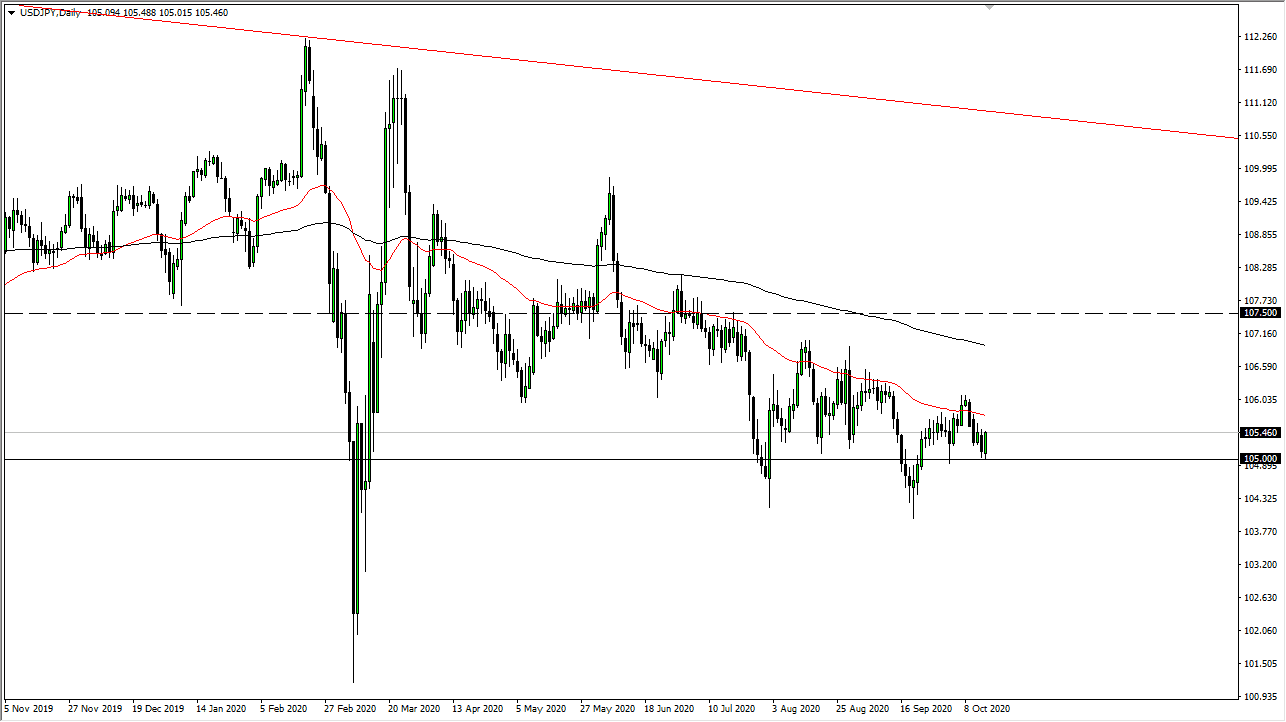

The US dollar has rallied significantly during the trading session on Thursday, reaching towards the ¥105.50 level. The 50 day EMA is above there, so I do think that the market will probably look at that as a small technical barrier, so looking for signs of exhaustion will be the way that I get involved to the downside yet again. After all, this is a market that has been in a downtrend for some time, and I do not necessarily think that we are ready to turn the entire trend around.

Looking at this chart, I think it is only a matter of time before the area between the 50 and the 200 day EMA causes a “zone of resistance” that people will be paying attention to. Ultimately, I think that we are more than likely go looking towards the lows again, reaching down towards the ¥104 level, but we obviously need a break down below ¥105 before that happens. If we can break below the ¥104 level, then we go looking towards the ¥102 level. That being said, I do not think we get there rather easily, and I do think that we need to have more of a grind lower than anything else.

The candlestick for the trading session does suggest that the market could bounce a bit further, as we are closing towards the top of the candlestick. This typically suggests that we are going to see a bit of continuation.This is a pair that has been grinding lower for multiple reasons, not the least of which is the fact that the United States is looking towards stimulus. However, even if we do not get stimulus there is the possibility that you have a bit of a “risk off” scenario, which also favors the Japanese yen anyway. Because of this, this is essentially a “win-win situation” when it comes to buying the Japanese yen. We would need to see some type of major shift in the markets overall to change this trend out of all of the markets that I follow here at Daily Forex. This has been one of the more reliable trends, so to see it suddenly change their would probably spell havoc throughout the Forex markets, so it will be an obvious shift in attitude.