The boring performance in limited movements rang remains the most important characteristic of the USD/JPY performance for six trading sessions in a row. The pair moved between the 105.24 support and the 105.80 resistance and stabilizes around 105.48 at the time of writing. Despite the market’s exposure to a lot of drivers, the lackluster performance of the currency pair continues. All that remains this week is the US jobs numbers for September, which will be announced on Friday. The pair did not react much to the hint of US Treasury Secretary Steven Mnuchin that lawmakers in Washington are close to reaching a deal on a pre-election stimulus package, which boosts stock markets and risk currencies alike.

Steve Mnuchin told CNBC that he hoped for a bipartisan deal on a stimulus package before the election, before indicating that the expected proposal from the White House for President Donald Trump would be similar to that presented by the House of Representatives "problem solving" Gathering. The caucus proposed a $1.5 trillion program that would put new money in the hands of families and registered or redundant workers, with an "escalation clause" that could increase the size of the package in the event of a renewed recovery in coronavirus infections, as the infection causes a new disorder.

"I think there is a reasonable compromise here," Mnuchin said at a conference hosted by CNBC and Institutional Investors, where other media outlets reported increased optimism about the prospects for a deal in Washington, raising hope that the deadlock that lasted months before the week could be broken.

Commenting on this, Chris Beauchamp, Senior Market Analyst at IG says: "The US markets got rid of the weakness that we have seen recently and are moving up again, with hopes for further progress in passing the stimulus package that helps overcome concerns about the elections." "The better ADP numbers, the rise in the Chicago PMI and better numbers from the housing data provided another step for the rise in stock markets, and once again the US economic data appears to give US stocks an advantage over European stocks." He added.

According to official economic data, the US economic growth rate has decreased at an unprecedented rate this spring. Even with a record recovery expected in the just-ended third quarter, the US economy is likely to contract this year, the first time this has happened since the Great Recession.

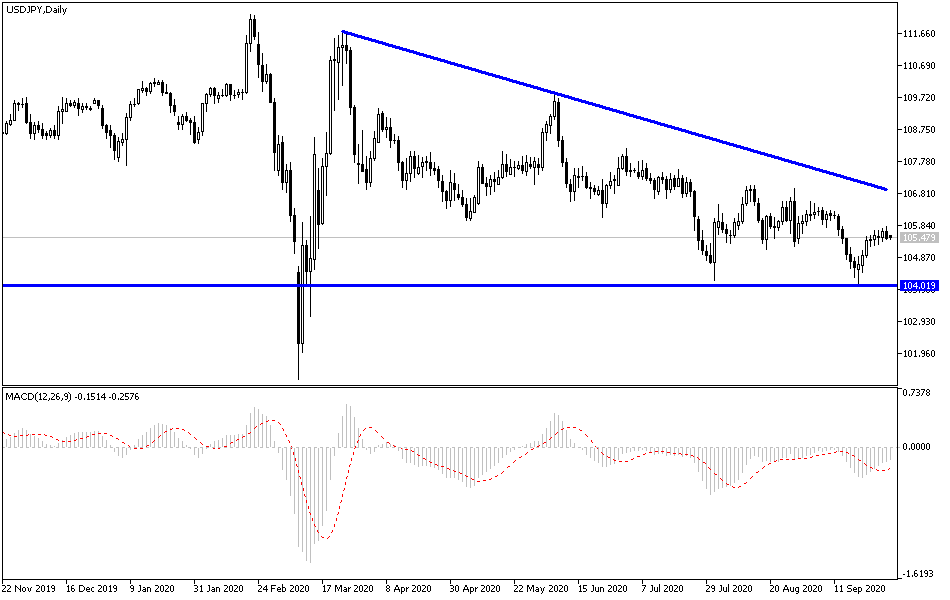

According to the technical analysis of the pair: Since there is nothing new in the price USD/JPY price movements, there is nothing new in my technical view of the pair. The recent performance, and for several trading sessions in a row, technically foreshadows a strong upcoming move in the near future, and the bears may regain control over the performance if it moves below the 105.00 support, which may open the way for testing stronger support levels. As I mentioned before, the bulls' control over the performance will be the most effective in the event that the pair bounces towards the 108.00 resistance, because it will support the next strong move towards the 110.00 psychological resistance, and through it, the reversal of the trend will be confirmed.

As for today's economic calendar data: From Japan, TANKAN's reading of the industrial and non-industrial sectors will be announced. Regarding the dollar, the weekly jobless claims announcement, the preferred indicator of the Federal Reserve to measure inflation in the country, is expected, along with prices of personal consumption expenditures, the average income and spending of an American citizen, and then a reading of the ISM industrial purchasing managers' index.