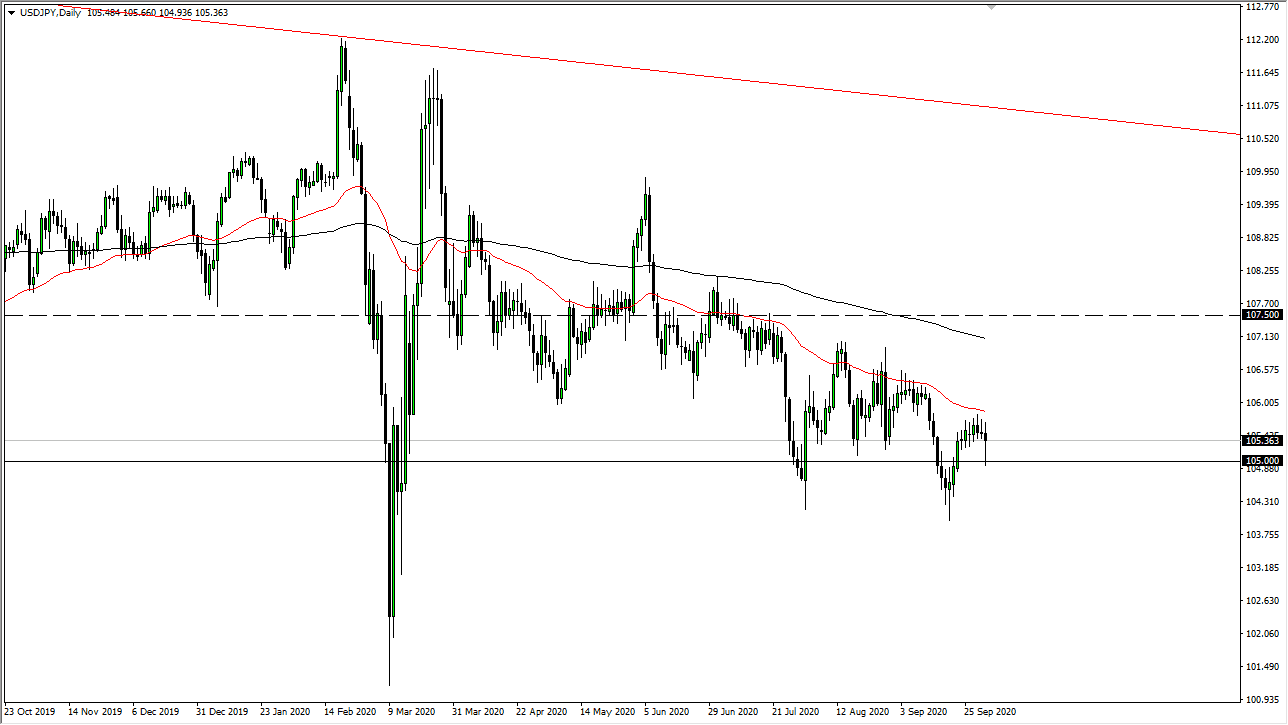

The US dollar has broken down during most of the trading session on Friday against the Japanese yen to reach towards the ¥105 level. At this point in time, the market has bounced, and it suggests that we are going to see a bit of support at the ¥105 level. However, even though the candlestick shape is somewhat supportive, you should keep in mind that we have only bounced about 35 pips. That is not a huge move, and this market looks as if it is likely to continue grinding lower overall.

Looking at the chart, the market has shown itself to fade rallies as they come, and I think that might end up being the way this market moves next as well. Ultimately, this is a market that I think will have a lot of volatility in it, and you should also keep in mind that it is highly sensitive to risk appetite. Risk appetite is something that is all over the place, and I think there is probably more risk to the downside as far as risk appetite is concerned than anything else. If that is the case, then it is very difficult to imagine a scenario where this pair rallies significantly.

Looking at this chart, I also see that the 50 day EMA is granting lower and has been reliable resistance lately. There also seems to be a lot of resistance between that indicator and the 200 day EMA. In other words, I do not have a scenario right now where am looking to buy this pair. This does not mean that it is impossible for me to buy this pair just that I do not have any desire to do so at this juncture.

I believe that the US dollar, in general, is trying to strengthen, but the Japanese yen is a bit of an outlier. This might be the one place with the US dollar fails to grab any traction, considering that the Japanese yen is considered to be the “ultimate safety currency.” I would not be surprised at all to see this market reach towards the lows we just made sometime this week.