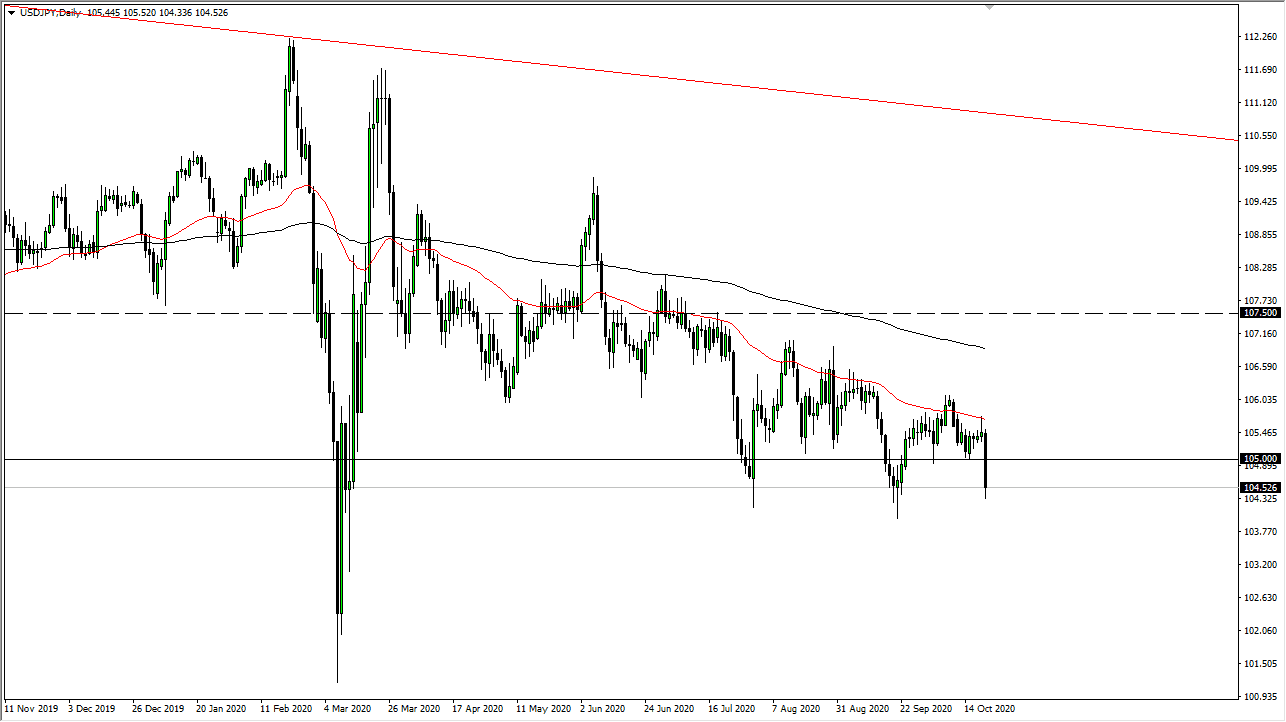

The US dollar got hammered during the trading session on Wednesday, slicing through the ¥105 level like it was not even there. Furthermore, we have threatened the ¥104.50 level, which was an area where we have seen quite a bit of. I think at this point, we are very likely to continue the overall “sell the rallies” type of scenario.

Underneath, the market breaking below the ¥140 level would kick off a major move lower, perhaps down to the ¥102 level. That is an area where we have seen a lot of support in the past, as we bounced from there during the month of March. We have since started to grind from there down to the current levels, and it suggests to me that we continue to see selling pressure. Furthermore, we are currently at the bottom of what I see as a potential descending triangle, and that measures for a move down towards the ¥102 level as well.

Bond markets favor the Japanese bond markets as far as yield is concerned so that works against the value of the US dollar. Having said that, we also see that there is a lot of stimulus hopes out there and that should drive down the value of the greenback. Beyond that, even if we do get some type of break down and risk appetite that also favors the Japanese yen in general. Looking at this chart, I believe it is only a matter of time before you look to fade signs of exhaustion, especially near the 50 day EMA which is an area that has caused a lot of resistance over the last several months, and also seems to be the beginning of a major “zone of resistance” that extends down to the 200 day EMA.

Looking at the chart, the candlestick is very negative, and it clearly shows that there has been a bigger push lower. I think at this point it is only a matter of time before we see people taking advantage of “cheap yen” as it appears. I have no interest in buying this pair, it is obviously in a major downtrend so right now it is not even a thought. The ¥105 level could offer a bit of resistance as well, so looking at this chart I think it is obvious that we only have one direction to go.