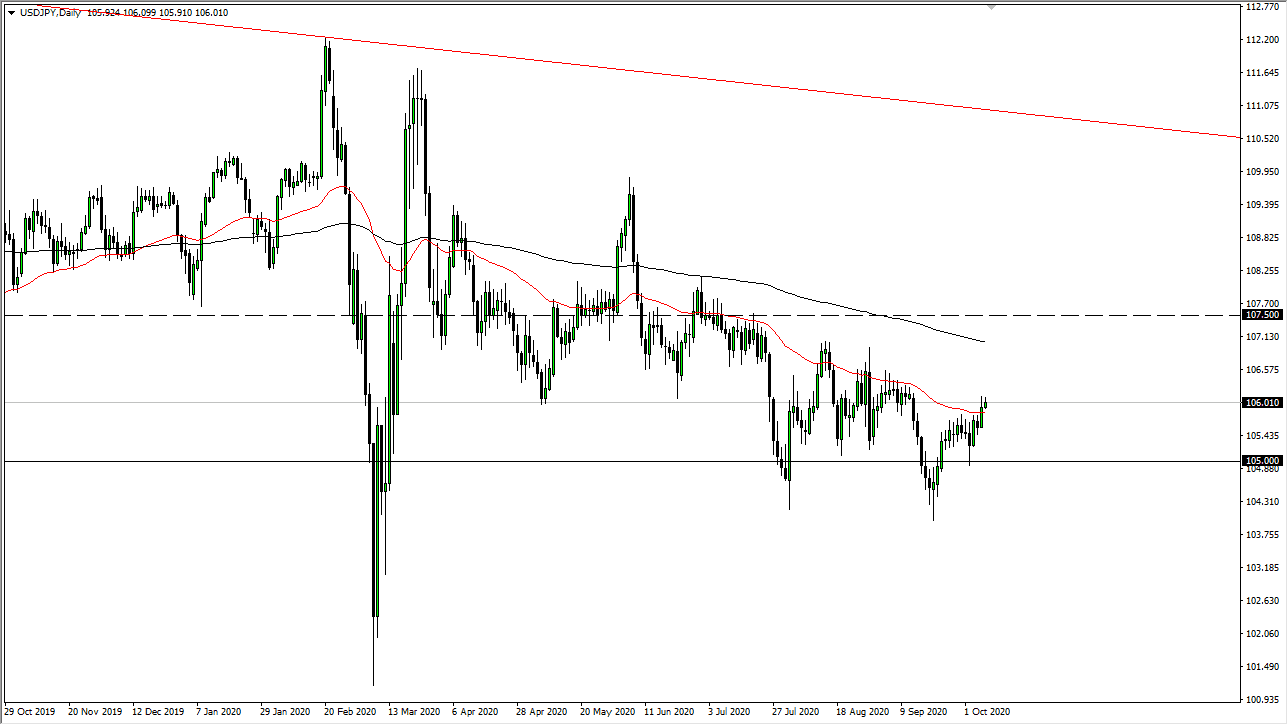

The US dollar has rallied a bit during the trading session on Thursday but continues to struggle right around the ¥106 level. This is a large round figure that has shown quite a bit of resistance previously, so therefore it would not be a surprise to see this market turn around and fall from here. I am willing to short this market, because there is so much noise above that we would need some type of major shift in attitude to make this market break out, something that I do not anticipate seeing in the short term.

When you look at the longer-term, you can see the US dollar has been grinding lower against the Japanese yen, but this has been a very noisy and choppy pair. This has not exactly been a major move, it is just the market grinding its way towards the yen based upon perhaps safety, and possibly the idea that the US dollar may be declining. In other words, it is a “lose-lose” situation for the US dollar in this pair right now. That does not necessarily mean that we are going to make a huge move, but it is worth noting that we have been in a downtrend for quite some time. We are above the 50 day EMA, which is a relatively strong sign, but we have been here before.

Between the 50 day EMA and the 200 day EMA we have seen a lot of resistance, so ultimately, I think it is not worth trying to buy this market. If we can break back below the 50 day EMA, then I would be a seller. A breakdown below the ¥105 level would signify even more bearish pressure, perhaps reaching towards the lows again. As far as buying is concerned, I would be very cautious about doing so, due to the fact that I think there are far too many reasons to think that this pair is suddenly going to change trend. If you want to buy the US dollar, you are probably better off buying it against something like the Australian dollar or the New Zealand dollar which will move much quicker. Ultimately, I think that this is a “fade the rallies” type of market, especially as the pair only moved a total of about 20 pips for the session.