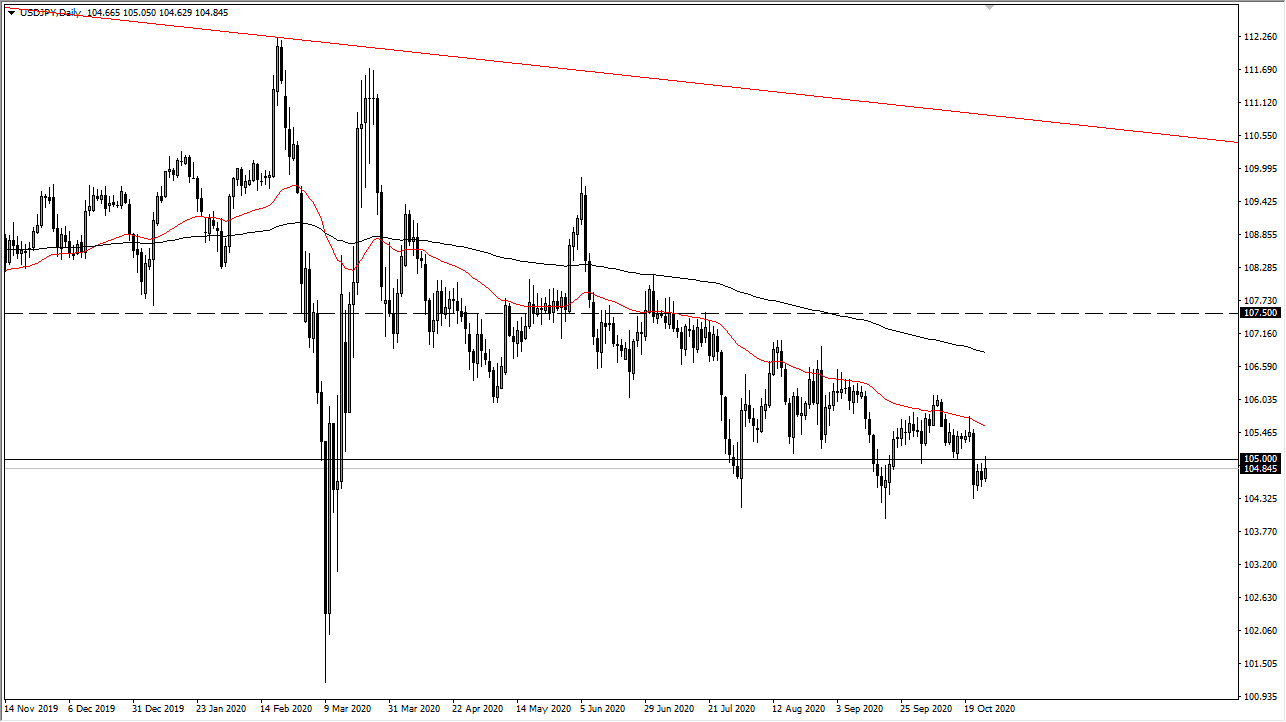

This is a pair that is highly sensitive to risk and has been in a major downtrend for some time. The ¥105 level of course is a large, round, psychologically significant figure, and could be an area that a lot of people will pay close attention to. This is a pair that is highly sensitive to risk appetite, so I think we do continue to grind much lower. When you look at the chart, you can make an argument for a descending triangle, which suggests that we are going to go lower.

When you look at the triangle, it measures for a move down towards the ¥102 level, and as a result it is likely that traders will find a lot of support there as it was a massive bounce. At this point in time, I like the idea of selling short-term rallies, and it is worth noting that the 50 day EMA has offered significant amount of resistance, that brings all the way up to the 200 day EMA. This is a complete zone of resistance, so it is difficult to imagine a scenario where we finally break above there, unless of course something changes rather drastically. At this point, there is still a lot of questions out there when it comes to stimulus, so all things being equal this is a market that simply cannot seem to make up some type of decision.

If we were to break down below the recent lows, it is likely that the move to the ¥102 level would be rather quickly achieved, as it was such a massive bounce. To the upside, the market would need to close above the 200 day EMA on a daily chart to consider going long, but really, I have a hard time seeing the scenario where that happens. After all, this is a pair that is sensitive to risk, and then it also could be driven by the US dollar falling due to stimulus. This is a market that will continue to be noisy, but again, I think is simply wait for some type of exhaustion in order to sell again. Buying is something that it will not happen anytime soon.