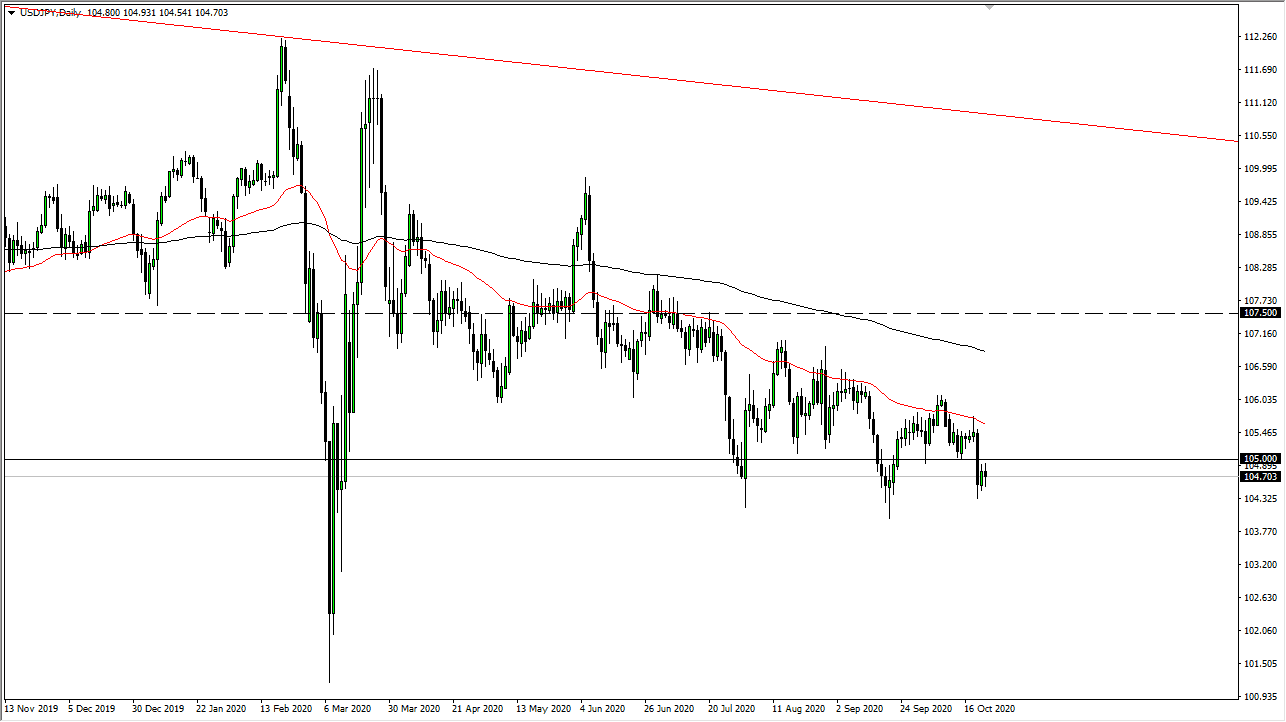

The US dollar has gone back and forth during the trading session on Friday as we closed out the week. The dollar has been dropping against the Japanese yen for a while, so the fact that we are somewhat negative is not a huge surprise at the clothes. All things been equal though, pay attention to the ¥105 level, because it is a large, round, psychologically significant figure, and it will make quite a bit of sense that we would see noise in that area as well.

When you look at the longer-term chart, you can see that we have a series of lower highs but we also have a significant amount of support at the ¥104 level. In other words, it is the descending triangle that is likely to see a lot of attention paid to it. Ultimately, if we break down below the ¥104 level, it you can take a look at the ¥102 level given enough time. When you look at the 50 day EMA, you can also see that it has been a massive barrier for traders as well.

The ¥102 level has been a massive bounce recently, and that suggests that we are going to see further support there as well. It makes a nice target based upon the measured move of the triangle, and the fact that the markets tend to test these major areas to make sure that they are going to hold. Furthermore, the US dollar is probably going to struggle a little bit due to the fact that there is a huge push for stimulus in the United States, and that could weigh upon the value of the greenback. Furthermore, the Japanese yen could be bought if there is more of a “risk off” type of attitude around the world, which is something that could very well happen. All things being equal, we do get a breakdown that I start selling or I start selling short-term rallies that show signs of exhaustion. I have no interest in buying this pair anytime soon, mainly due to the fact that there has been such a massive barrier between the 50 day EMA and the 200 day EMA. Furthermore, the trend has been so well ensconced that it is difficult to imagine that it is going to change on a whim.