The USD/JPY continued in the downward correction, and losses reached the support level at 105.03 before stabilizing around 105.15 at the beginning of trading on Thursday. What supported risk aversion was the return of the economic shutdown policy to contain a new Coronavirus spread and the international pharmaceutical companies' cessation of their experiments to produce a long-awaited vaccine, in addition to the anxiety that dominates the future of Brexit and the suspension of stimulus efforts to relief the US economy.

On the economic front, the US Labour Department said that there was an increase in the producer price index in September, which measures inflation before it reaches the consumer, following a 0.3% rise in August and a 0.6% increase in July, which was the largest monthly gain since late 2018. 0.4% in September is larger than economists expected and partly reversing a 1.2% increase in food costs, the biggest rise since the 5.6% in May, as coronavirus-related closures at food processing plants created shortages.

For September, energy prices eased for a second month, down 0.3% after a 0.1% drop in August. Prior to that, the government reported that retail inflation rose 0.2% in September, only half of August's gain, even though the price of used cars jumped the most in more than half a century.

Over the past twelve months, inflation at the wholesale level rose by only 0.4%, while core inflation, which excludes volatile food and energy costs, rose 1.2%. While the September wholesale price hike was larger than expected, economists said the trend over the past year shows that US inflation remains weak, well below the Fed's 2% annual increases target.

On the other hand, there was disappointment with statements of Chinese President Xi, which assert that Trump's victory in the presidential elections means an extension of the trade war between the two largest economies in the world. On Wednesday, Chinese President Xi Jinping promised new steps to promote the development of China's largest technology centre, Shenzhen, amid a dispute with Washington that has disrupted access to US technology and fuelled ambitions to create Chinese suppliers. In a speech marking the 40th anniversary of the declaration of a former fishing village bordering Hong Kong, the ruling Communist Party's first district to allow free enterprise, Xi pledged to ease regulations to encourage new industries.

China's efforts to create its technological competitors have increased tensions that have prompted President Donald Trump to increase import duties on Chinese goods in 2018. Washington has also blocked Huawei's access to US components and technology. This threatens to hamper its sales of smartphones and other equipment. In the same pressure, Trump issued an order in August announcing that WeChat, a popular messaging service run by Shenzhen's other tech giant, Tencent Holding Ltd, is a threat to national security.

This is why economists are warning that other Chinese tech producers could be disrupted by US restrictions on access to US components and services such as Google's Android smartphone operating system.

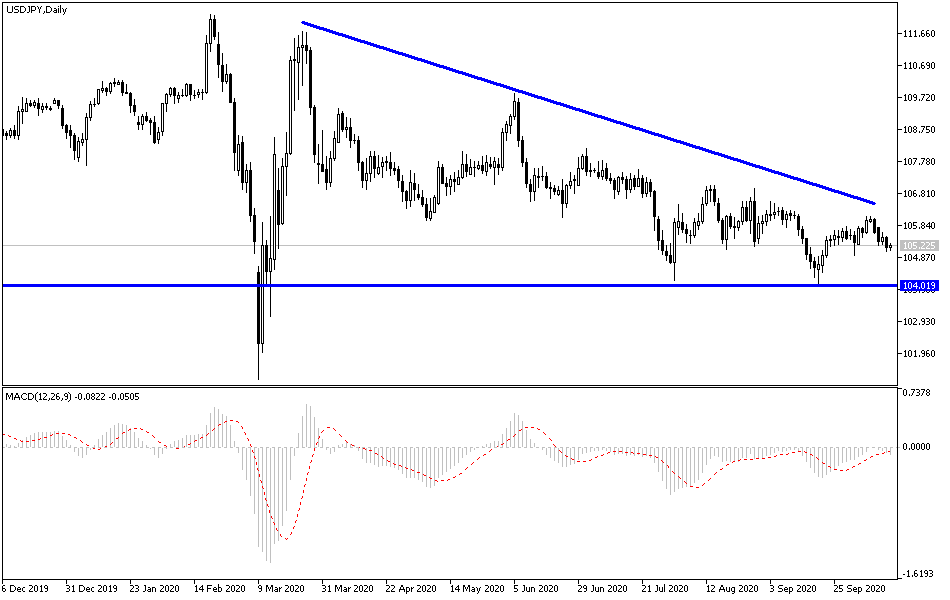

According to the technical analysis of the pair: There is no change to my technical view of the USD/JPY performance, as it returned to its descending channel range, which is highlighted on the daily chart below. A breach below the support level at 105.00 will increase the sell-off to test the lower levels, the closest of which are currently at 104.75 and 103.90 and reaching the last level would be ideal for buying, awaiting a correction. On the upside, the 108.00 resistance is still the most important for bulls to make a real shift in the current bearish outlook.

Amid the absence of important Japanese economic data, the focus will be on the results of the US economic data, including the weekly jobless claims, the Philadelphia industrial index reading and the Empire State Index. Along with comments from members of the Federal Reserve throughout the day.