The USD drop and the investors strong rush to buy the Japanese currency as a safe haven in preparation for the consequences of the second coronavirus, and its impact on the rest of the global economy, contributed to a downward correction for the USD/JPY for the third day in a row, with losses reaching the 105.25 support, where it is stable at the beginning of Tuesday's trading before the US inflation figures and the Chinese trade balance figures were announced. For more than two weeks in a row, the pair attempted to rebound higher, but gains did not cross the 106.10 resistance. Financial markets responded to Friday's news that US politicians are close to a stimulus deal, a development that was followed by higher stocks and commodities while "safe havens" such as the dollar and the yen declined.

Democratic House Speaker Nancy Pelosi on Saturday rejected what was actually the most generous offer by the Trump administration's plan to date, labeling it as "a step forward and two steps back." Meanwhile, the Republicans who control the Senate have rejected it as being too costly and a potential political loss to fiscal conservatives. While expectations for a deal are still low, they are far from over. The Trump administration has called on Congress to pass an abstract version of the relief bill on Sunday, while negotiations on a broader package continue this week.

These expectations may maintain bids in the equity markets and support the dollar, although major moves are unlikely until more concrete developments emerge. These developments confused expectations. Analysts at Natwest Markets and Barclays told clients that the likelihood of a US stimulus bill to boost the market ahead of the November vote is low. Natwest Markets told clients that the prospect of a "phase four" of fiscal stimulus has "faded", as Democrats' incentive to stop the stimulus continues to grow until after the election.

Analysts at Natwest Markets believe that one of the main factors driving the expectation of failure of the stimulus talks is Trump's erratic stance on this issue. So he might force Republican senators to commit. But that doesn't seem likely at this point because Trump is in a state of disarray. Trump called for full negotiations last week, in a move that appeared designed to force more concessions from the Democrats. In fact, he thought later in the week that he wanted a deal and a "big" deal at that.

Meanwhile, political difficulties extend beyond the traditional lines of Democrats versus Republicans, with Senate Republican leader Mitch McConnell now focused on ensuring a smooth confirmation process in the Senate for the nomination of Judge Amy Connie Barrett as the next Supreme Court judge. As for the rounds of US presidential candidates, President Donald Trump returned to the electoral campaign track after an absence of 11 days while recovering from the Coronavirus. He organized a march in Florida. Meanwhile, Democrat Joe Biden is campaigning in Ohio.

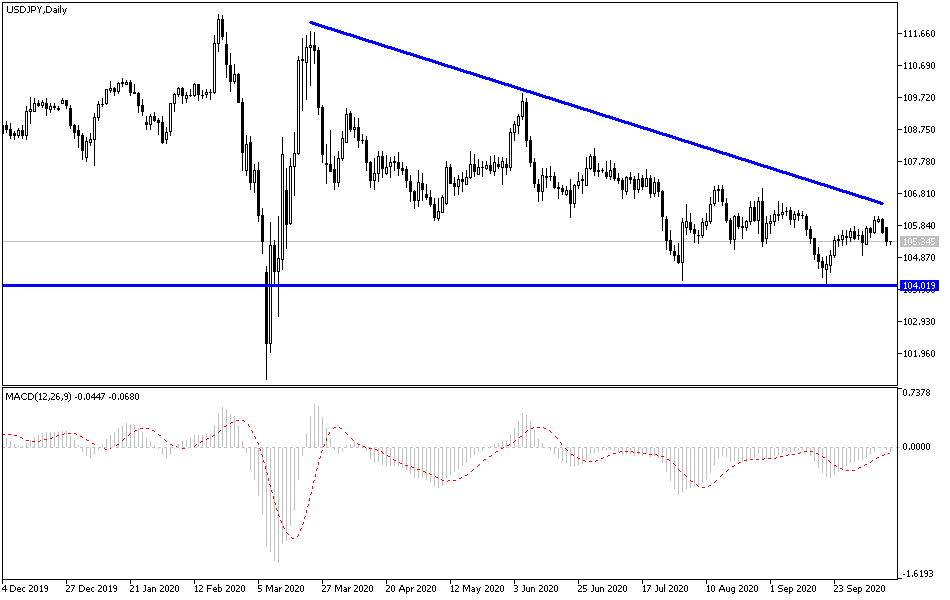

According to the technical analysis of the pair: USD/JPY approaching near and below the 105.00 support level will support the strength of the bears' control over the performance and thus prepare for testing stronger support levels. Nevertheless, it is better to buy the USD/JPY pair from the support levels at 104.80 and 103.90, if it moves towards there. According to the performance on the daily chart, bulls still have obstacles to confirm the reversal of the general trend, which is still bearish, and I see that the 108.00 resistance is still the most important one for that to happen. Today, the pair will be affected by the US inflation figures, through the Consumer Price Index reading, and the Chinese Trade Balance figures. This is in addition to the extent of investor risk appetite.