For four trading sessions in a row, the USD/JPY pair was under downward pressure pushing it towards the 105.25 support before settling around 105.50 at the time of writing. The strength of the Japanese yen has increased recently in light of investors' demand for it as a safe haven amid the daily announcement of an increase in new global infections with the Coronavirus. The subsequent imposition of economic restrictions to contain the spread of the pandemic, which will increase the pressure on the global economy. This is in addition to political anxiety in the United States of America, with the presidential elections approaching. The global pharmaceutical companies' announcement, in succession, to stop testing for Corona vaccines, has increased the uncertainty. This is in addition to waiting for the European Union summit, which will determine the fate of Brexit. All of which is a good environment for gains in the Japanese yen, a safe haven for investors.

According to reports, Italy is considering imposing a ban on private parties after a recent spike in new coronavirus cases. France is set to impose new restrictions, and the Czech Republic has announced that it will close bars and switch most schools to distance learning. As for US economic news, the Labour Department released a report showing a modest increase in consumer prices in September, with price increases matching economists ’estimates.

The report mentioned that the Consumer Price Index rose 0.2% in September after rising 0.4% in August. Used car and truck prices rose 6.7% in September after a 5.4% increase in August, and are now 10.3% higher in the past twelve months. The September increase is the largest monthly increase since February 1969. Over the past twelve months, the overall inflation rate rose 1.4% while core inflation, excluding energy and food, rose 1.7%. Energy prices rose by 0.8% in September but are still down 7.7% for the past 12 months. Energy services, such as electricity and gas utilities, rose again last month and have been higher in the past 12 months. Gas utility services increased by 4.2% in September and increased by 3.8% last year.

In general, US inflation is still below the Fed's 2% target, and so in the summer, US central bank officials changed their operating policy to say that they were prepared to allow inflation above this level for a period of time, in order to make up for the many years during which it was below this goal. Because of this change, many economists believe the Fed will leave US interest rates at a record low near zero for the foreseeable future as it tries to pull the country out of a recession that has cost millions of jobs.

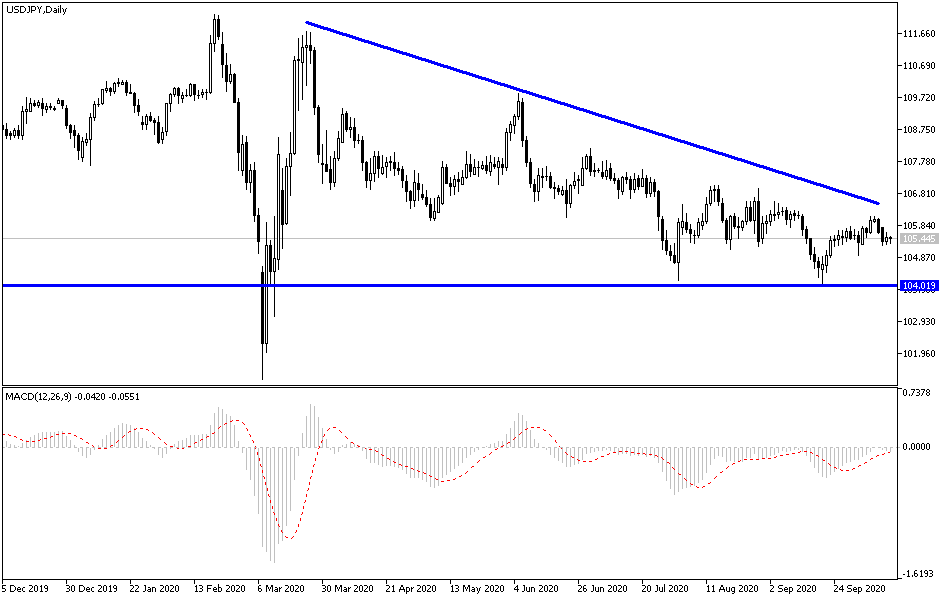

According to the technical analysis of the pair: According to the USD/JPY performance on the daily chart, the pair is still under downward pressure, and attempts to rebound upwards have not succeeded recently. As mentioned before, we stress now that there will be no chance for the Bulls to control performance and initiate a real reversal without breaching the 108.00 resistance level. According to the current performance, the stronger bears dominate will increase in the event that the currency pair moves towards the support levels at 104.90 and 104.00, which at the same time are the best places to buy and wait for the opportunity to bounce higher. In addition to the extent of the risk appetite, the USD/JPY currency pair will interact with the announcement of the producer price index in the United States of America.