Investors resorted to buying safe havens amid a strong and noticeable increase in the number of new coronavirus cases and deaths again with the advent of the winter season. Investor concerns supported the USD/JPY downward stability between the 104.47 and 105.05 levels for four consecutive trading sessions and stabilized around 104.75 at the time of writing. We may witness instability in the performance of the USD whenever we get closer to the US presidential elections, which will be held next week. Investors do not rely much on the results of opinion polls that see Biden’s lead over Trump.

In addition to anticipating the election results, there is a rise in confirmed COVID-19 cases throughout the United States of America, so there is a risk that the US economy will weaken again as more people choose to stay home, and there might be a need for more stimulus than negotiators in Washington think. Data from Johns Hopkins University shows that more than 83,000 infections were reported on Friday and Saturday - well above the previous record. Accordingly, the Institute for Health Metrics and Evaluation of the University of Washington expects that the death toll in the United States, now roughly 225,000, may reach 318,000 by January 1, 2021.

It is possible that a small economic relief package will be approved in the post-election session of Congress. But more likely, a broad bailout could be enacted early next year, particularly if Joe Biden wins the presidency and his fellow Democrats seize the Senate. And even if President Donald Trump wins re-election, most analysts expect at least a modest stimulus next year. Until then, economists are concerned that the United States risks repeating a mistake it made after the Great Recession of 2008-2009, when restrictions on federal spending and layoffs by states and localities impeded the economic recovery. Therefore, more aid to states and cities could prevent further layoffs. And states, which are generally required to balance their budgets, should now do so with less revenue.

With no potential stimulus for the rest of this year, economists at Goldman Sachs cut their forecast for US economic growth in the October-December quarter to 3% at an annual rate of 6%. In this regard, Eric Winograd, chief US economist at Alliance Bernstein, expects more federal aid to be approved early next year and that the US economy will grow by 3.4% for 2021, which is a strong pace. But even at this rate, the economy will not recover to pre Covid-19 level until early 2022. Without further stimulus, Winograd predicts that growth for 2020 may erode to 1.5%.

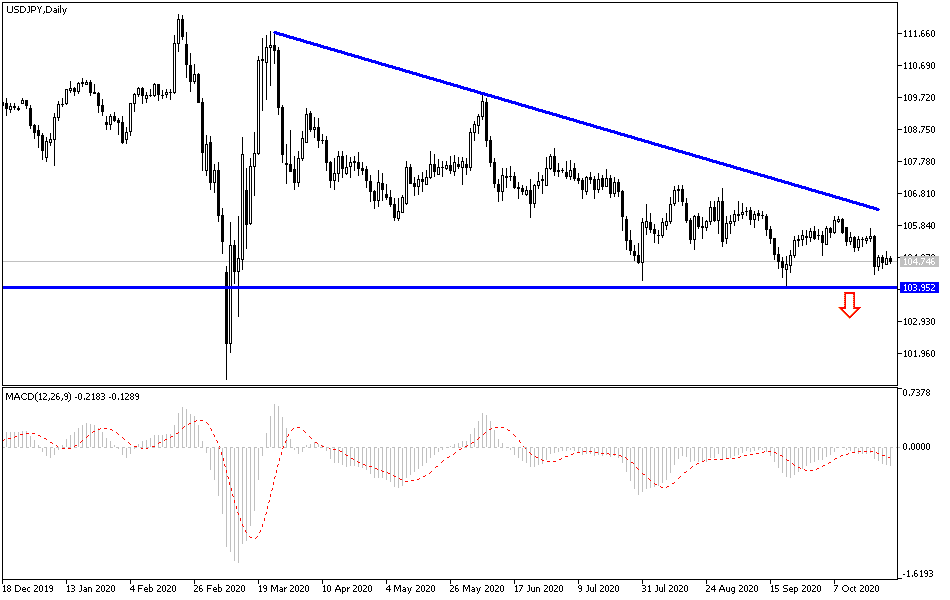

According to the technical analysis of the pair: The USD/JPY general trend is still down, and the bears have increased their control over the performance with the stability below the 105.00 support. Technical indicators are still giving signals that the pair's price has reached strong oversold areas. Accordingly, the pair may be considering buying the pair from the support levels at 104.55, 103.90 and 103.00, while waiting for the opportunity to bounce and correct to upward at any time. On the upside, I still see the 108.00 level as the most important level at for bulls to control the performance and get out of the current bearish swamp.

As for the economic calendar data today: From Japan, the National Consumer Price Index will be announced. Then there is the US durable goods orders announcement, along with the Consumer Confidence Index reading and the Richmond Industrial Index reading.