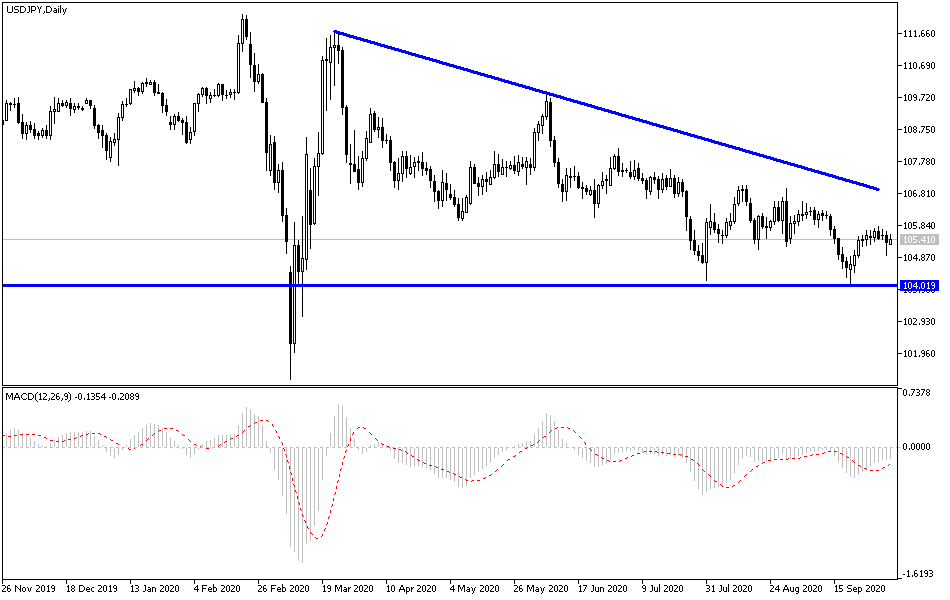

I mentioned frequently in recent technical analysis for the USD/JPY, that the stability of the pair in limited ranges for several successive trading sessions technically portends a strong movement coming in one of the two directions, leaning more towards a drop in light of investors fleeing from risk. By the end of last week’s trading, markets were subjected to strong shocks between the announcement of the discrepancy in US September employment numbers, as well as the shocking announcement that US President Trump and his wife were infected with the Coronavirus. The currency pair retreated to the 104.94 support, after attempts to rebound higher, and reached the 105.80 resistance. The pair is stabilizing around 105.30 at the beginning of this week’s trading, with the announcement of the stability of Trump's health condition.

On the economic front, more than 10 million unemployed Americans may not regain their former jobs, according to the latest labor market report, which shows that the rapid employment recovery in recent months is now at risk of stalling, leading some economists to argue the urgent need for another round of fiscal stimulus. According to the economic data results, the US economy added 661 thousand jobs in the non-agricultural sector during the month of September, which is much less than what the markets were looking for by adding 859 thousand and much less than 1.489 million in August.

The bottom line from the data results is that the US labor market recovery is stalled. During the month of May, 2.7 million jobs were added, 4.8 million in June, 1.8 million in July, and 1.5 million in August. Overall, US employment is still 10.7 million less than the levels seen in February when the Covid-19 pandemic spread around the world and pushed global financial markets into a meltdown.

Permanent job losses increased by 345,000 to 3.8 million, the highest level in 7 years, and those classified as long-term unemployed (27 weeks and over) increased by 781,000 to 2.4 million, the highest level since 2015.

One of the salient elements in the US jobs report for September chosen by economists was the shrinking level of employment in the government sector, which reflects the pressures on US public agencies and can highlight the urgent need for more stimulus. In this regard, Republicans and Democrats are currently unable to reach an agreement on a new stimulus package, which highlights how political risks have begun to affect the real economy.

According to the technical analysis of the pair: Bears are pushing the USD/JPY below the 105.10 support and will be technically negative, with the bearish stochastic indicator intersecting and the RSI retreating, with the possibility of both falling. Constant closing below 105.10 gives back the possibility of moving towards the next psychological support at 104.00 again. Unless the bears react quickly, the USD/JPY rally remains a selling opportunity. US President Trump has tested positive for COVID-19. The implications could be numerous, and it is too early to measure its true impact.

First of all, being infected with the Coronavirus for a person in his mid-70s is troubling, and whatever your policy, it is something that no one should wish for another person. Accordingly, questions increased in the markets and among observers about what are the implications are on the main markets and the presidential elections in case of Trump’s death? There will be some wild conspiracy theories and a lot of speculation about how this will affect the election. Ultimately, this means that there will be a state of extreme uncertainty and volatility in the markets. When the leaders of the United Kingdom and Brazil were infected with the COVID virus, their currencies were sold off, however, the dollar is still a classic safe haven. On the upside, 108.00 resistance will still be an important component of the bearish outlook reversal.