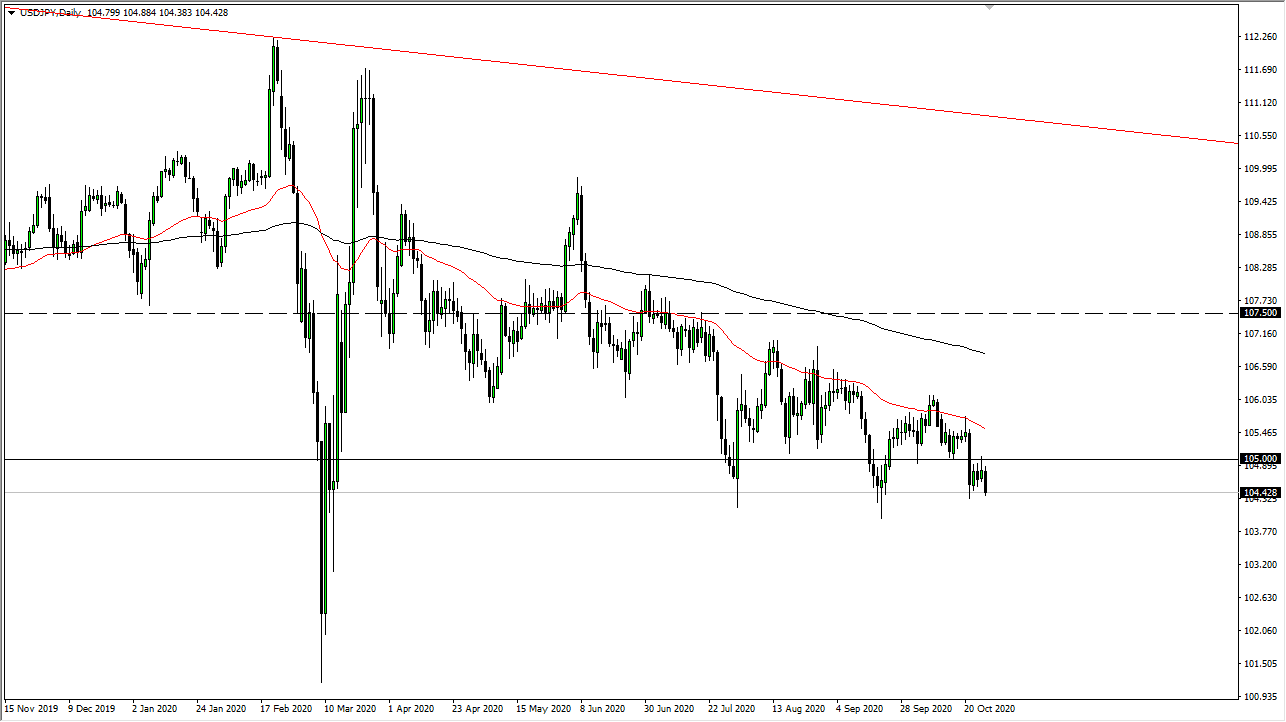

This is a market that has been in a downtrend for some time and it is probably only a matter of time before we break down significantly to fall through the floor again. If we do, then it opens up the possibility of breaking through the ¥104 level, reaching down towards the ¥102 level. That is where we had seen a massive bounce from previous trading, so it does make sense that we would try to retest that area.

In a sense, this is a perfect trade because we have the possibility of stimulus coming out of the United States, which of course will work against the value of the US dollar in general. You can see that the market is hoping for this against several currencies, such as the Euro, the Pound, and the Australian dollar. However, the Japanese yen is a little bit different in that it is also a safety currency, so it is worth paying attention to in the sense that the market does tend to flood towards the Japanese yen when people are concerned. In other words, this is a currency pair that could get a bid to the downside regardless of what happens next.

Yes, we are probably not going to see stimulus in the short term but at the end of the day most traders believe it is eventually coming. If that is going to be the case, then it does make quite a bit of sense that we would see more bearish pressure than bullish, and that short-term rally should continue to be selling opportunities. I believe at this point the ¥105 level has offered significant resistance barrier and it is obvious that the 50 day EMA above there also does, so it is difficult to imagine a scenario where the pair turned around and start rallying. In fact, I do not even necessarily have a scenario where I am buying this pair anytime soon. There is a “massive zone of resistance” between the 50 day EMA and the 200 day EMA, so we have plenty of room to look for selling opportunities. Longer-term, it would not surprise me at all to reach towards that ¥102 level, because it has been so important in the past.