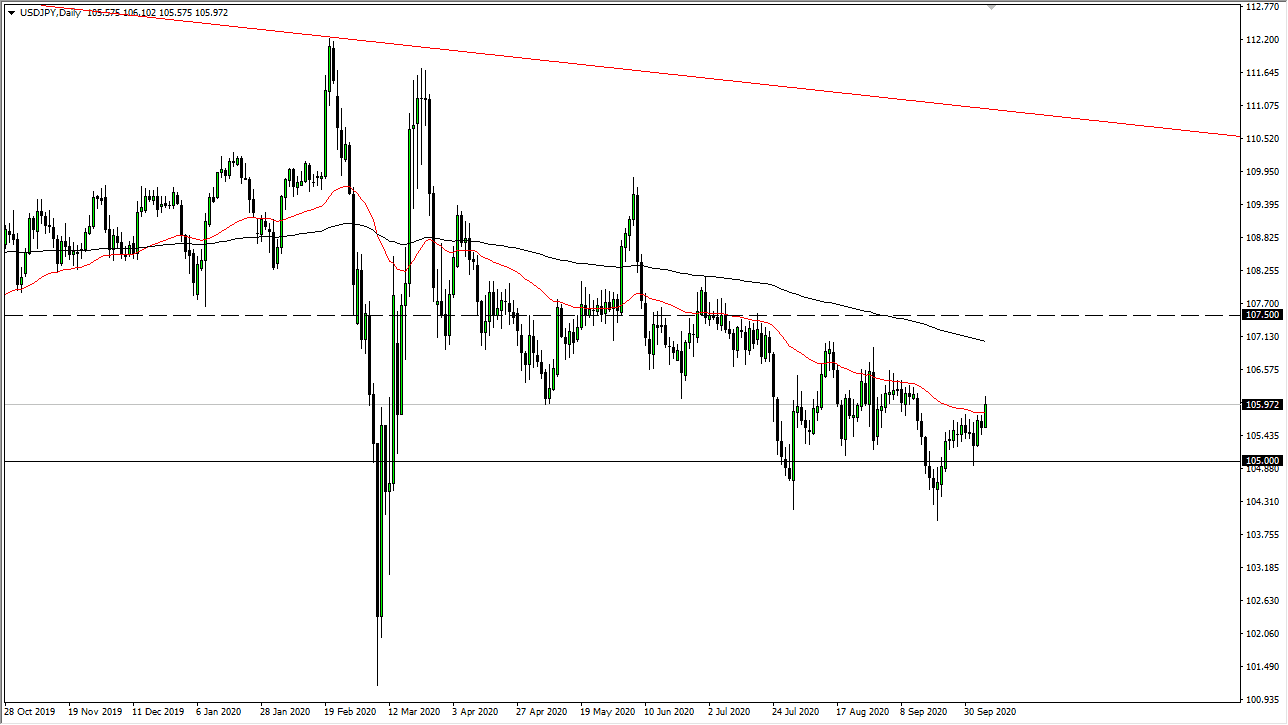

The US dollar rallied against the Japanese yen during the trading session on Wednesday to break above the 50 day EMA. This is something that the market has not quite been able to do as of late, so it is interesting to note is that we are above there. Having said that, the ¥106 level continues offer resistance, so I do believe that it is going to be difficult to continue going higher. Furthermore, this would suggest that there is going to be a major “risk on push” in general. While that could be the case, the last vehicle I would use to trade against the Japanese yen in that scenario would be the US dollar. If we go higher here, you will probably get more mileage out of the trade in the NZD/JPY pair, GBP/JPY pair, and so on. This is because both of these currencies are considered to be a “safety currency.”

Furthermore, the value of the US dollar falling against almost everything else will be a bit of headwind for this market grinding higher for the longer-term move. I think that there is still a lot of noise between here and the 200 day EMA, so I am just not interested in buying. However, if we break back below the 50 day EMA I could be convinced the start shorting, especially if there is a bit of a shock to the system. If we start to see stock markets around the world got hit hard, it is possible that this pair will drop in order to find safety in the Japanese yen. It does not really matter though, because I see so much noise above that the easiest path in my estimation is going to be to the downside at this point in time.

If we do break down from here, then it is likely that the market will go looking at the ¥105 level, which of course is a large, round, psychologically significant figure, and an area where a lot of traders have been involved in. Because of this, I think that the area might be a bit difficult to break through, but it certainly will be a bit of a magnet for price if we really start selling off. A breakdown below there could open up the possibility of a move down to the ¥104 level.