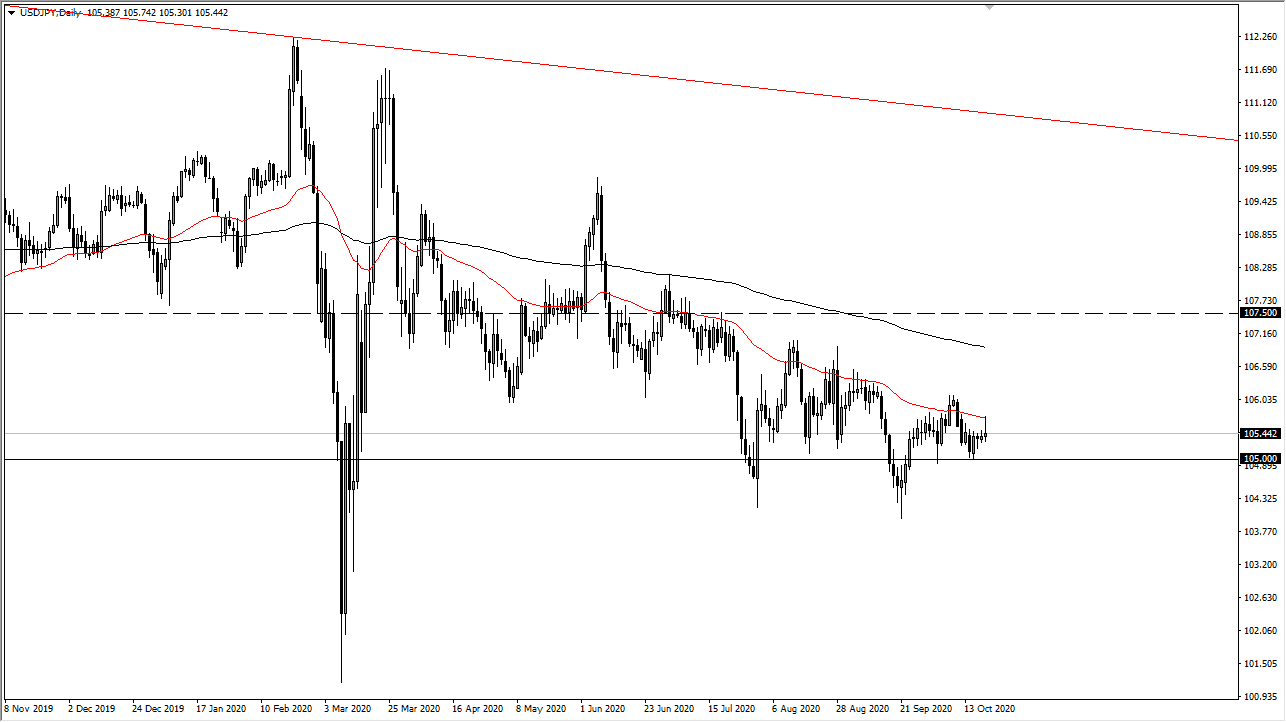

The 50 day EMA has been crucial for quite some time, and it has offered a lot of resistance for several months. The area between the 50 day EMA and the 200 day EMA has been massive resistance, and therefore I think it is going to be difficult to break above there. All things being equal, this is a market that I think is in a downtrend and it is looking for a reason for sellers to get short.

The shape of the daily candlestick is a shooting star, which of course shows signs of weakness. Rallies at this point in time should be sold into for what I see, even though we are starting to see the possibility of more of a “risk on rally”, so people will be paying attention to whether or not the stock market takes out to the upside. This would more than likely be based upon the idea of stimulus, which would have people looking to get away from the Japanese yen.

Looking at this chart, the ¥105 line continues to be significant support, and of course a psychologically significant figure. Ultimately, this is a market that is going to be very noisy, but the market breaking down below the ¥105 level should send this market down to the ¥104 level is we have bounced from. If we break down below there, then it is likely that we go looking towards the ¥102 level. I have no interest whatsoever in trying to buy this market, because the downtrend has been so strong and reliable. With that being the case, I do believe that simply fading rallies that show signs of exhaustion will continue to be the way most traders play this pair. I have no interest in trying to fight the overall trend, it is well ensconced, and quite frankly it is difficult to imagine a scenario where things change suddenly. Because of this, being patient and waiting for a short-term signal is probably the best way to go. If we do break above the top of the shooting star for the trading session on Tuesday, then we probably reset and go looking towards the ¥106.50 level.