For three trading sessions in a row, the USD/JPY has been moving in a narrow range between the 105.18 support and the 105.60 resistance, where it is stable around at the time of writing. Performance is very boring for forex traders as the poles of the currency pair are among the most important safe havens for investors, especially in the Coronavirus era, which explains the movement in a narrow range for a longer period. Stopping stimulus efforts for the US economy and anticipating the presidential elections, which will be held at the beginning of next month, and the second wave of the Corona pandemic, all create a state of balance between the yen and the US dollar.

Commenting on the pair’s performance, analyst Richard Berry of Hantec Markets says that technical studies indicate that any short-term strength is a selling opportunity. As the USD/JPY exchange rate is at 105.39 at the beginning of the new week, with the exchange rate remaining in a narrow range for several days, as with many of the major forex pairs, the last few sessions showed no clear real trend.

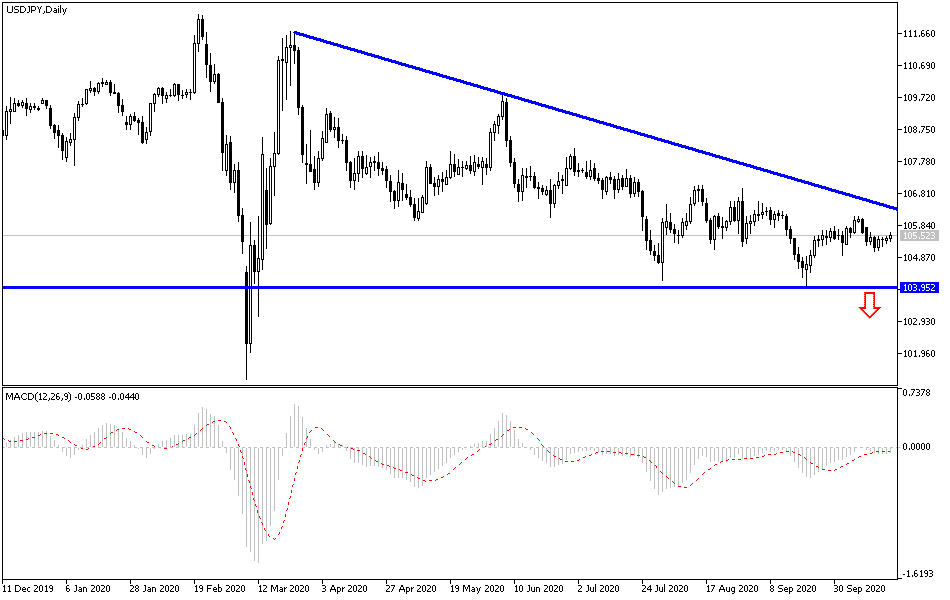

Regarding the USD/JPY, the overall bias remains bearish, which lasted three and a half months.

According to the technical analyst's vision, the hourly chart shows that the RSI consistently stumbles around 60, which at best means consolidation in the past few days. A move above 105.60 might be an early sign of a recovery, but we still expect the rally to falter fairly quickly. Markets continue to trade with uncertainty as news flow of the major macro factors remains on edge. In a final attempt to break the deadlock over US financial support, Democratic House Speaker Pelosi gave a 48-hour deadline over the weekend.

This means that the next couple of days can generate high volatility from any announcement, but markets consider this a positive thing.

Japanese exports fell at a slower pace in September in a sign of easing trade damage from the coronavirus pandemic, according to data from Japan's Finance Ministry. The report showed that Japanese exports in September decreased by 4.9% compared to the same month of the previous year, which was better than their drop of 15% in August. The country's overall imports decreased by 17.2% compared to 20.8% in August. Exports to China jumped 14% while shipments to the United States rose 0.7%, in another possible sign of a gradual recovery. By sector, computer exports to the world increased by about 45%.

All in all, the export-dependent Japanese economy entered a recession, with three consecutive quarters of contraction during the June outbreak of the deadly disease sparked criticism of business activity and choked trade. But the recovery in China, where COVID-19 emerged late last year, and recovery in some other Asian countries are helping Japan regain momentum.

New Japanese Prime Minister Yoshihide Suga, who took office a month ago, left Sunday for Vietnam and Indonesia, where COVID-19 cases are relatively low, to mobilize business and trade. His predecessor, Shinzo Abe, tried to maintain economic growth through "Appenomics" programs that relied on zero interest rates and reduced deflation. Suga, who is also from the ruling Liberal Democratic Party, is expected to continue these policies.

According to the technical analysis of the pair: Forex traders are waiting for opportunities to buy the USD/JPY, and we see that support levels at 104.90 and 104.00 are suitable for buying at the present time. As I expected before, I confirm now that the upward correction of the pair will not occur without crossing the resistance barrier at 108.00. Otherwise, the general trend of the pair will remain bearish. What will affect the pair’s trends in the coming period is the investors’ risks appetite, the extent to which the global economy will be affected by the second wave of the Corona outbreak, the future of stimulus for the US economy, and expectations about the winner in the US presidential elections.