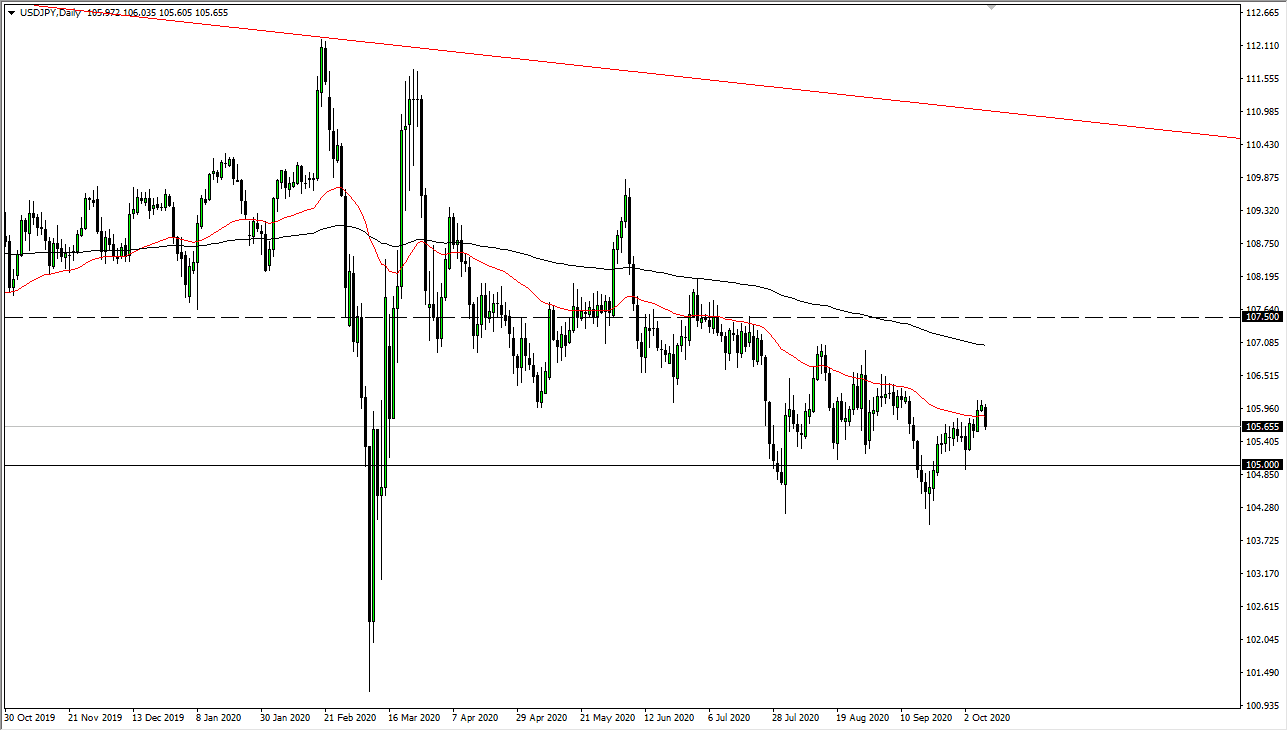

The US dollar has fallen a bit during the trading session on Friday, breaking below the 50 day EMA. At this point, the market has resumed the overall downtrend that we have been in, with a very negative looking candlestick to go into the weekend. This is probably predicated more upon the idea of stimulus coming out of the United States than anything else, so that is something worth paying attention to. Because of this, it looks as if the ¥105 level underneath is a potential target, which is a large, round, psychologically significant figure.

Looking at this chart, I believe that we are likely to see a lot of choppy behavior going forward, so do not be surprised at all if we bounce a bit, only to turn around and fall again. With that being said, I think that this is a market that continues the overall longer-term downtrend, and therefore I like the idea of fading short-term rallies. With that being the case, the market is likely to see a lot of noise going forward due to the fact that not only are we looking at stimulus coming out of the United States, but the market is also paying close attention to any type of risk appetite. This might be a scenario where this market is set up to fall based upon stimulus, or fall based upon a major risk-averse type of move.

To the upside, if the market was to reach towards the ¥106 level, we will more than likely continue to see resistance. That being said, I think this is a market that continues to hug the 50 day EMA overall, as it has been so reliable, going back to at least June this year. Given enough time, I do think that we not only test the ¥105 level, but we break down below there. Ultimately, we will probably make fresh, new lows, especially if we do get some type of stimulus as bond yields in Japan are starting to outperform the United States, something that is almost impossible to believe. That being said, that should continue to favor the downtrend as well and therefore I have no interest whatsoever in buying this market anytime soon. In fact, I see a massive resistance barrier that extends all the way to the 200 day EMA.