Risk aversion and the mixed US economic results was a catalyst for the USD/JPY pair to move downwards towards the support level at 105.03, before closing last week’s trading around 105.40. It is difficult for forex traders to take a view amid the frustrating lack of progress in the US financial support negotiations and the impasse over the UK/EU trade deal. In Washington, the financial stimulus to aid the US economy from the effects of the pandemic into a political football that is circulating about who can use it in their favor in the US presidential elections, which will be held early next month.

From Japan, the new Japanese Prime Minister, Yoshihide Suga, headed out on Sunday on his first foreign trip since taking office after Shinzo Abe last month, heading to Vietnam and Indonesia. The choice to visit Southeast Asia confirms Japan's efforts to counter Chinese influence and build stronger economic and defense ties in the region, in line to a large extent with Abe's vision. It also reflects the realities of the pandemic. With the US’s engagement with domestic politics before the November 3 elections, Suga was unable to travel to Washington immediately to hold talks with Japan’s most important ally after he replaced Abe, who resigned for health reasons.

US retail sales rose strongly in September, the fifth straight month of growth, as Americans spent more on apparel, cars, and sporting goods. According to official figures, US retail sales jumped 1.9% last month. This is more than double what economists had expected. It is up from 0.6% in August. Sales in clothing stores were up 11%, which was a large part of the overall growth for the month of September. Even sales at large stores, which have been declining out of fashion among shoppers for years, rose 9.7% last month.

As it is known, consumer spending accounts for two-thirds of the economic activity in the United States, and it is closely monitored to gauge the country's economic health.

On another level, US industrial production fell -0.6% in September, the weakest rate since the spring and an indication that the economy's recovery from the pandemic caused recession may falter completely as confirmed viral infections re-emerge in most parts of the country. The Federal Reserve reported Friday that industrial production suffered its first decline since a decline of -12.7% in April during the spring shutdown of companies that crippled the US economy. The main category reflecting industrial production decreased by 0.3%. Meanwhile, mining production, which includes oil and gas exploration, decreased by 5.6%. Production at utilities rose 1.7%.

Last month's reading of industrial production came on the heels of four consecutive increases that began in May after sharp declines in March and April. US industrial production recovered more than half of its fall in the spring but remained 7.1% below the pre-pandemic level in February.

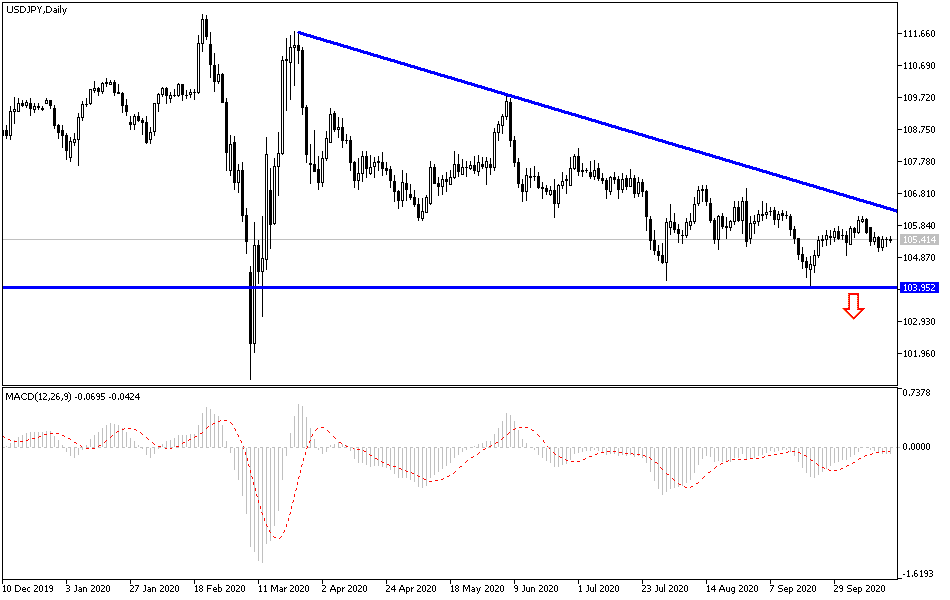

According to the technical analysis of the pair: There is no doubt that the movement of the USD/JPY around and below the 105.00 support still confirms the extent of the bears’ control on the performance. The pair does not care about the technical indicators reaching oversold areas, but the greater concern is the extent of investor risk appetite. More economic restrictions to contain the coronavirus outbreak, investor disappointment from speeding up the stimulation of the US economy, and the darkening of the scene regarding the presidential elections, all will be in the interest of strengthening the Japanese yen, and therefore support levels at 104.90, 104.00 and 103.45, may be the next targets in the current downward path.

On the upside, I still see that there will be no shift to the current trend without testing the 108.00 resistance. The performance of the USD/JPY currency pair will focus today on the announcement of the trade balance figures in Japan, the reaction to the Chinese economic data, and then the upcoming statements of Federal Reserve Governor Jerome Powell.