What matters to the USD/JPY is the announcement of monetary policy by the Japanese central bank, and then the economic growth figures for the United States of America. Prior to that, we witnessed a collapse in the USD/JPY pair towards the 104.11 support, its lowest level in five weeks, before settling around 104.35 at the time of writing. Investors' risk aversion was in favour of the Japanese yen more than the dollar. When investors chose between the two to turn to safe havens, in light of the daily record numbers of infections with the deadly Coronavirus, which increased government restrictions to contain the disease.

On the economic front, Americans are showing increased anxiety about their country's economy. Consumer confidence declined in October after rising sharply in September. Consequently, consumers ’expectations of the economy have fallen over the next six months in particular, according to the Conference Board, a trade research group. Commenting on this, Lynn Franco, Senior Director of Economic Indicators at the Conference Board said: “There is not much to suggest that consumers expect the US economy to gain momentum in the last months of 2020, especially with the rise in COVID-19 cases and unemployment is still high in the country””.

Since last August, the economic outlook has darkened as employment slowed. Consumers may spend cautiously during the winter, and if the increase in COVID cases causes widespread trade shutdowns or restrictions, the US economy will have difficulty maintaining a strong recovery. Accordingly, economists at Goldman Sachs have already cut their fourth-quarter growth forecast to 3% at an annual rate from 6%.

Commenting on the future of the Japanese yen after the US election, an analysis from SuMi TRUST - one of Japan's largest financial services groups - suggests that the Japanese yen could strengthen if Democratic candidate Joe Biden wins the US presidential election in November. According to Naoya Oshikubo, chief economist at SuMi TRUST, a Trump victory would maintain the status quo and boost stocks, but a Biden victory could mean far-reaching changes for Japan.

“Biden’s victory could mean very important changes,” Oshikubo said. First, it could lead to a value reversal in the Japanese stock market. If Biden issues more bonds to fund large-scale government projects, that could lead to a steeper 10-year yield curve with the United States. Therefore, the yield rises to 1%. In this scenario, the Japanese stock market is likely to favour financial stocks, with steeper yield curves in the US and Japan expected to improve financial firms ’profits given their investments in US and Japanese bonds.

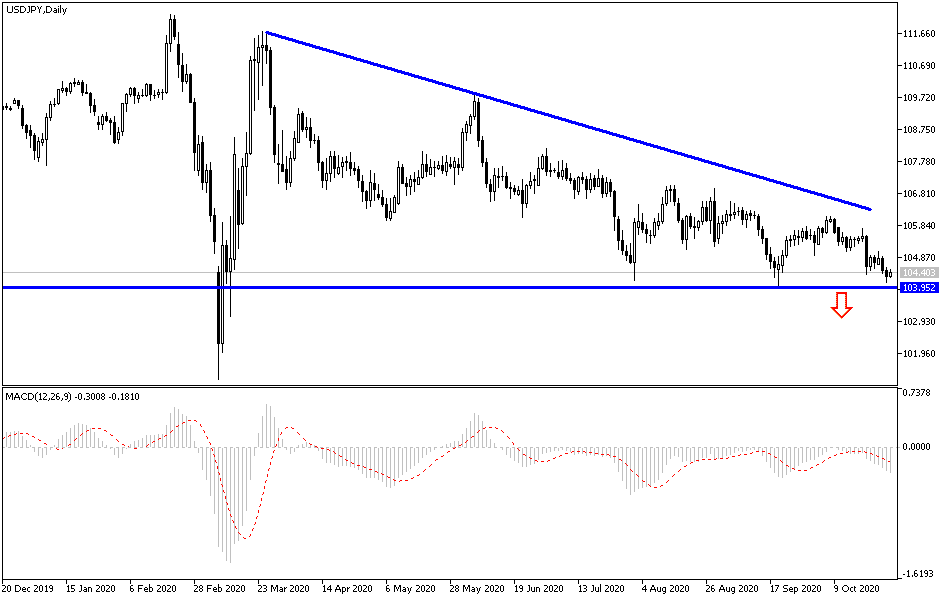

According to the technical analysis of the pair: On the daily chart, the USD/JPY is still in the range of a sharp downward channel supported by stability below the 105.00 support, and despite technical indicators reaching oversold areas, the pair is ready to test stronger support levels, the closest of which are currently at 104.00, 103.45 and 102.80, respectively. In general, I still prefer to buy the pair from every downside level, despite the recent pessimistic outlook. On the upside, forex traders are awaiting the possibility of the pair returning to move stable above the 106.00 resistance as the first opportunity for a correction to the upside.

As for today's economic calendar data: From Japan, focus will be on monetary policy decisions from the Japanese central bank, Japanese retail sales and Japanese consumer confidence. Regarding the US dollar, US GDP growth figures, jobless claims and then pending US home sales will be announced.