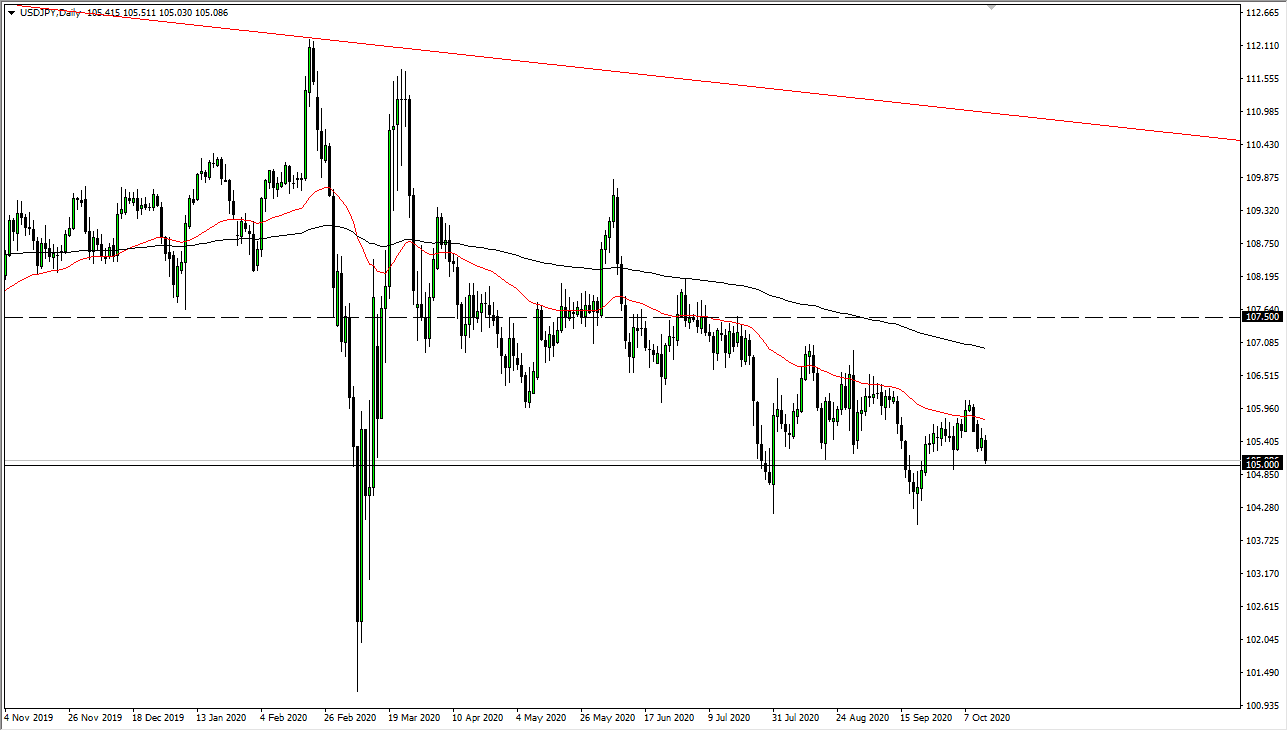

The US dollar fell during the trading session on Wednesday, reaching down towards the ¥105 level again. This has been an area that has been important more than once, so therefore it should not be a surprise that we ended up down in that general vicinity. We had recently bounced from there, but we have also seen this market slice through that level a couple of times. Because of this, I think that breaking down below the ¥105 level is much more likely than not, especially as we have been closing towards the bottom of the candlestick at the end of the session on Wednesday.

All things being equal, I like the idea of looking at short-term rallies that show signs of exhaustion, that I can take advantage of as it would offer “value” in the Japanese yen. With that being the case, I think that this is a market that can continue to be very choppy, but the occasional rally should give me an opportunity to short yet again. This is a market that I have no interest in buying because I think at this point it is obvious that the overall trend is still very much negative. The 50 day EMA has been the beginning of significant resistance that extends all the way to the 200 day EMA. That is a massive zone of resistance that we have not been able to get past.

Ultimately, this is a market that I think favors the Japanese yen mainly because of two conflicting paradigms: The possibility of stimulus coming out of the United States and driving down the value of the US dollar, and the “risk-off trade” that shorting this pair signifies. In that sense, this is almost a “win-win situation” when it comes to shorting the pair. At this point, I would not be surprised at all to see this market try to reach towards the ¥104 level, and possibly even break down below there. If we do, then I anticipate the market looking towards the ¥102 level, which had been a major support level as we had bounced so significantly in the past. This is a market that I think will continue to be noisy but if you can trade shorter-term charts you should continue to see plenty of opportunities on each little bounce.