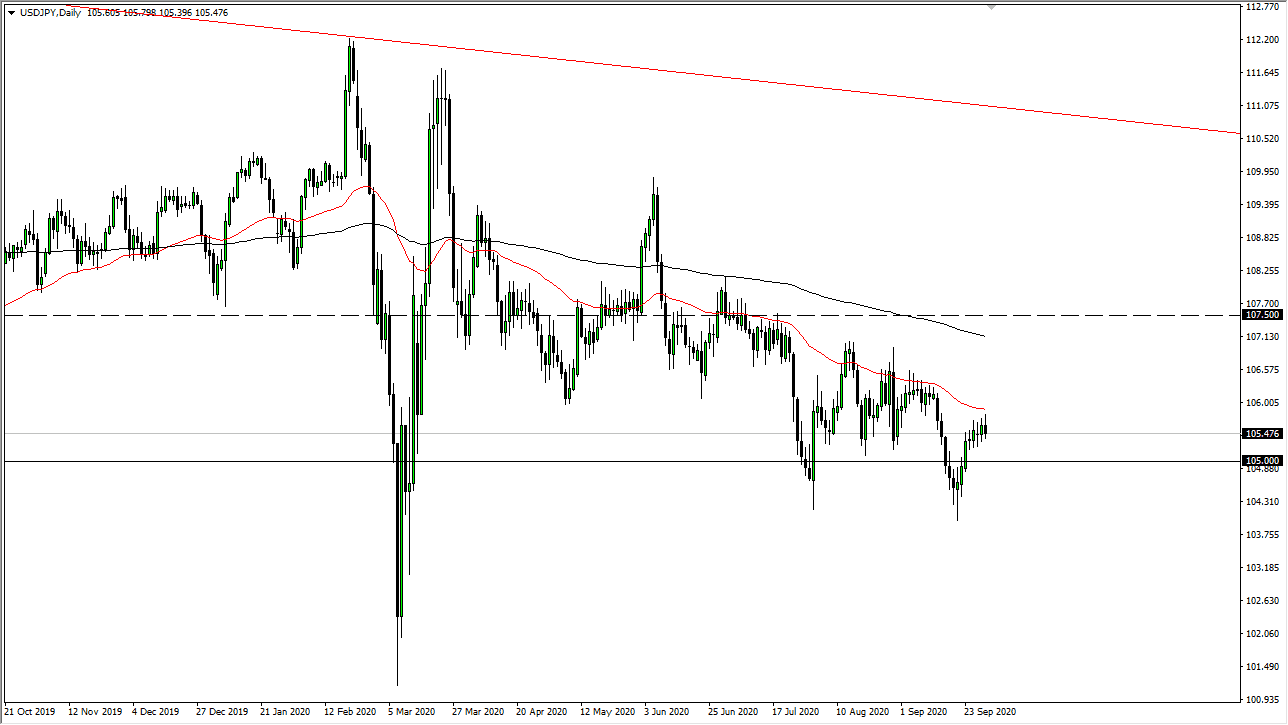

The US dollar initially pulled back a bit during the trading session on Wednesday, only to turn around and rally towards the 50 day EMA yet again. However, as we have seen time and time again, the 50 day EMA has offered significant resistance. The resistance above the 50 day EMA extends all the way to the 200 day EMA, and massive resistance should continue to push this market lower overall. After all, keep in mind that the US dollar sold off rather drastically but then we had a bit of fear come into the market later which favors the Japanese yen overall.

Looking at this chart, the ¥105 level underneath is significant in its importance due to the fact that it is a large, round, psychologically significant figure that a lot of traders will be paying attention to. If the market breaks down below there, then it is likely that the pair goes down to the ¥104 level. If we break down below there, then it is likely that we go down towards the ¥102 level, which was important the longer-term charts. Breaking down below there then opens up the possibility of the market going all the way down to the ¥100 level, an area that has historically had the Bank of Japan react and start talking.

To the upside, if we do break above the 50 day EMA then the most obvious resistance levels should be the 200 day EMA and then the structurally important ¥107.50 level. It is not until we break above that level that I would be willing to buy this market, because this is a pair that not only features the US dollar, but it also features the risk appetite in the highly sensitive Japanese yen. In other words, if the market rolls over due to fear when it comes to risk appetite, the pair then falls as money repatriate itself back to Japan. Ultimately, I think that every time we see the market rally on short-term charts, people are more than willing to step in and start shorting. I believe at this point in time this is a market that is in a very strong downtrend, and we are now entering an area that makes quite a bit of sense for people to look at to pick up “cheap yen.”