The US dollar has gone back and forth during the trading session on Wednesday as we continue to see a lot of inconsistencies as to where risk appetite may go. It has been all over the place during the trading session on Wednesday, as we have to worry about whether or not there is going to be more drama when it comes down to the global growth situation. There are a lot of concerns out there in the meantime, as people are concerned about whether or not the global economy is going to continue to struggle due to the coronavirus infection numbers rising.

Early in the day we did see a lot of negativity due to the fact that the Europeans are now starting to talk about locking down economies, and that of course suggests that we are going to see a lot of economic drag out there. When people are concerned, they typically pick up the Japanese yen in a bid to get a bit of safety. This is especially true now that Japanese bonds are starting to pay a little bit more in the way of interest than the US bond market does.

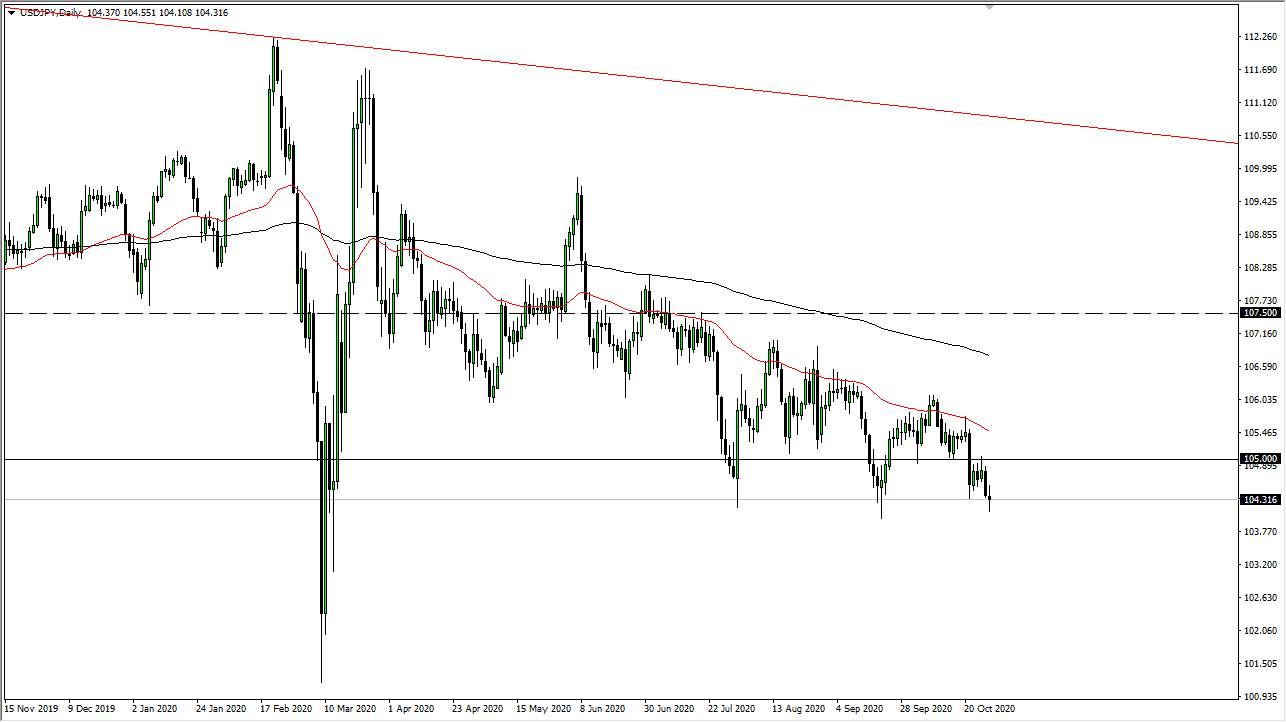

Looking at this chart, the market has seen a lot of selling pressure previously, as we have formed a bit of a descending triangle over the last several months which of course is a negative sign as well. Furthermore, the 50 day EMA sits above and is racing towards the ¥105.50 level. I think rallies at this point in time will see rallies sold into as we have in the past. However, if we were to break down below the ¥104 level, the market is likely to see a break down towards the ¥102 level which is the scene of a significant bounce previously. Ultimately, this is a market that I think is attracted to that level like a magnet, as these major levels do tend to be tested eventually. If we break down below the ¥102 level, then it is likely that the market goes down to the ¥100 level. To the upside, I do not have any interest in buying until we break above the 200 day EMA at the very least. At this point, this is a “fade the rallies” type of situation only.