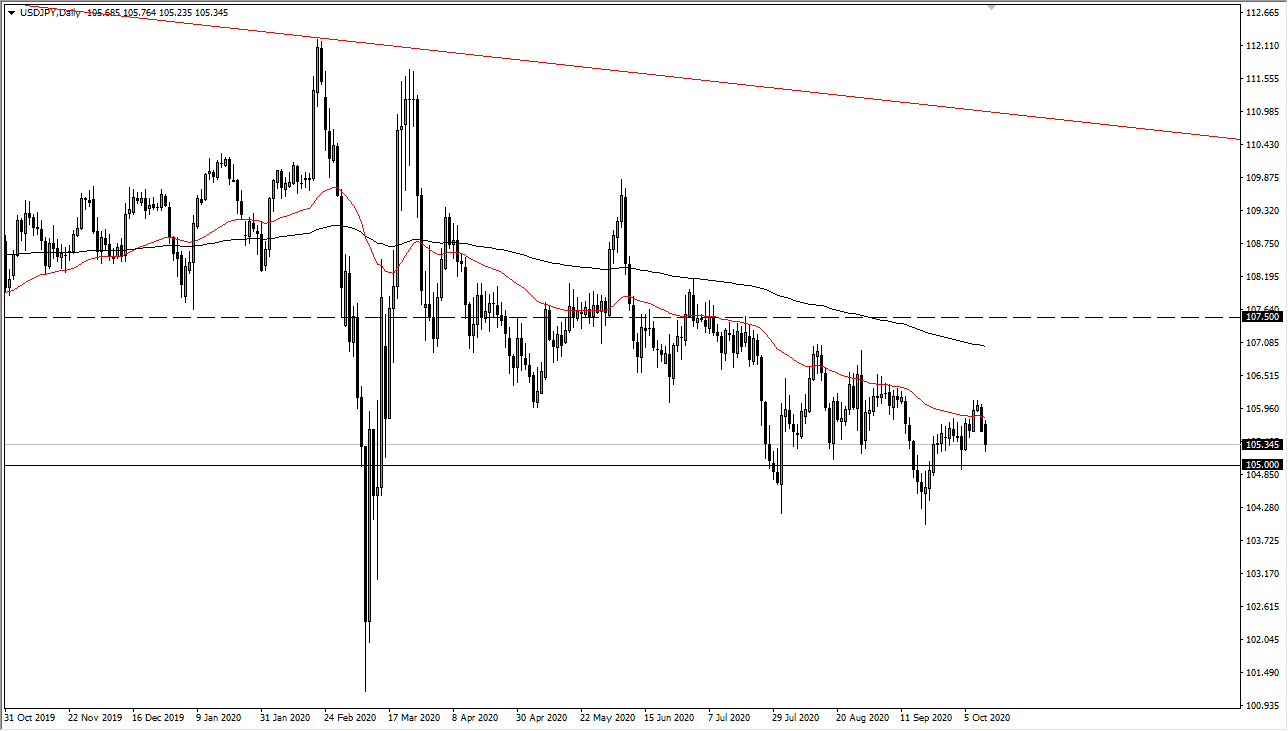

The US dollar has initially gapped higher against the Japanese yen but then broke down towards the ¥105.25 level underneath. Underneath there, the market looks to see the ¥105 level targeted relatively soon, and then possibly down towards the ¥104 level. At this point in time, the idea of any rally will probably be sold into as the 50 day EMA continues to be very crucial. After all, it has offered resistance for several months, and I think that we will continue to see it be adhered to.

Ultimately, this is a market that I think continues to see a lot of resistance between the 50 day EMA and the 200 day EMA. After all, this is a market that is in a downtrend, but obviously, it is not necessarily falling apart. This makes quite a bit of sense considering that the US dollar and Japanese yen both are considered to be safety currencies, and therefore it makes sense that we would see a little bit of back-and-forth here because both of these currencies will be favored. However, there is also the question about the stimulus, and that is probably the more important driver for this pair.

The US dollar fell hard as we continue to see a lot of people focus on the idea of massive amounts of stimulus, which should drive down the value of the US dollar, at least in theory. However, the market participants continue to see a lot of back and forth based upon the idea of the bond markets, and the idea of whether or not there are bigger concerns out there. That does drive up the value of the US dollar in general, but I think against the Japanese yen we will continue to struggle to pick up gains and it is very likely that we follow the most recent “lower low” towards the ¥102 level. However, this is a very choppy and term type of movement, so I think you are probably looking to fade short-term rallies and take relatively quick gains. I have no interest in buying this pair, at least not anytime soon. Once we get through stimulus, then we can reevaluate everything but at this point, the market simply seems to be hoping for massive amounts of fiscal package is coming out of the US, which works against the currency.