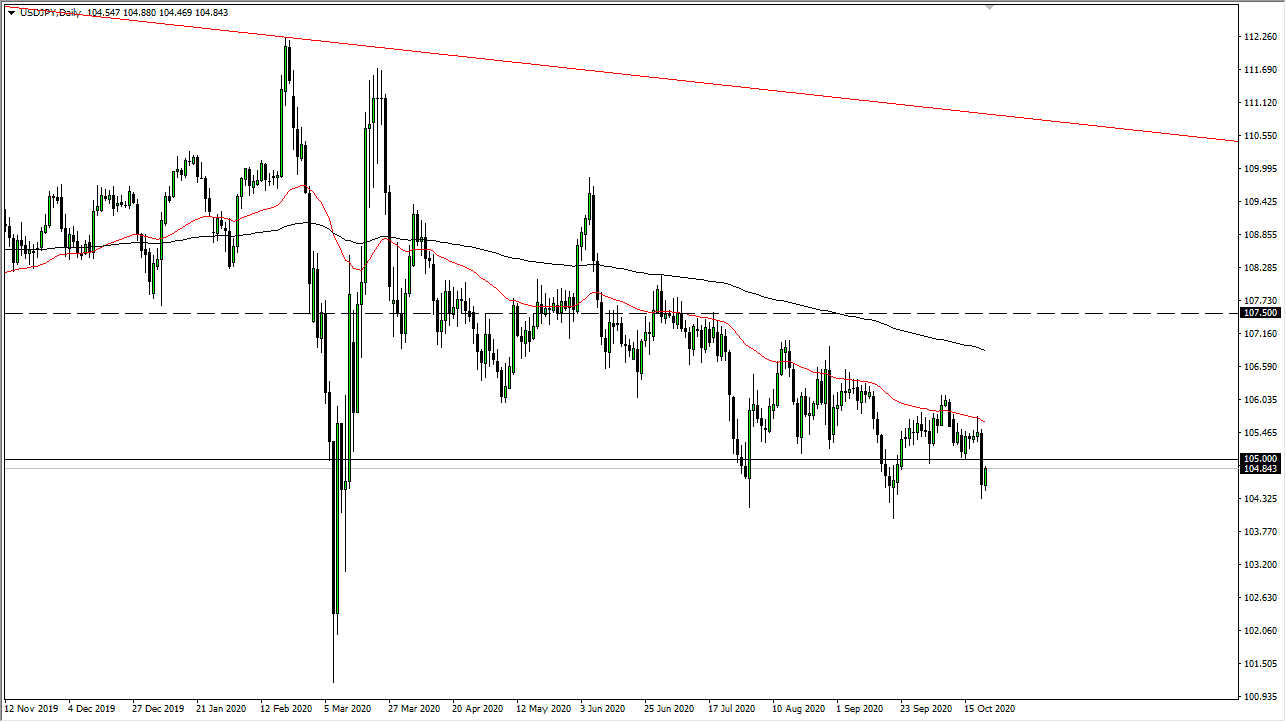

This is a market that has been sold off quite drastically multiple times and it appears that we continue the same basic action that we have been in for a while. Keep in mind that the 50 day EMA has offered nice selling pressure in the past, and I think that the market will continue to respect that area, assuming that we even get to that level. The massive candlestick from the trading session on Wednesday of course is something that we should be paying attention to, as it showed such negativity. That being said, we are trying to turn things around, and I think this offers a bit of value when it comes to the Japanese yen.

Looking at the candlestick, although it is bullish, it is not a huge range. Because of this, I think it is simply a recovery and a rebound and what we have seen during the day does not change much as far as the intraday charts are looking either. The ¥105 level should offer plenty of resistance, but above there the 50 day EMA at the ¥105.50 level should be paid close attention to because of the convergence.

Looking at the US dollar, it is dealing with stimulus, and as a result it is likely that the US dollar could get a little bit of negative pressure, driving this pair down. Furthermore, we could see the market break down due to a “risk off” move. Typically, this pair will break down a bit if there is a lot of fear, and therefore you could see a lot of negativity as well. All things been equal, I think that we continue to see a lot of noise and disruption but given enough time it is likely that we would continue the longer-term move. Looking at this move, you can see that we have started to form a bit of a descending triangle, which measures for a move down to the ¥102 level. That was where we had seen a lot of bullish pressure underneath, so it is all starting to tie in quite nicely. With this, I look to fade short-term rallies that show signs of exhaustion.